Eastern Cornbelt:

Separate

storms on July 14 and July 15 caused widespread damage and power outages across

northern Illinois and northwestern Indiana. Multiple tornadoes were reported,

while 70 mph wind gusts knocked out power to thousands of customers. The

National Weather Service was still investigating at least two dozen potential

tornado paths at midweek.

Cooler

weather was reported in Ohio and Michigan as the week progressed, with a chance

of weekend showers.

Good

or excellent ratings were assigned to 73% of the corn and soybeans in Illinois

on July 14, compared with 67% in Indiana and 64-67% in Ohio. Michigan’s corn

crop was 72% good or excellent, with 62% of the state’s soybean crop falling

into those two categories.

Western Cornbelt:

A

line of strong storms in central and eastern Iowa on July 15 produced at least

one tornado and left thousands without power. The Storm Prediction Center later

called the storm a derecho, with top winds estimated at 97 mph in Dubuque

County.

Heavy rain hit southern

Missouri at midweek, producing flash floods and prompting evacuations in some

areas. Seven inches fell in less than six hours in Branson, Mo., causing Turkey

Creek at Hollister, Mo., just south of Branson, to rise 12 feet in two hours.

USDA rated 74-79% of the

corn and 72-77% of the soybeans as good or excellent in the region on July 14.

Good or excellent ratings were also assigned to 60% of Missouri’s cotton and

79% of the state’s rice crop, along with 78% of Nebraska’s sorghum crop.

Southern Plains:

Kansas

and Oklahoma residents enjoyed cooler temperatures for most of the week, with

highs topping out in the 80s. Forecasts warned of potentially strong

thunderstorms over the coming weekend in both states, however.

Lower

temperatures were also reported throughout Texas during the week, along with

spotty thundershowers in northern areas of the state. Heavy rain was reported

in New Mexico as the week progressed, while eastern Colorado saw slightly

cooler temperatures after record heat the previous weekend, when highs exceeded

105 degrees in some areas of the state.

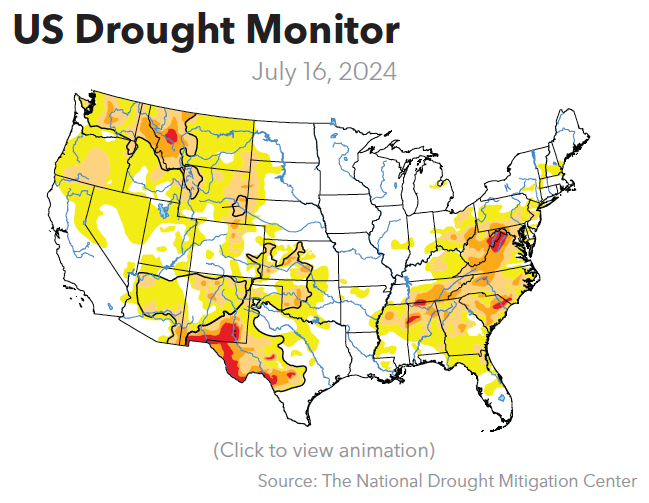

Severe-to-extreme

drought conditions were reported across a wide swath of southern New Mexico and

western Texas in mid-July, with small areas of moderate-to-severe drought

popping up in northern New Mexico, central Oklahoma, and central Kansas.

Crop

conditions varied widely in the region. Corn in the good or excellent

categories totaled 61% of the crop in Kansas, 54% in Colorado, and 42% in

Texas, while 76% of the soybeans in Kansas fell into those two categories.

While 76% of Oklahoma’s cotton was rated as good or excellent at mid-month,

just 34% of the Texas crop came in with those ratings, along with 64% of the

acreage in Kansas.

Sorghum

rated as good or excellent totaled 61% of the crop in Oklahoma, 55-57% in

Kansas and Texas, and 47% in Colorado.

South Central:

Flash

flood emergencies were declared in central and northern Arkansas at midweek

after torrential rains hit the region on July 17. News reports said 6-11 inches

of rain fell in just five hours, resulting in evacuations in some areas as

rivers and streams rose dramatically.

Parts

of Middle Tennessee and southern Kentucky also collected some needed rain

showers at midweek, ushering in cooler temperatures after intense heat the

previous weekend. Southern Louisiana was bracing for 2-4 inches of rain late in

the week and over the coming weekend.

USDA

rated 56-63% of the corn in Tennessee and Kentucky as good or excellent on July

14, while soybeans in those two categories totaled 62% of the acreage in

Tennessee, 63% in Mississippi, 64% in Kentucky, 73% in Arkansas, and 85% in

Louisiana.

Fully

93% of Louisiana’s cotton crop was rated as good or excellent at mid-month,

compared with 81% in Arkansas and 49-50% in Mississippi and Tennessee. Rice in

the good or excellent categories totaled 89% of the acreage in Louisiana, 75%

in Arkansas and Texas, and 60% in Mississippi.

Southeast:

Much

of the Southeast was bracing for an extended period of wet weather in the

second half of July, thanks to a stalled-out cold front that brought heavy rain

to parts of the Southwest and South Central region during the week.

Thunderstorms

moved through parts of North Carolina and Virginia on July 18, triggering

severe thunderstorm watches that warned of large hail and wind gusts up to 70

mph. A wide swath of the Carolinas, Georgia, and Virginia were preparing for

2-5 inches of rain by the weekend, with 1-3 inches possible across Florida.

Earlier

drought conditions have taken a toll on crops in the Southeast. Just 9% of

North Carolina’s corn was rated as good or excellent on July 14, with 73% of

the crop rated as poor or very poor. North Carolina’s soybeans were 26% good or

excellent and 31% poor or very poor on that date.

Cotton

in the good or excellent categories totaled 40-41% of the crop in the Carolinas

and 57-58% in Alabama, Georgia, and Virginia. The peanut crop was slightly

better, with good or excellent ratings assigned to 50-55% of the acreage in the

Carolina, 58% in Georgia, 63% in Florida, 77% in Alabama, and 79% in Virginia.