The Andersons Inc. reported third-quarter net income from continuing operations attributable to the company of $9.7 million, down from the year-ago $17.4 million. Revenues declined to $3.64 billion from $4.22 billion. Adjusted EBITDA was $70.3 million, down from $83 million.

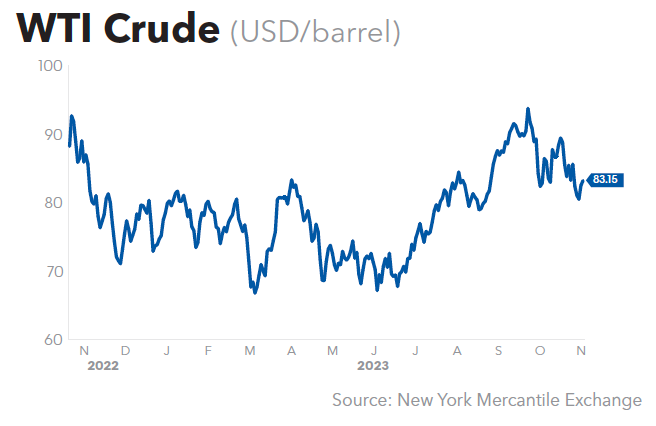

“Third-quarter results were solid for the company compared against last year’s best-ever third quarter,” said Patrick Bowe, President and CEO. “Our third quarter includes record results from our Renewables team with great operating performance in our ethanol plants, a strong margin environment and good results from our renewable diesel feedstock merchandising team.”

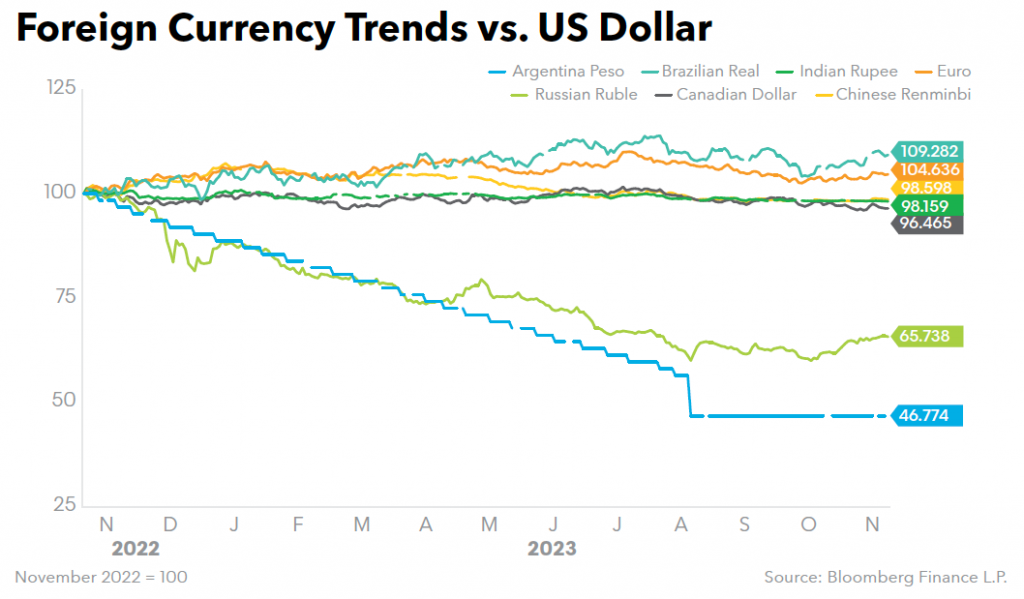

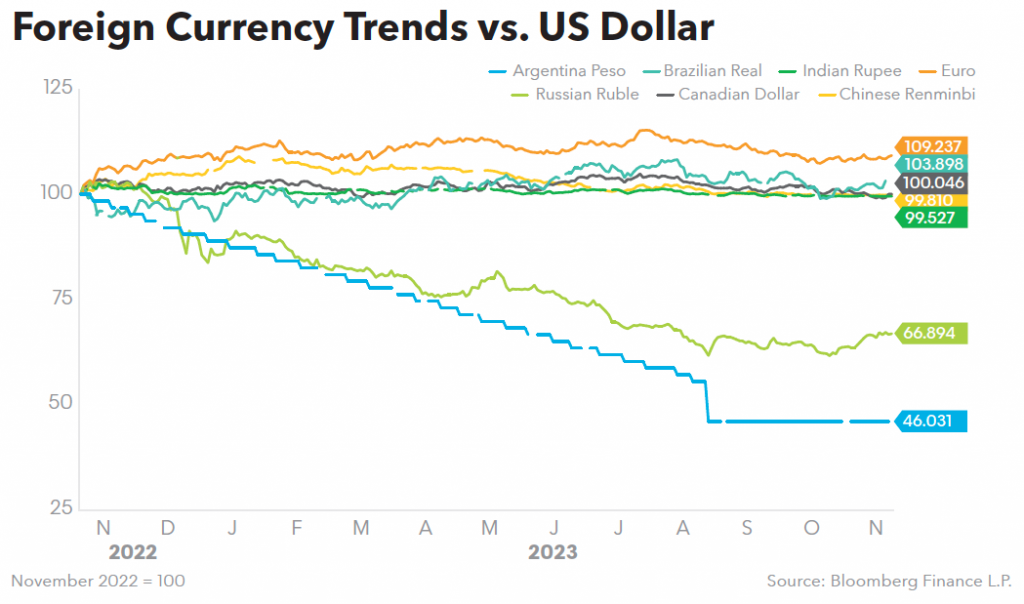

“We had solid core operating performance in our Trade segment, which was offset by a currency loss in our international business,” Bowe continued. “Lastly, our Nutrient & Industrial segment’s third quarter, which is typically a loss in this seasonally slow period, had year-over-year improvements in both its ag and manufacturing businesses.”

Bowe said the company is confident about the balance of the year and expects to achieve its previously communicated full-year adjusted EBITDA outlook of $350-$375 million.

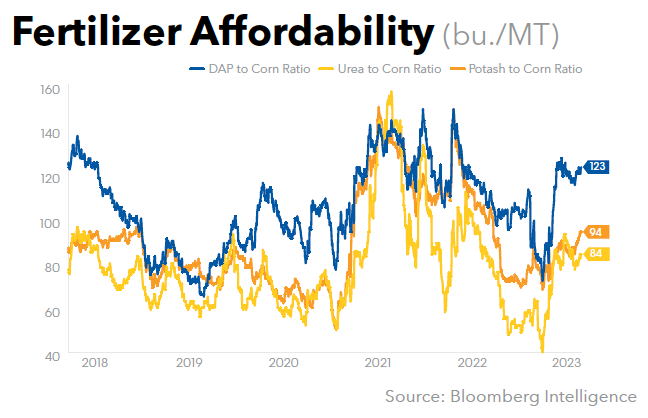

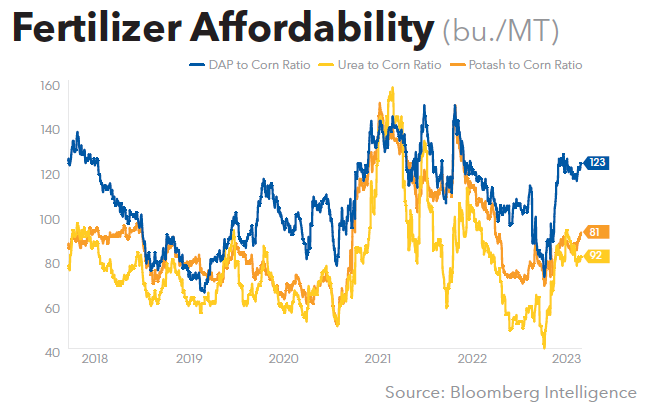

“Farm income is projected to decline from lower commodity prices but should remain above the long-term average,” Bowe told analysts. “At these levels, we believe farmers should still be incented to invest in crop inputs. With our broad portfolio of ag products, we remain positioned to perform well into 2024.”

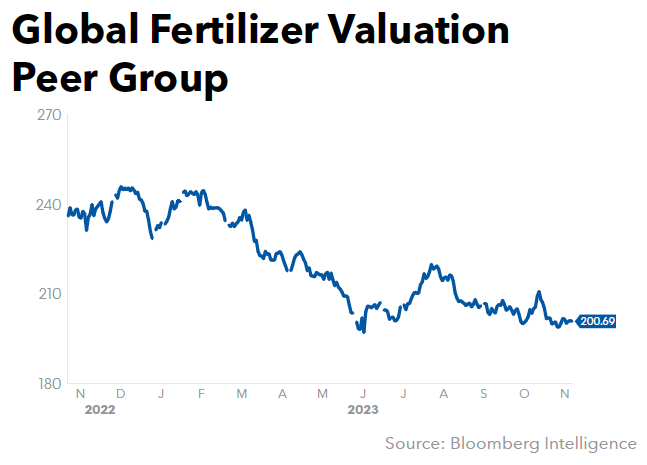

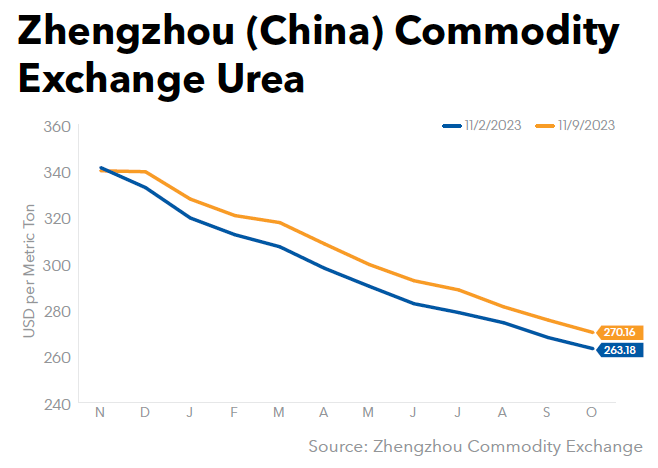

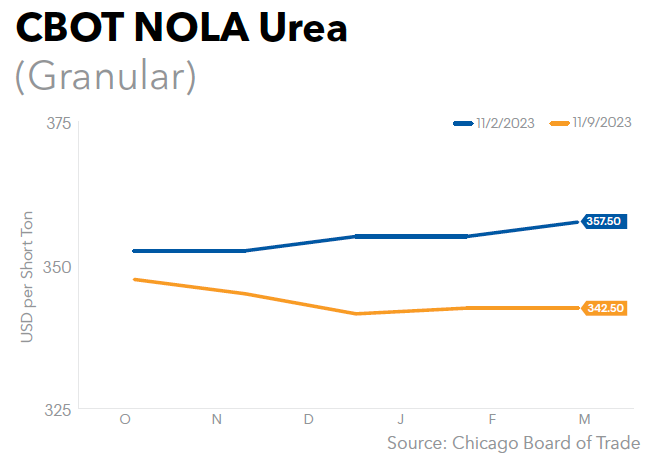

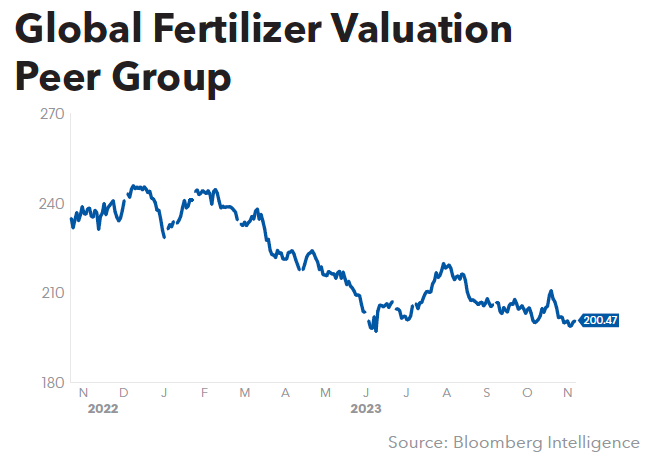

Nutrient & Industrial reported a third-quarter pretax loss of $8 million, an improvement over the year-ago loss of $12 million. Gross profit was $19 million, up from $15 million, while EBITDA was a positive $500,000, up from a negative $3 million. Revenues were $129 million, down from $164 million.

The company said the segment’s volumes were down 6% with an overall increase in margins. Improved margins boosted gross profit by $4 million and were partially offset by the volume decline. The Sioux City, Iowa, specialty liquid plant was impacted by a rail service interruption that had an impact on volumes for approximately one month.

For the fourth quarter, the company expects the segment to have improved year-over-year margins and solid volumes in fall application season.

Company-wide, nine-month net income from continuing operations attributable to the company were $50 million on revenues of $11.54 billion, versus the year-ago $104 million and $12.65 billion, respectively. Adjusted EBITDA was $270 million, down from $308.2 million.

Nutrient & Industrial reported nine-month pretax income of $24 million on revenues of $738 million, down from the year-ago $37 million and $844 million, respectively. Gross margin was $107 million, down from $120 million, while EBITDA was $51 million, off from $63 million.