Trammo Inc., New York City, and ReMo Energy Inc., Boston, on Oct. 17 announced that they have signed a Memorandum of Understanding (MOU) for Trammo to purchase green ammonia from ReMo’s forthcoming 16,000 st/y green ammonia production plant. ReMo will develop a green hydrogen-based ammonia facility at Trammo’s existing anhydrous ammonia terminal in Meredosia, Ill., and Trammo will be the facility’s exclusive offtaker.

The parties say that based on the current projected start-up timing for the plant in 2024, the facility would be the first green ammonia production location to be commissioned at commercial scale in the US.

“Low-cost renewable energy has changed the game for commodities production,” said Guido Radaelli, ReMo CTO. “To take advantage of this new energy resource, ReMo has re-engineered how ammonia plants will be designed, manufactured and operated. For the first time, cost-competitive local production of green ammonia is now practical.”

“This project is perfectly in line with our strategy to quickly develop access to green ammonia for our customers,” said Christophe Savi, Trammo’s Global Ammonia Product Manager.

“As the world’s leading independent marketer of anhydrous ammonia, Trammo maintains a unique position in the transportation and distribution of ammonia,” said Jeffrey Minnis, Trammo President of North America Trading. “In this role we are dedicated to being at the forefront of the transition to a low-carbon future and facilitating ammonia’s direct role in that development. Our participation in this project represents a meaningful and practical step in that direction. We are pleased to be working with ReMo Energy and its highly skilled team to bring green ammonia to our customers in the U.S. Midwest.”

“We are delighted that Trammo has chosen ReMo for this effort,” said Scott Rackey, ReMo CEO. “Trammo’s decades of experience, vast infrastructure and global presence make them an ideal partner to build the green ammonia industry.”

When ReMo announced the launch of its technology earlier this year, it said it was already in advanced discussions with prospective offtakers (GM May 13, p. 1). At that time, it said is had completed a front-end loading (FEL) level 2 study for a 16,000 st/y demonstration scale facility, which would facilitate off-the-shelf components and ReMo’s patent-pending architecture. The company anticipates its full-scale plants would produce 80,000-100,000 st/y.

ReMo lists as an investor Breakthrough Energy, Kirkland, Wash., which was established in 2016 by Bill Gates and a coalition of private investors concerned about the impacts of accelerating climate change.

This is not Trammo’s first foray into green ammonia. The company has an 800,000 mt/y offtake agreement for a proposed Sept-Iles, Quebec, project being developed by Teal Corp., Magog, Quebec (GM April 1, 2022; June 3, 2022), with Teal and Trammo also eyeing a low-carbon project in Texas.

Trammo has an MOU for 1 million mt/y of offtake from a project planned in Chile with ASOE Chile Diez SpA (GM May 21, 2021). It has signed an MOU to become a partner in the Transhydrogen Alliance, which entails a joint initiative and mutual cooperation on the production and import of green hydrogen and ammonia into Europe via Rotterdam, as well as its export from selected locations worldwide (GM March 26, 2021). It also has an MOU with Proton Ventures for joint cooperation on green ammonia projects, with subsequent green ammonia supply to Trammo (GM Jan. 22, 2021).

On the other side of the coin, Trammo has an MOU to supply green ammonia to Lotte Fine Chemical, Seoul, the largest ammonia buyer in Asia (GM Sept. 17, 2021).

Martin Midstream Partners LP (MMLP) announced on Oct. 19 that through an affiliate Martin ELSA Investment LLC, it has entered into definitive agreements with Samsung C&T America Inc. (SCTA) and Dongjin USA Inc., an affiliate of Dongjin Semichem Co. Ltd., to form DSM Semichem LLC (DSM). DSM will produce and distribute electronic level sulfuric acid (ELSA).

DSM will leverage the existing assets of MMLP located in Plainview, Texas, and installing additional facilities as required, DSM will produce ELSA that meets the strict quality standards required by the recent advances in semiconductor manufacturing.

MMLP will own a 10% non-controlling interest in DSM and will be the exclusive provider of feedstock to the ELSA facility. MMLP, through its affiliate Martin Transport Inc., will also provide land transportation services to end-users of the ELSA produced by DSM.

“We are excited to partner with Samsung C&T America Inc. and Dongjin USA Inc. in this unique opportunity to capitalize on the diverse and complimentary skillsets, operating expertise, and vast market knowledge of the three parties,” said Bob Bondurant, MMLP President and CEO. “The new facilities will incorporate technology currently being utilized to produce ELSA in Taiwan, which exceeds the quality of sulfuric acid being produced in the United States today.”

Assuming growth capital investments of approximately $20 million, the partnership expects to realize annual distributable cash flow of $5-$6 million from both the improvements to the existing assets and its interest in DSM. The ELSA facility is estimated to start-up in the first quarter of 2024.

“This strategic alliance allows the partnership to capitalize on our existing asset base to participate in the manufacturing and transportation supply chain of the most advanced and power-efficient chip technology to date,” Bondurant said. “ELSA supply presently sourced in the US does not meet current domestic demand, and with announced new fabrication and existing fabrication facility expansions, we anticipate an attractive market for the ELSA produced in Plainview.”

MMLP said it will fund the capital improvements and the contribution to DSM through a long-term land lease and using available capacity under its revolving credit facility.

SCTA is a global trading and investment company that functions as an independent American subsidiary of the Samsung C&T Corp. Trading & Investment Group. Since being formed in New York in 1964, SCTA has been engaged in the trading of industrial materials and operates thermal power generation and renewable energy projects across North, South, and Central America. The Trading & Investment Group operates globally in trading and project organizing with a network of 70 offices in 42 countries. It pursues and develops businesses around the world in the areas of chemicals, steel, energy, and materials.

Dongjin Semichem Co. Ltd. is a publicly traded global manufacturer of fine chemicals, headquartered in Seoul, Korea. With operations across Asia, Europe, and the US, it holds a portfolio of products for diverse applications in the electronic materials industry, with major product lines include display materials, semiconductor materials, and renewable energy materials.

Air Liquide, Chevron Corp., LyondellBasell, and Uniper SE on Oct. 19 announced their intent to collaborate on a joint study that will evaluate and potentially advance the development of a hydrogen and ammonia production facility along the US Gulf Coast.

The companies said the facility could support industrial decarbonization and mobility applications in the region, and expand clean ammonia exports, helping to increase the supply of lower carbon power internationally.

The potential project to be studied is intended to cover the end-to-end energy value chain, utilizing each participant’s technical expertise in production, operational experience, storage, distribution, and export logistics. Collectively, the consortium will bring capabilities and expertise in air separation technology, hydrogen technologies, lower carbon intensity and renewable natural gas, carbon capture and storage (CCS), electrolysis-based technologies, and petrochemicals.

The consortium will assess the potential for producing hydrogen using natural gas with CCS and renewable hydrogen via electrolysis to supply end-use markets, including the ammonia, petrochemicals, power, and mobility markets.

If development proceeds, the project could leverage existing advantages along the Gulf Coast, including pipeline infrastructure, to supply lower carbon and renewable hydrogen to local industrial clusters. Likewise, ammonia infrastructure could support exports to both Europe and the Asia Pacific region.

“Air Liquide is proud to evaluate, with its customers and industry partners, opportunities to further develop and deploy low-carbon and renewable hydrogen, and carbon capture technologies in the region,” said Adam Peters, CEO of Air Liquide North America. “The Gulf Coast is the ideal location to model hydrogen and carbon capture technologies as immediate pathways to decarbonizing hard-to-abate sectors.

“This project exemplifies Air Liquide’s commitment to decarbonizing industrial basins around the world,” he continued. “Prioritizing sustainable technologies, like hydrogen and carbon capture, means we can provide energy transition careers for many thousands of American workers while building a more sustainable energy future for all.”

“Across the value chain, collaborations are critical to developing a hydrogen ecosystem, and this is an example of bringing together leaders in the space to explore lower carbon hydrogen opportunities and to contribute complementary expertise,” said Austin Knight, Vice President of Hydrogen, Chevron New Energies. “We are seeking to accelerate the deployment of lower carbon solutions and believe companies like Chevron can help bring the capabilities needed to make this a reality. We are excited to be a part of this effort.”

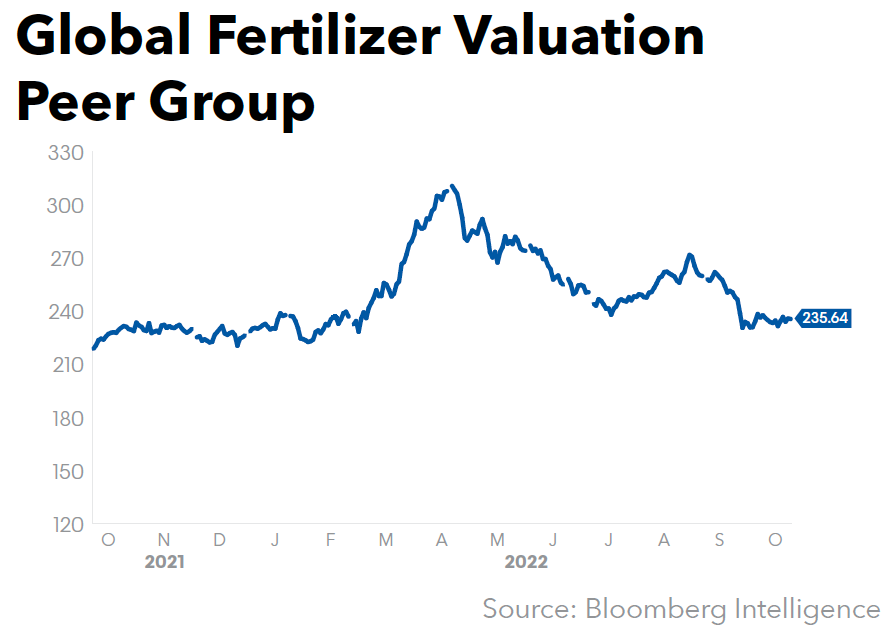

Yara International ASA posted third-quarter net income attributable to shareholders of $402 million, compared with a net loss of $143 million in the same year-ago period, beating analysts’ average estimates of $373.1 million (Bloomberg Consensus). Earnings per share were $1.57 compared with a negative $0.56 per share the previous year.

Third-quarter EBITDA excluding special items increased by 31% to $1 billion, up from $765 million, also higher than analysts had estimated. The average estimate had been $821.5 million. Revenue rose 39% to $6.22 billion from the year-ago $4.49 million, versus the analysts’ average estimate of $5.38 million.

“Yara’s business model has proven its resilience for decades and continues to perform well despite a challenging operating environment with extreme price volatility and plant curtailments in Europe,” said Yara International President and CEO Svein Tore Holsether. “Our margins are up, with strong margins more than offsetting lower deliveries.”

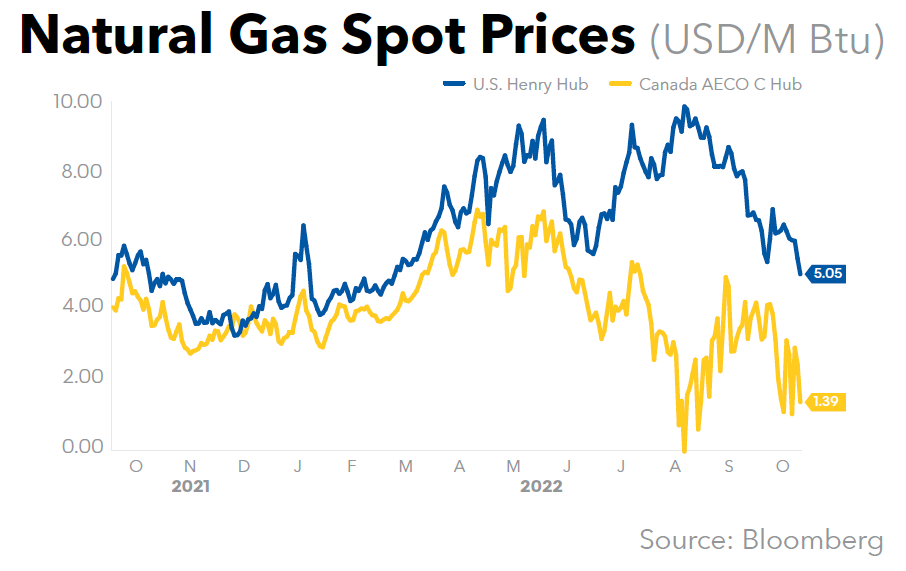

Amid a continued “challenging operating environment” primarily due to “unprecedented gas price volatility in Europe,” Holsether said Yara continues to adapt to market conditions and currently has production curtailments at several of its production plants, amounting to annual capacity of 1.7 million mt of ammonia and 0.9 million mt of finished fertilizer.

European ammonia production in the third quarter fell to just 57% of the regional capacity total of 4.8 million mt/y, down from 81% in the second quarter, Yara said in a webcast earnings presentation on Oct. 20.

In late August, Yara had said it was implementing further curtailments that would reduce its total European ammonia capacity utilization to around 35% (GM Aug. 26, p. 1). At that point, the company had curtailed an annual capacity equivalent of 3.1 million mt of ammonia and 4.0 million mt of finished products (1.8 million mt urea, 1.9 million mt nitrates and 0.3 million mt NPK) across its production system in Europe.

Yara this week reiterated that it will continue to use its global sourcing and production system to supply customers, where possible, but reiterated that it cannot produce at negative margins.

Holsether told analysts that the company’s current curtailments on finished fertilizer are “quite limited” as the situation in Europe has improved with significantly lower gas prices. He said the only significant market-related finished fertilizer curtailments in Europe are currently at Yara’s Italian plants.

He added that the planned turnaround at the Belle Plaine plant in Regina, Sask., in the third quarter took longer than planned. However, Holsether confirmed Belle Plaine would be back to full production in the fourth quarter.

Third-quarter ammonia production fell 81% from the second quarter, to 1.53 million mt, and was down 16% from the year-ago 1.82 million mt. Third-quarter finished fertilizer output was also down 16%, to 4.6 million versus 5.45 million mt in last year’s third quarter.

Total deliveries in the third quarter fell by 20% year-over-year, to 7.94 million mt from 9.98 million mt. Fertilizer deliveries were down 26%, to 5.63 million mt from the year-ago 7.59 million mt, while deliveries of industrial products were 3.5% lower at 1.85 million mt versus the prior year’s 1.92 million mt.

While Yara is seeking to protect its margins in Europe, the tight global nitrogen market boosted profits in the Americas, Africa, and Asia. Yara proposed an additional dividend of NKr10 per share (approximately $0.95 at current exchange rates), which will be paid in the fourth quarter. It said it will also consider further cash returns including share buybacks in the coming quarters.

Carnegie analyst Morten Normann said Yara’s lower-than-planned curtailments point to higher volumes in the fourth quarter and through 2023, Bloomberg reported. Norne analyst Tomas Skeivys said Yara’s “very strong” third quarter proves the company’s flexible business model, and its “ability to source cheaper ammonia globally is bearing fruit.”

Credit Suisse analyst Samuel Perry, however, noted that Yara is “overweight” in European gas, which he estimates as an $800 million headwind in 2023, prior to the impact of curtailments. Perry noted the company would need a ~30% increase in nitrates pricing from “already high levels” to offset this.

Based on current forward markets for natural gas in October, and assuming stable gas purchase volumes, Yara said its gas cost for the fourth quarter is estimated to be $540 million higher than a year ago.

For the nine-months, the company posted a net income attributable to shareholders of $2.02 billion ($7.88 per share), up from $410 million ($1.59 per share) the previous year. EBITDA excluding special items increased by 80%, to $3.82 billion from $2.13 billion, while revenue rose 61%, to $18.59 billion from the prior year $11.58 billion.

Yara Production and Deliveries

| ‘000 mt | 3Q-2022 | 3Q-2021 | 9M-2022 | 9M-2021 |

| Production1 | ||||

| Ammonia | 1,531 | 1,819 | 4,942 | 5,503 |

| Finished fertilizer and industrial products (excluding bulk blends)1 | 4,601 | 5,463 | 13,929 | 15,687 |

| Yara Deliveries | ||||

| Ammonia trade | 457 | 471 | 1,304 | 1,518 |

| Fertilizer | 5,629 | 7,588 | 17,535 | 21,786 |

| Industrial product | 1,851 | 1,919 | 5,514 | 5,535 |

| Total deliveries | 7,937 | 9,979 | 24,353 | 28,639 |

1 Including Yara share of production in equity-accounted investees, excluding Yara-produced blends

Yara Crop Nutrient Deliveries

| ‘000 mt | 3Q-2022 | 3Q-2021 | 9M-2022 | 9M-2021 |

| Crop Nutrition Deliveries | ||||

| Urea | 1,000 | 1,467 | 3,702 | 4,637 |

| Nitrate | 1,183 | 1,327 | 3,415 | 4,091 |

| NPK | 2,212 | 2,966 | 6,333 | 7,695 |

| CN | 341 | 405 | 1,185 | 1,351 |

| UAN | 242 | 297 | 859 | 1,058 |

| DAP/MAP/SSP | 150 | 280 | 442 | 762 |

| MOP/SOP | 261 | 534 | 772 | 1,200 |

| Other products | 234 | 312 | 827 | 992 |

| Total Crop Nutrition Deliveries | 5,629 | 7,588 | 17,535 | 21,786 |

| Europe Deliveries | 1,979 | 2,104 | 5,793 | 7,055 |

| Americas Deliveries | 2,688 | 4,149 | 8,492 | 10,870 |

| North America | 436 | 643 | 2,173 | 2,665 |

| Brazil | 1,763 | 2,904 | 5,006 | 6,582 |

| Latin America excluding Brazil | 489 | 602 | 1,313 | 1,623 |

| Africa & Asia Deliveries1 | 963 | 1,336 | 3,250 | 3,861 |

| Asia | 715 | 987 | 2,550 | 2,950 |

| Africa | 248 | 349 | 700 | 912 |

| Industrial Solutions Deliveries | 1,851 | 1,919 | 5,514 | 5,535 |

1 The Africa and Asia business also includes Oceania

Incitec Pivot Ltd. (IPL), Southbank, Victoria, announced the appointment of Christine Corbett as CEO Designate of the proposed standalone Incitec Pivot Fertilisers (IPF) business. Corbett will lead the business starting Jan. 9, 2023, as part of IPL, and through the proposed structural separation, which was announced in May (GM May 27, p. 1).

Corbett was Managing Director and CEO Designate for energy company AGL Australia in AGL’s demerger, which did not proceed earlier this year. She joined AGL in 2019 as its Chief Customer Officer responsible for both the consumer and large industrial business areas. Prior to joining AGL, Corbett built a career at Australia Post spanning nearly 30 years.

CF Industries Holdings Inc. on Oct. 17 announced appointments related to the company’s clean energy initiatives.

Erik Mayer has been appointed Vice President, Clean Ammonia Growth. In this newly created role, he will lead a team focused on the evaluation and development of CF’s blue ammonia capacity expansion. He has been with CF for 17 years, most recently serving as Vice President, Clean Energy Solutions. He has also been Vice President, Product Management, Ammonia, and held numerous roles at the Donaldsonville Complex. He will report to Ashraf Malik, Senior Vice President, Manufacturing and Distribution.

Lei Chen has joined CF as Vice President, Clean Energy Solutions. She will lead a team charged with working to support CF’s decarbonization strategy, and will develop market opportunities for CF to manufacture and sell blue and green ammonia. She brings 20 years of experience in the energy industry, most recently as Head of Business Development in Fuels for Alimentation Couche-Tard/Circle K. Prior to that, she had a long-standing career with BP and held a number of commercial development roles with BP supply, trading, and downstream businesses. She will report to Chris Bohn, Senior Vice President and CFO.

The Mosaic Co. confirmed on Oct. 21 that its phosphate operations that were idled due to Hurricane Ian (GM Oct. 7, p. 1) are back up. There were no further details.

Mosaic reported on Oct. 3 that significant flooding and high winds were experienced throughout Central Florida during the storm and caused modest damage to its phosphate facilities and supporting infrastructure.

It said early assessments indicated that phosphate production could be down by approximately 200,000-250,000 mt, split roughly evenly between the third and fourth quarters of 2022. Repairs were expected to take 1-2 weeks.

The strike at Mexico’s Grupo Fertinal’s Lazaro Cardenas phosphate plant is over, according to industry sources, though the company had not responded to inquiries at press time. The strike was reported to have begun on Aug. 26, and Fertinal declared force majeure soon thereafter (GM Sept. 2, p. 28).

The company was reported to be in the process of bringing the plant back to production. Fertinal has approximately 1. 2 million mt/y of DAP/MAP/TSP capacity at Lazara Cardenas, according to the Green Markets Global DAP/MAP Supply & Demand Model.

Winnipeg-based Sollio Agriculture has announced that Ontario Grain LP, a grain partnership in which Sollio holds a majority stake, has decided to exit the grain market and wind down activities in Ontario. The decision will initiate the sale of six operating elevators at Shetland, Staples, Talbotville, Princeton, Becher, and Palmerston.

“The extraordinary events of the past two years causing global economic disruption led to unexpected, significant business challenges and a volatile commodity market,” said Casper Kaastra, CEO of Sollio Agriculture. “Ontario Grain made this difficult but necessary decision after an exhaustive analysis of all available options.”

Sollio, formerly known as La Coop fédérée before a major rebranding in early 2020 (GM Feb. 29, 2020), acquired the Ontario Grain partnership’s assets in 2018 as part of a broader growth strategy. Earlier this year, however, Sollio announced it was entering a phase of consolidating its acquisitions and optimizing its assets.

Sollio said this consolidation process will allow it to focus on its remaining core business activities in crop and livestock production. According to its website, the company’s crop production business is the largest supplier of seeds and fertilizer to farmers in Quebec and eastern Ontario.

Sollio said Ontario Grain intends to honor all existing contracts and to fulfill its obligations to farm customers, employees, and business partners for an orderly transition. It also plans to continue serving clients during the 2022 harvest season, although at a reduced capacity.