US Gulf:

NOLA urea narrowed to $288-$298/st FOB for July

business during the week, falling within the prior week’s broader $288-$302/st

FOB range. Very limited trading was confirmed ahead of the Southwestern

Fertilizer Conference in Nashville, Tenn., on July 14-18.

US Imports:

Urea

imports firmed 14.1% in July-May, to 5.22 million st from 4.58 million st in

the same period of 2022-2023. May imports were off 38.0%, however, dropping to

478,348 st from the year-ago 771,385 st.

July-May

imports from Russia were 1.53 million st. Qatar sent 1.10 million st, Algeria

shipped 569,381 st, and Saudi Arabia sent 485,933 st.

US Exports:

May

urea exports were noted at 51,103 st, a 39.6% increase on the year-ago 36,610

st. July-May volumes were off 43.2%, however, at 762,091 st compared to the

1.34 million st reported one year earlier.

Exports

to Canada totaled 548,125 st in July-May, followed by 93,519 st to Mexico and

77,185 st to Chile.

Eastern Cornbelt:

Urea

was unchanged at $365-$375/st FOB in the Eastern Cornbelt, with the low

confirmed at Cincinnati, Ohio, and the high out of inland warehouses. Most

Illinois River terminals remained at the $370/st FOB level for July-August

tons. The low end of the Great Lakes urea market was steady at the $365/st FOB

level in Michigan.

Western Cornbelt:

Urea in the Western Cornbelt remained at $345-$365/st

FOB, with the low reported at St. Louis, Mo. The Port Neal, Iowa, market was

pegged at $350-$355/st FOB for limited offers on forward sales.

Northern Plains:

Urea

remained at $360-$380/st FOB regional terminals in the Northern Plains.

Inventories were described as very tight, with the higher end of the range

confirmed for limited offers for forward sales at St. Paul, Minn. Delivered

urea was pegged at $400-$440/st in North Dakota, with the low out of unit train

facilities.

Northeast:

Urea pricing in the Northeast

slipped to $370-$375/st FOB Fairless Hills, Pa., and $375-$380/st FOB

Baltimore, Md., down $10/st from mid-June.

Eastern Canada:

Urea remained in a broad range at C$592-$700/mt FOB

in Eastern Canada in mid-July.

India:

The

Indian Potash Ltd. (IPL) tender closed on July 8. Nineteen companies offered a

total of 2.7 million mt, though many of those offers are likely duplicates,

sources said.

OQ Trading set the lowest price for East Coast delivery, offering 100,000 mt at $365/mt CFR, about $26/mt above the East Coast price from the March Rashtriya Chemicals and Fertilizers Ltd. (RCF) tender. The lowest West Coast offer came from Liven at $350.50/mt CFR for 50,000 mt, a $2.50/mt increase on the West Coast award in the prior Indian tender.

IPL Urea Tender Results

|

Offering Company

|

Quantity WCI

|

$/mt CFR

| |

|

Liven

|

50,000

|

350.50

| | |

|

OQ

Trading

|

300,000

|

351.00

| | |

|

Continental

|

100,000

|

352.00

| | |

|

Medallion

|

50,000

|

353.10

| | |

|

ETG/Agricommodity

|

45,000

|

355.50

| | |

|

Samsung

|

90,000

|

358.70

| | |

|

Alkagesta

|

45,000

|

360.00

| | |

|

Aditya

Birla

|

50,000

|

368.40

| | |

|

Indagro

|

42,500

|

369.40

| | |

|

Fertiglobe

|

45,000

|

370.00

| | |

|

Hexagon

|

50,000

|

371.26

| | |

|

Ameropa

|

194,300

|

372.00

| | |

|

FertiStream

|

47,500

|

372.00

| | |

|

Dreymoor

|

90,000

|

372.00

| | |

|

RE

Energy

|

50,000

|

372.91

| | |

|

Midgulf

|

100,000

|

377.00

| | |

|

MacroSource

|

45,000

|

379.50

| | |

|

Koch

|

47,500

|

379.80

| | |

|

Total

|

1,441,800

|

| | |

|

Offering Company

|

Quantity ECI

|

$/mt CFR

| | |

|

OQ

Trading

|

100,000

|

365.00

| | |

|

ETG/Agricommodity

|

45,000

|

366.00

| | |

|

Continental

|

100,000

|

366.00

| | |

|

Samsung

|

90,000

|

367.70

| | |

|

Medallion

|

50,000

|

368.10

| | |

|

Alkagesta

|

45,000

|

370.00

| | |

|

Hexagon

|

50,000

|

371.26

| | |

|

Indagro

|

42,500

|

373.40

| | |

|

Sun

International

|

100,000

|

374.15

| | |

|

Fertiglobe

|

45,000

|

377.00

| | |

|

Aditya

Birla

|

50,000

|

377.40

| | |

|

Koch

|

47,500

|

377.90

| | |

|

Ameropa

|

194,300

|

378.00

| | |

|

Dreymoor

|

90,000

|

378.00

| | |

|

FertiStream

|

47,500

|

379.00

| | |

|

Midgulf

|

100,000

|

382.00

| | |

|

MacroSource

|

45,000

|

385.50

| | |

|

Total

|

1,241,800

|

| | |

Sources

drew immediate attention to the wide price gap between the two coasts. While

the disparity typically runs close to $5/mt to account for the extra freight

costs from the Arab Gulf to the East Coast, the current tender’s nearly $15/mt

gap can provide Arab Gulf suppliers with better netbacks for East Coast sales

compared to the West Coast.

As

Chinese urea is not available in large quantities, sources had predicted that

Arab Gulf and Russian material would dominate the tender offers. The West Coast

price represents a netback to Russian Baltic ports of $290/mt FOB and to Arab

Gulf producers in the low-$330s/mt FOB, a lackluster level for both groups. The

estimated East Coast netback to the Arab Gulf was put in the low-$340s/mt FOB,

however, a price that has already been achieved from the AG and a level that

producers want to maintain.

Counterbids

were initially made to the next 10 lowest offers for West Coast delivery. One

trader said the move made sense, as the landed price was much lower than the

East Coast price. As the July 10 deadline approached, however, there were no

responses to the counterbids, prompting IPL to extend the deadline to July 11.

Reports

indicate that two shipments totaling 80,000 mt were ultimately offered. Sources

said Continental and Aditya Birla will be supplying the product.

Rumors

that IPL was ready to counterbid East Coast deliveries despite the higher price

were reported late on July 11. Sources said IPL issued the counterbids to all

the companies offering tons for West Coast ports.

The

Liven and OQ Trading offers secured 150,000 mt for IPL. The rumored additional

80,000 mt from Continental and Aditya Birla puts IPL’s potential take at

230,000 mt, well below even the most pessimistic predictions for the tender.

Going into the tender, sources were expecting purchases up to 700,000 mt, with

the Arab Gulf supplying at least 400,000 mt of that amount.

However,

the low West Coast price established a netback to the Arab Gulf well below what

producers were willing to take. Soon after the prices were revealed, several

traders began discussing a maximum purchase of just 400,000 mt, and possibly as

little as 300,000 mt. The East Coast netback, however, is closer to the

producers’ desires, leaving the possibility that additional tons might still be

secured.

The

next lowest offers for the West Coast were from OQ Trading with 300,000 mt at

$351/mt CFR and Continental’s 100,000 mt at $352/mt CFR. Facing a spread of

just $0.50/mt and $1.50/mt, respectively, from the lowest price, sources said

these two companies might have been able to accept the IPL counterbid without a

major financial impact.

As

previously noted, however, only Continental has accepted the counterbid, and

with fewer tons than in the initial offer. Because of the better netbacks

offered in the $365/mt CFR East Coast price, more companies are likely to

accept the counterbid.

The tender’s shipping deadline is Aug. 27. Regardless of how many tons IPL ultimately buys, sources said India’s next tender is unlikely to be called before late August.

Pakistan:

Trading

Corp. of Pakistan (TCP) called a tender for 150,000 mt to close on July 29. The

call came after talks with Turkmenistan for a government-to-government supply

deal reportedly fell through.

The

TCP tender calls for the tonnage to arrive by Sept. 25. The documents divide

the deliveries into three distinct periods in August, with each period

involving either one 50,000 mt cargo or two 30,000 mt shipments. The size of

the vessel will be determined by the discharge port.

The

government earlier approved the import of 200,000 mt of urea. In recent years,

TCP arranged government-to-government deals after that authorization was

granted. The last was in late 2023, when TCP bought 220,000 mt from Azerbaijan,

Russia, and the UAE.

The

use of government-to-government deals has been helpful to Pakistan, which

maintains limited hard currency reserves. These limited funds – and the

possibility of delayed payment – have in the past led some traders to avoid

participating in tenders.

Black Sea:

Black

Sea prilled urea moved up to $310-$315/mt FOB.

Mediterranean:

European

buyers have been closely watching developments with the IPL urea tender and in

Egypt, where gas supply has been restored and producers are reportedly ramping

up operations. Buyers in the Mediterranean are in no rush, however, as

highlighted by the lack of new indications and inquiries in Spain and Italy.

In

France, liquidity for fresh offshore tons was reported around $400/mt CFR,

while FCA prices reflected closer to a $410/mt CFR equivalent. This week,

granular urea in the Mediterranean was quoted higher at $385-$400/mt CFR.

Southeast

Asia:

The Southeast

Asia granular urea market was reported at $350-$366/mt FOB this week. Pupuk

Indonesia awarded its 30,000 mt granular urea tender, which closed on July 5at $366/mt FOB Bontang, to the buyer Universal Harvester. No further

granular sales were reported, with Petronas still down at Bintulu and Brunei

reportedly committed through August.

Indonesia:

Pupuk

surprised the urea industry by calling a selling tender for 30,000-45,000 mt of

granular urea to close on July 5, before the close of the Indian tender. Prices

from the Pupuk tender were released just as the numbers from the Indian tender

were also becoming available.

Pupuk

sold 30,000 mt at $366/mt FOB to Universal Harvester, of the Philippines,

surprising many players. Recent sales from regional producers Malaysia and

Brunei had closed in the low-$350s/mt FOB. Going into the tender, sources were

predicting a price range of $350-$352/mt FOB out of Indonesia.

Universal

Harvester may have been under pressure to supply material to a contract holder

in the Philippines, one trader speculated, and bid a high price to ensure it

got the tons it needed. As the week closed, sources had not heard of any

additional sales at the tender’s price level.

After

a Pupuk granular tender is awarded, the producer normally engages in talks with

other potential buyers. Pupuk’s last tender, for 45,000 mt, settled at $312/mt

FOB. Following talks with other buyers, Pupuk ultimately sold 278,000 mt at the

tender price.

The

high price in the new tender appears to be keeping potential buyers away,

however. Sources said it would be very difficult for a trader to find a home

for the product at the current price level.

Middle

East:

Arab

Gulf producers were expected to be the primary suppliers of urea in the

IPL/Indian tender, and sources estimated that at least 400,000 mt would find

its way from the Middle East to Indian ports.

However,

the lowest West Coast price of $350.50/mt CFR indicates a netback well below

producers’ pricing expectations. Pricing to India’s East Coast at $365/mt CFR

appears to offer a better opportunity for producers.

The

large price gap between the East and West Coasts allows for a higher netback to

the Arab Gulf if sales can be made under the Indian tender. Because of the

lower price, however, IPL’s first counterbid was only made to traders who

offered sales into India’s West Coast. The netback to the Arab Gulf from the

West Coast price was put in the mid-$330s/mt FOB, well below producers’

expectations.

The

estimated netback from an East Coast sale falls in the low-$340s/mt FOB, an

area where producers have already secured deals. While an East Coast sale would

not push the price into the $350s/mt FOB as producers have been arguing, it

also does not force a price reduction.

Egyptian

production is reportedly ramping up as natural gas supplies return to normal.

MOPCO already has two plants operating at 80% of rated capacity, sources said,

and other facilities were also said to be nearing an 80% production rate. Only

a few smaller companies are taking longer to return to normal output.

Producers

need the tons currently being manufactured not only to build reserves, sources

said, but also to replace tons sold under swap deals during the short period

when production was halted. If production rates continue to increase, one

trader said the producers will be in good shape to offer tons for August and

September shipment.

For

now, the focus is on covering old deals and building reserves, and no new spot

sales were reported from the area.

China:

Sources

described prilled and granular urea at parity when discussing estimated export

prices for the week. Mixed messages are coming out of China, however, with some

reports citing an export-equivalent price in the upper-$320s/mt FOB and others

claiming a price in the low-$330s/mt FOB.

The

variance could easily be attributed to differences in plant location and

regional urea demand, one trader noted. Regardless of the price level, however,

sources said prices are still too high and reserves too low for government

export inspectors, and players do not anticipate any urea exports of

significance until September.

Reserves

are expected to begin building this month and into August as more plants slowly

ramp up production. Some production facilities are coming off routine

maintenance turnarounds, while others are reacting to the government’s

encouragement to step up production. The government is reportedly anxious to

see plants operating at 80% of rated capacity. The average is reportedly closer

to 60%, with some plants running as low as 20-30% of capacity.

Some

sources are also reporting that the inspection process is being stretched up to

30 days, beyond the usual 14 days. At the same time, the inspectors are also

insisting on reviewing the contracts for exports with a particular focus on

payment methods. This, said one trader, is adding another two weeks to the

review process.

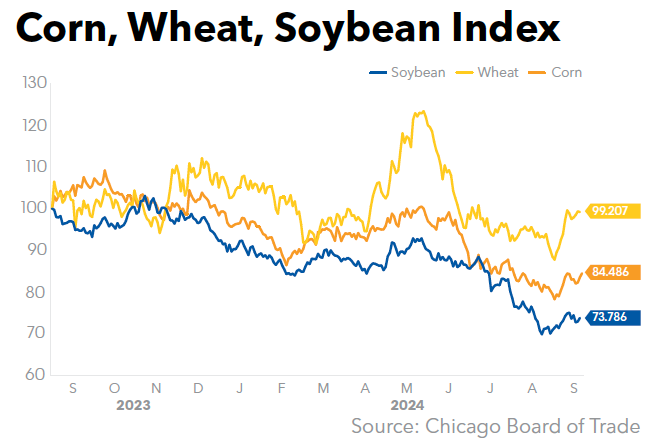

Brazil:

The

decrease in domestic corn prices has incentivized growers to delay nitrogen

purchases for the second corn crop, typically delivered in the fourth quarter.

Ample global supply has further eroded support for higher prices, players said.

Brazil granular urea prices increased $5/mt at the bottom of the range to settle at $360-$365/mt CFR, with new offers reported at $370/mt CFR. Despite widespread availability of sanctioned product during the week, buyers were focused on securing phosphates, resulting in limited demand for nitrogen. Offers were noted at $475-$495/mt FOB Rondonópolis, a $5/mt decline from last week.

January-June

imports firmed 8% year-over-year, Trade Data Monitor reported, to 3

million mt from 2.8 million mt. Nigeria shipped 658,000 mt, followed by Oman

with 574,000 mt and Qatar with 548,000 mt. Second-quarter imports lifted

slightly, to 1.5 million mt from 1.4 million mt in April-June 2023.

June imports totaled 606,000

mt, a more than 50% year-over-year increase, with approximately 25%

of the tonnage coming from Oman. Venezuela added 33,000 mt.