Eastern Cornbelt:

After starting the week with temperatures in the mid-80s, much of the Eastern Cornbelt was bracing for a major cooldown by the weekend, with highs topping out in the 60s and low-70s. Weekend lows were expected in the mid-40s across the region.

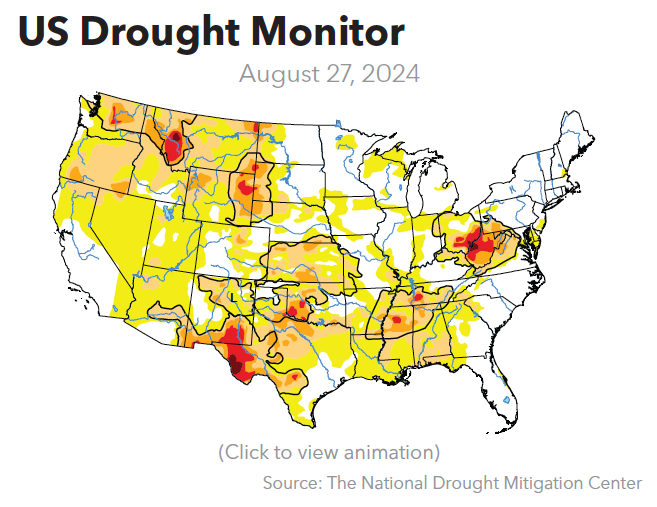

Central Ohio received less than half of its normal precipitation from June through August, leaving about 75% of the state under some level of drought and nearly 43% dealing with severe drought conditions or worse. Central Ohio also experienced 31 days of 90-degree heat during that three-month period, well above the 14-day average.

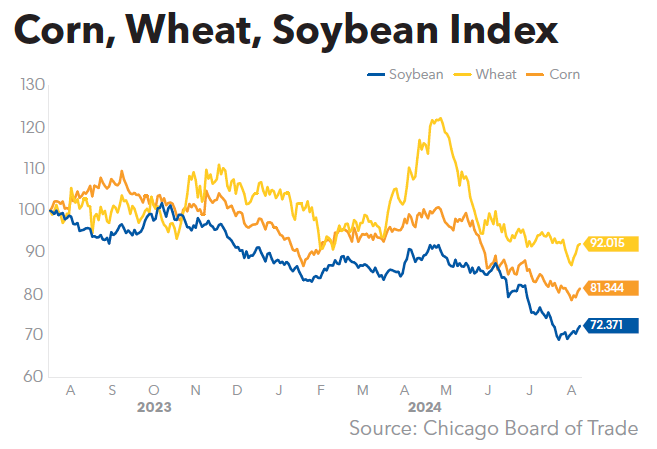

USDA on Sept. 1 reported that 24% of the corn was mature in Illinois, compared with 12-14% in Indiana and Ohio and just 2% in Michigan. Good or excellent ratings were assigned to 68-71% of the corn and soybeans in Illinois, 68% in Indiana, 63-67% in Michigan, and 42-46% in Ohio.

Western Cornbelt:

The Western Cornbelt experienced mostly dry weather during the first week of September, though scattered showers were reported across Iowa later in the week. Cooler weather was on tap for Iowa and Nebraska as the week progressed, with highs expected to dip to the 60s and 70s by the weekend, down from the mid- to upper-80s.

Summer heat continued across Missouri, with highs touching the 90s as the week progressed. By the end of the week and into the weekend, however, highs were only expected to reach the 70s across much of the state.

Good or excellent ratings were assigned to 77% of the corn and soybeans in Iowa on Sept. 1, compared with 74-79% in Missouri and 67-68% in Nebraska. Fully 39% of Missouri’s corn was mature by that date, along with 23% of the acreage in Nebraska and 10% in Iowa.

Missouri’s rice crop and cotton were 69% and 59% good or excellent, respectively, with 15% of the rice crop harvested by Sept. 1. Nebraska’s sorghum crop was 78% good or excellent.

California:

Excessive heat warnings were in effect across California during the first week of September, with highs reaching 105-113 degrees in parts of Southern California and the mid-80s in San Francisco. Triple-digit highs were also common across the Sacramento Valley during the week, including Stockton, Chico, Redding, and Sacramento.

Numerous wildfires continued to burn in California in early September, including the Bear Fire, which was first reported on Sept. 2 and quickly spread to 1,400 acres due to 30-40 mph winds. The fire prompted mandatory evacuations from several Sierra Nevada communities during the week.

Crop conditions remained favorable as of Sept. 1, with 95% of the rice and 100% of the cotton rated as good or excellent in California.

Pacific Northwest:

Excessive heat warnings were in effect for western Oregon and southwestern Washington during the week, with triple-digit highs reported in multiple locations. In addition to the heat, a fire weather watch was posted for Portland, Ore., on Sept. 4 due to low humidity and 20 mph winds, with red flag fire warnings in effect for the Western Columbia River Gorge.

Cooler weather was reported across Montana early in the week, along with scattered thunderstorms, but highs in the 80s and 90s were once again in the weekend forecast for much of the state.

The harvest of small grains continued at a brisk pace in the Pacific Northwest. Washington growers had 86-87% of the spring wheat and barley in the bin by Sept. 1, compared with 77-81% in Idaho and 68-77% in Montana.

Western Canada:

Air quality warnings were in effect across Western Canada in early September due to smoke from multiple wildfires in the region. The haze was accompanied by high heat, with temperatures soaring over the 30-degree C mark across portions of Alberta and Saskatchewan during the week.

Manitoba’s harvest was 24% complete as of Sept. 2, according to the latest provincial crop report, while harvest progress in Saskatchewan and Alberta was rated at 25% and 20% complete, respectively.