AdvanSix reported a 44% drop in first-quarter net income, to $35 million on sales of $400.5 million, compared with the year-ago record quarter’s $63.1 million and $480 million, respectively. Adjusted EBITDA was $65.4 million, down from $103.2 million.

“As a diversified

chemistry company, our first quarter performance reflects the resilience of our

business model and our team’s ability and commitment to perform through various

economic and industry conditions,” said Erin Kane, AdvanSix President and

CEO. “We delivered solid earnings results in the current macro environment

and against a record first quarter in the prior year period.”

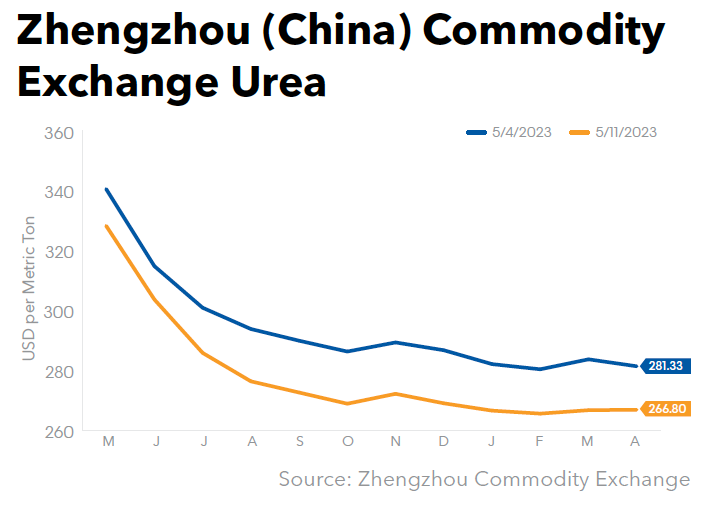

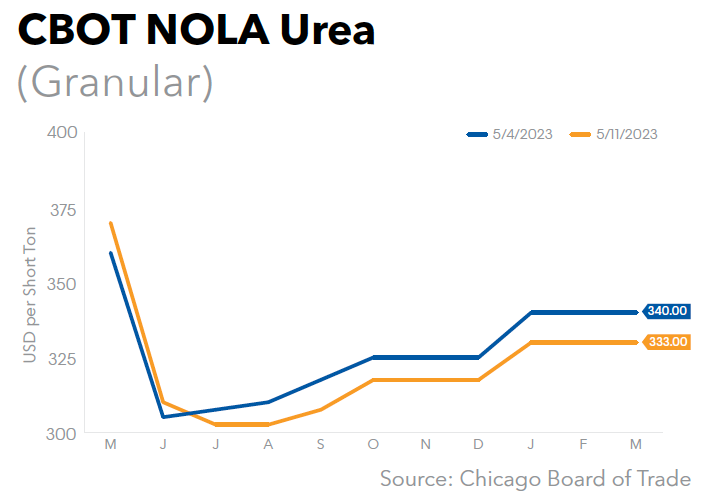

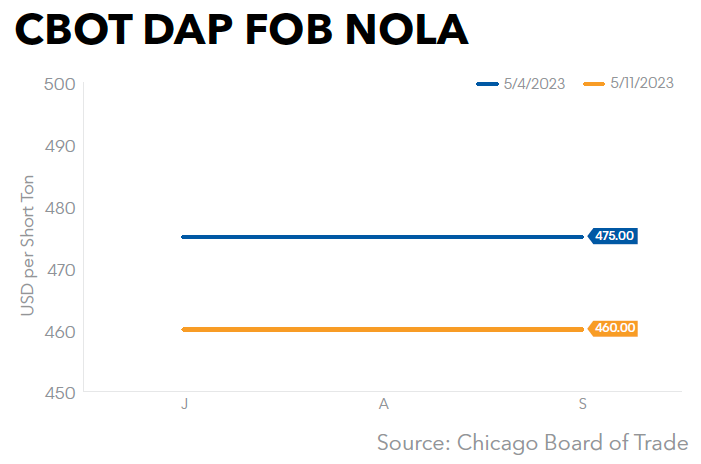

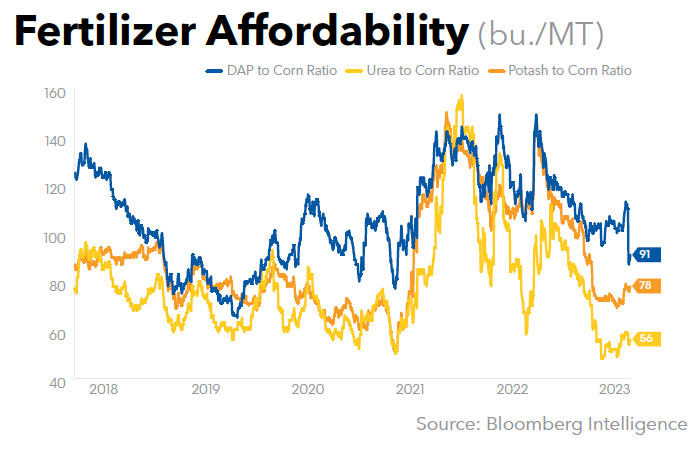

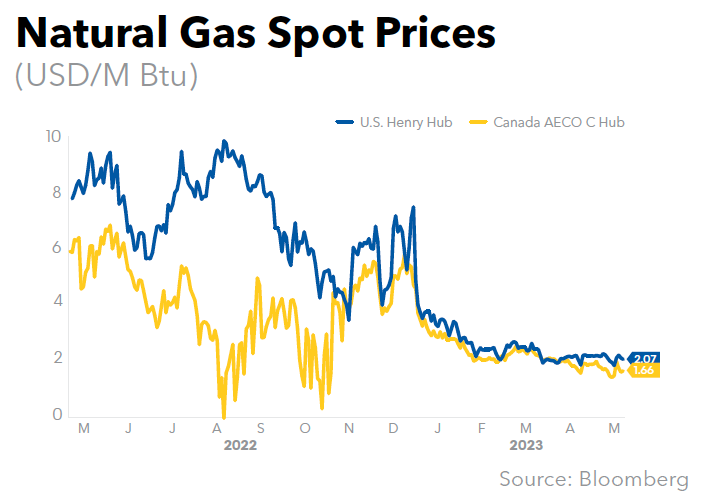

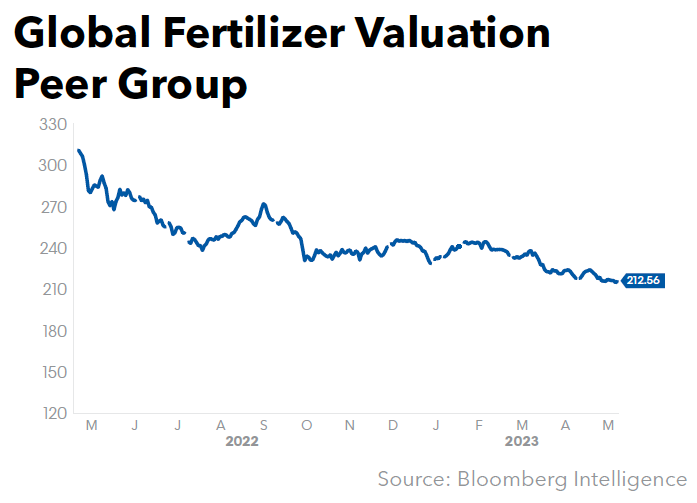

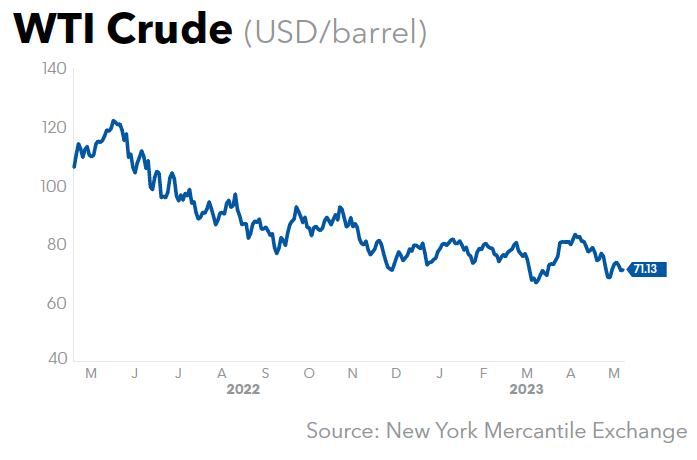

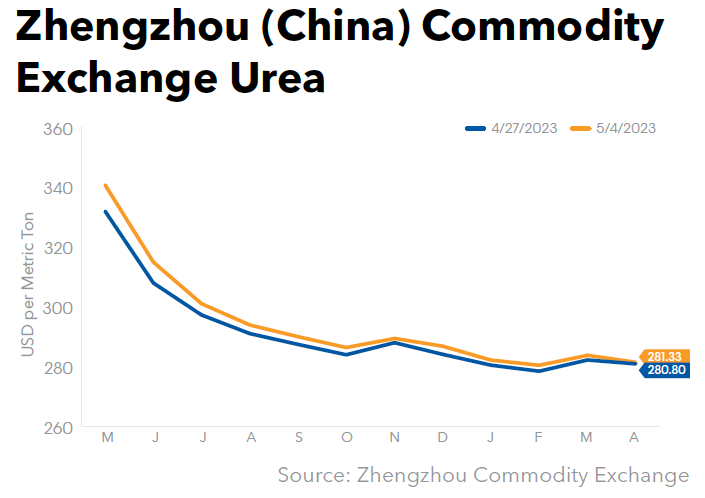

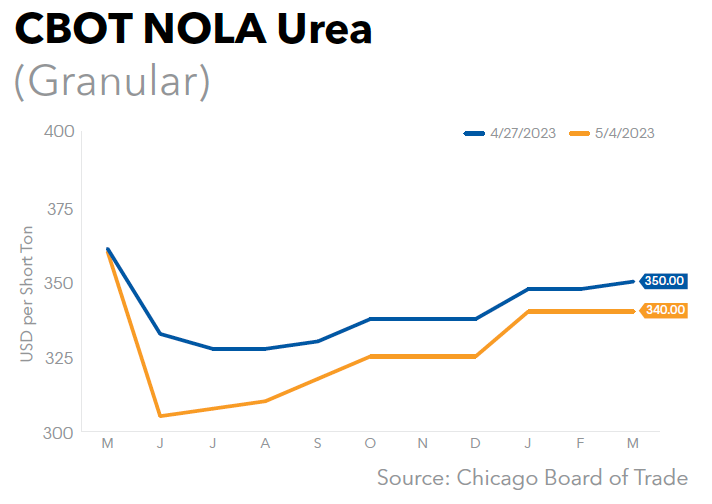

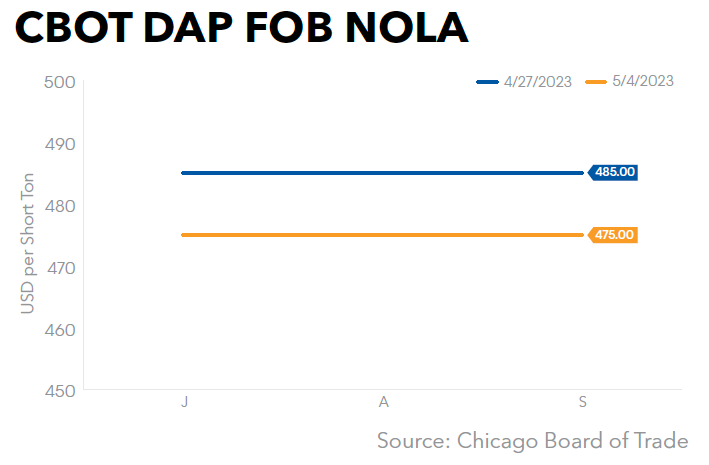

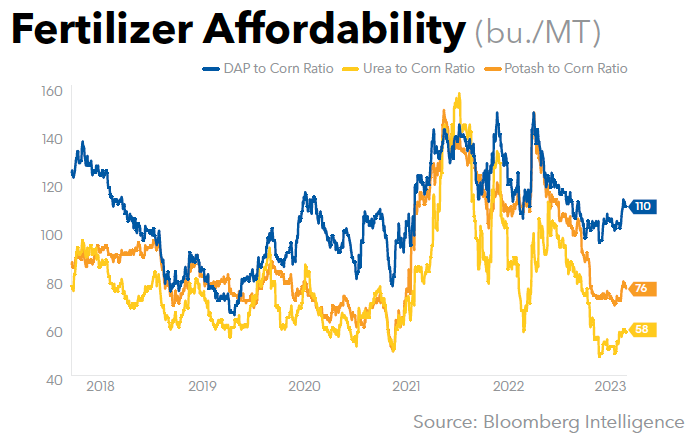

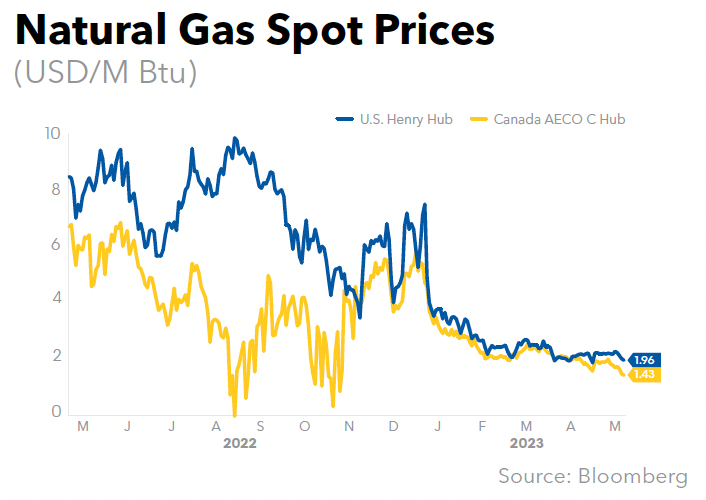

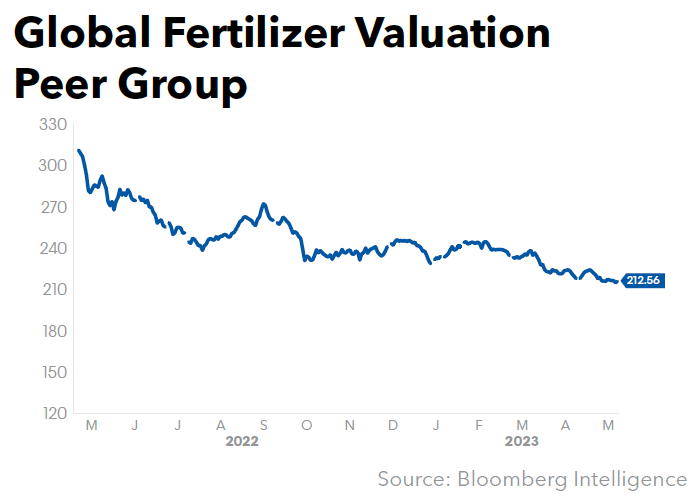

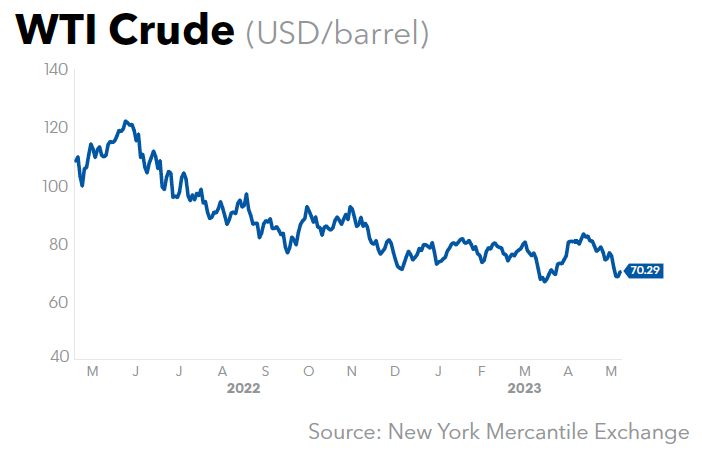

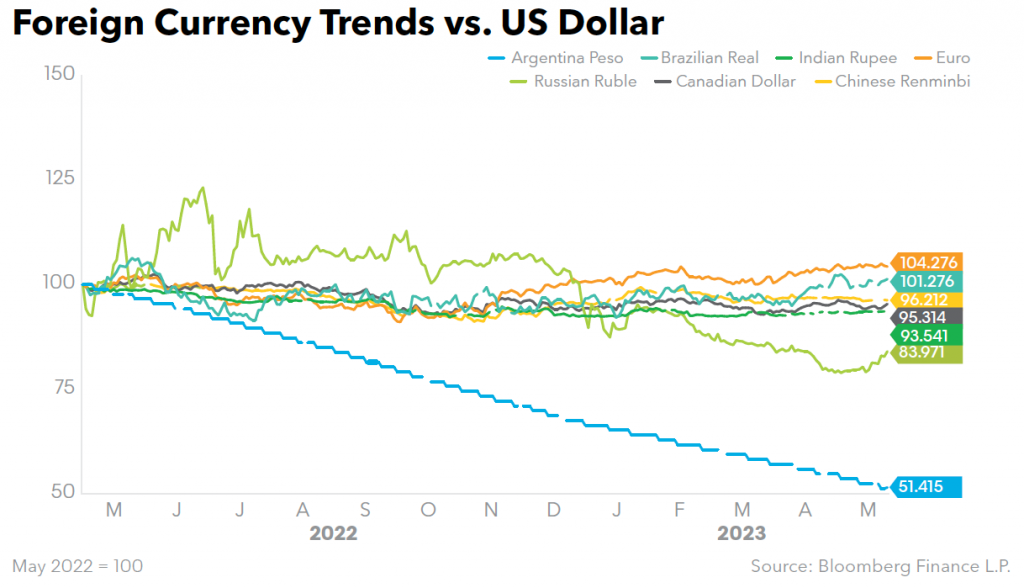

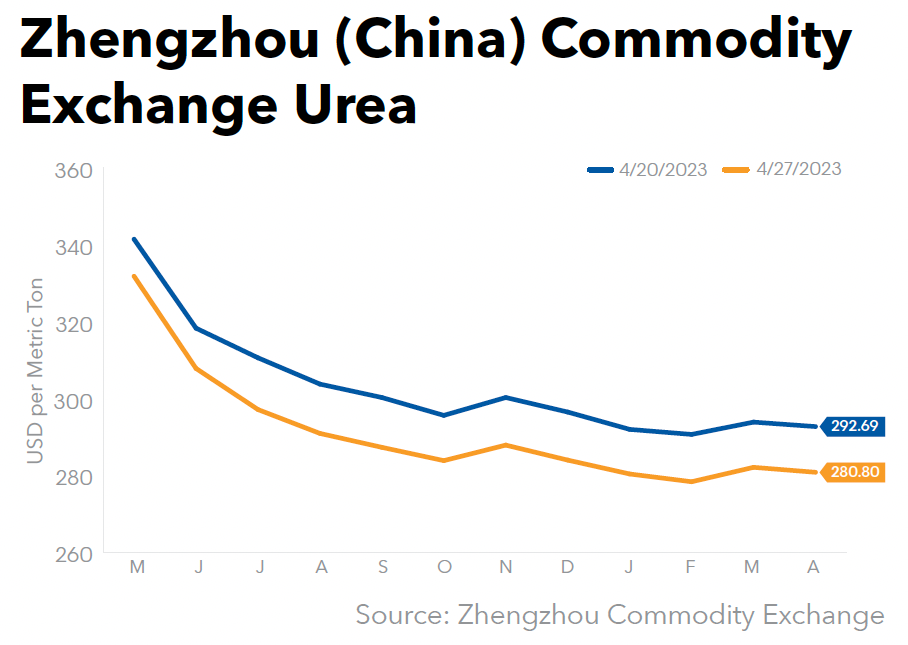

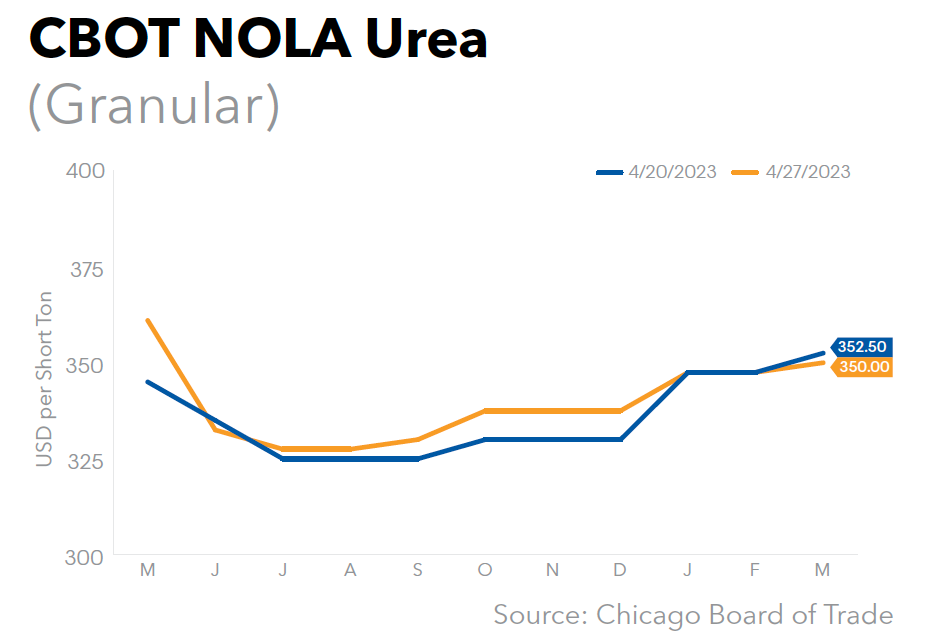

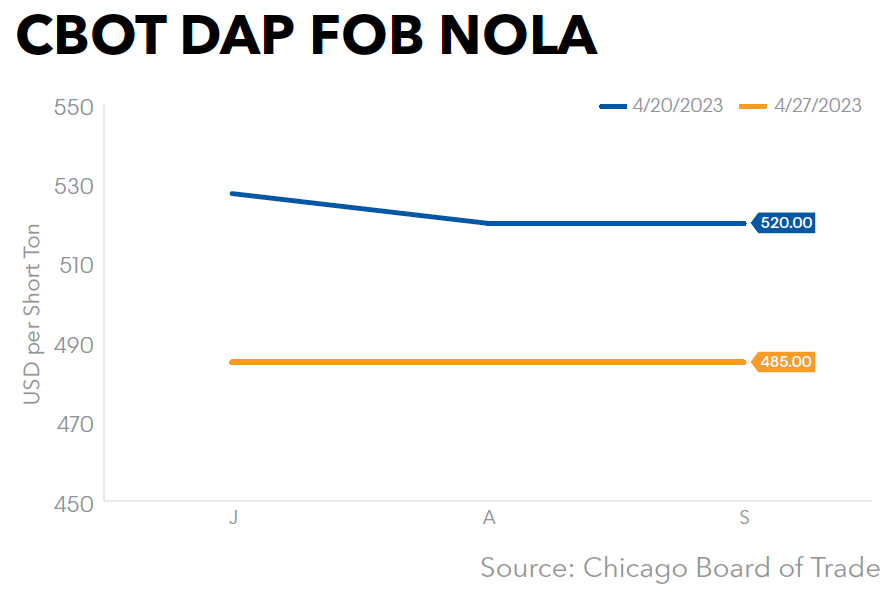

“Our performance was

achieved in an environment that saw nitrogen fertilizer pricing reset amid

lower energy costs and improved supply,” she added. “While down from last

year’s peak levels, ammonium sulfate value pricing remains robust and we

continue to be well positioned to serve our key plant nutrients customers as

the season progresses. While headwinds in consumer durables and building and

construction end markets persist across portions of our nylon and chemical

intermediates portfolio, North American acetone supply and demand continues to

be balanced supporting our performance. With confidence in the health of our

balance sheet, we continued to deploy a significant amount of capital through

increased capital expenditures and $18 million of cash returned to shareholders in

the form of share repurchases and dividends.”

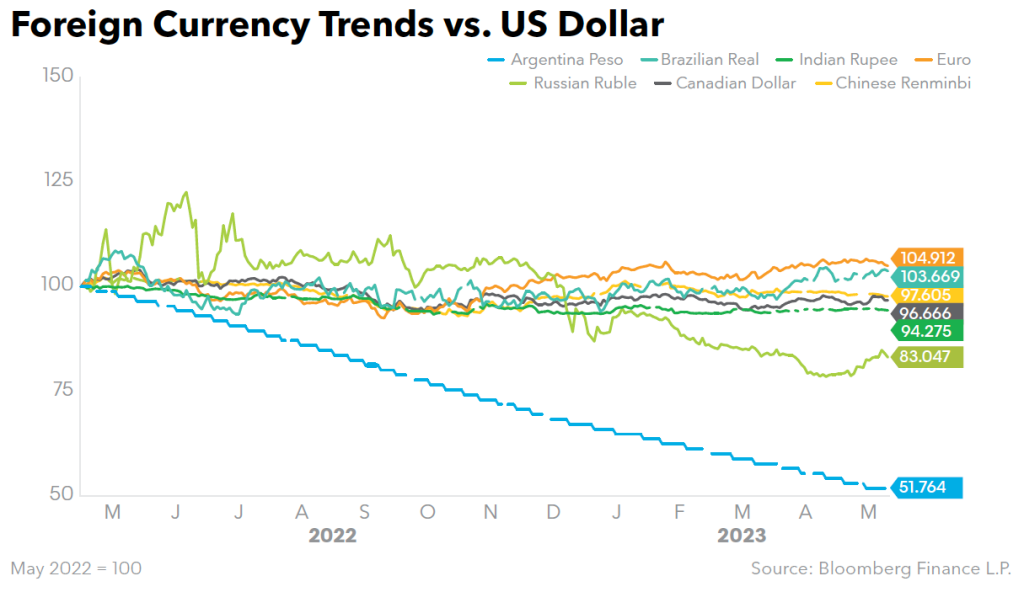

The company said sales

volume decreased approximately 9%, driven by cautious buying behavior for

ammonium sulfate ahead of the start of the domestic planting season as a result

of significant pricing declines year-over-year. Market-based pricing was

unfavorable by 6% compared to the prior year primarily reflecting lower

ammonium sulfate pricing. AS represented 28% of total sales for the quarter

versus the year-ago 32%.

The company also cited

soft end market demand, particularly in consumer durables and building and

construction impacting portions of its nylon and chemical intermediates product

lines.

AdvanSix expects strong

underlying agriculture and fertilizer industry fundamentals to continue through

the domestic planting season. It anticipates improvement in second-quarter AS

domestic sales volume in a lower nitrogen and raw material pricing environment.