Potassium thiosulfate remained at $730/st FOB Terre Haute, Ind., for the last confirmed offers.

All posts by mickeybarb@charter.net

Crops/Weather

Eastern Cornbelt:

Power outages and storm damage were reported across central Illinois on June 29 after powerful storms ripped through the region. Strong winds upended several semis on I-57 during the storm, forcing temporary highway closures.

The powerful system then plowed through central Indiana, causing nearly 50,000 power outages across western areas of the state during the afternoon of June 29. While Ohio was largely spared from storm damage, much of the state remained under air quality advisories due to smoke from Canadian wildfires. Air quality alerts were also posted in Michigan during the week.

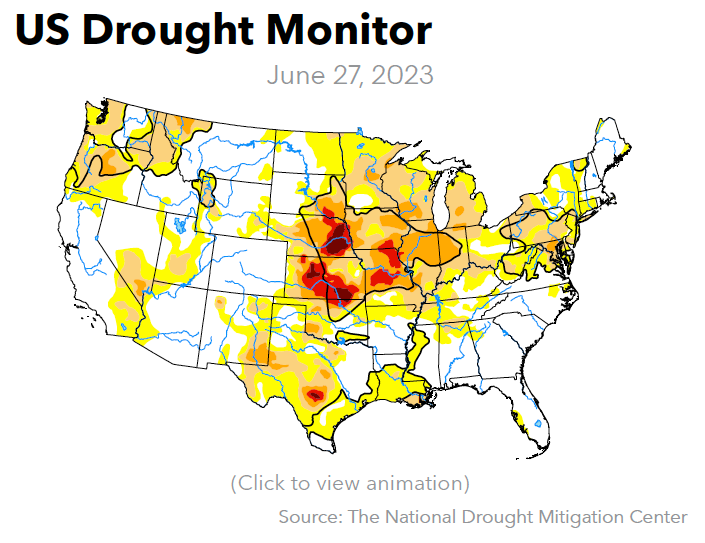

With severe drought now covering most of Illinois, crop conditions in the state worsened in late June. Just 25-26% of the corn and soybeans in Illinois fell in the good or excellent categories as of June 25, compared with 47% in Indiana and 66% in Ohio. Michigan’s crops were also struggling from drought, with 28% of the corn and just 23% of the soybeans rated as good or excellent.

Western Cornbelt:

A band of rain and thunderstorms moved through southeastern Nebraska and southern Iowa late in the week, prompting a severe thunderstorm watch on June 29, with forecasts warning of 50-60 mph winds.

The storm zone also included northern Missouri, where wind gusts up to 80 mph were reported after heat index values climbed to 96-108 degrees across the state. Forecasts warned of another round of potentially severe storms across northern Missouri on June 30.

Severe-to-exceptional drought continued to cover central and eastern Nebraska, central and northern Missouri, and portions of southern, western, and eastern Iowa. Crop quality was deteriorating as a result, with just 31-32% of Missouri’s corn and soybeans rated as good or excellent on June 25, compared with 47-57% in Nebraska and Iowa.

Nebraska’s sorghum crop was 61% good or excellent in late June, while Missouri’s cotton and rice were 64% and 74% good or excellent, respectively.

Southern Plains:

Much of the Southern Plains experienced sweltering heat and strong thunderstorms in late June, with triple-digit heat reported in southern Kansas during the week. Highs in Wichita reached 102-103 degrees at midweek, while severe thunderstorms tracked through southern areas of the state on June 27.

Oklahoma also registered very high temperatures during the week, but damaging storms on June 27 prompted severe thunderstorm watches for several counties, with reports of 100-mph winds in parts of northern Oklahoma.

A heat dome remained in place over much of Texas, pushing temperatures into the triple digits and causing at least 13 deaths in the state since mid-June. According to news reports, the city of Laredo on June 28 had recorded 16 consecutive days of 105+ degree temperatures. Heat advisories were also in effect across southern New Mexico during the week.

A wide swath of extreme-to-exceptional drought continued to blanket central Kansas, but crop conditions remained largely positive. USDA placed 55% of the Kansas corn crop in the good or excellent categories on June 25, compared with 63% in Texas and 76% in Colorado. The Kansas soybean crop was 56% good or excellent, while cotton in those two categories covered 51% of the Kansas crop, 32% in Texas, and fully 76% of the acreage in Oklahoma.

Growers were planting sorghum and harvesting winter wheat in late June, with progress on the former estimated at 66-98% complete across the region. The winter wheat harvest was 74% complete in Texas by June 25, compared with 55% in Oklahoma and 21% in Kansas.

South Central:

Excessive heat warnings and advisories were in effect for southern Kentucky, Middle Tennessee, Arkansas, and southern Louisiana and Mississippi during the week, with heat indices expected to reach 100-115 degrees across the region.

An air quality alert was also in effect for parts of the region due to smoke drifting in from Canadian wildfires. The forecasts called for spotty thunderstorms during the week as well, with a chance of severe storms in parts of Arkansas and Tennessee, including the potential for tornadoes, damaging winds, hail, and heavy rain.

Crop conditions were favorable in the region in late June, with good or excellent ratings assigned to 66-72% of the regional soybean crop and 60-73% of the corn in Kentucky and Tennessee. Cotton in the good or excellent categories totaled fully 84% of Louisiana’s crop, 77% in Arkansas, 75% in Tennessee, and 64% in Mississippi, while rice in those two categories covered 73% of the crop in Texas, 67% in Arkansas, 60% in Mississippi, and 57% in Louisiana.

Southeast:

Severe storms on June 26 produced strong wind, lightning, hail, and heavy rain across central North Carolina, causing flooding in some locations and leaving up to 35,000 residents without power in Benson, Fayetteville, and northern Raleigh.

The same system also caused widespread power outages in central Virginia, while another band of powerful thunderstorms battered parts of central and northern Georgia late on June 25, leaving up to 300,000 residents without power.

Alabama experienced near-record temperatures in the 100s and a heat index close to 110 degrees during the week, with much of Florida also baking in excessive heat.

Crop conditions remained largely favorable in the region, with 72-74% of North Carolina’s corn and soybeans rated as good or excellent as of June 25.

Cotton rated as good or excellent totaled 99% of Virginia’s acreage, compared with 75% in Alabama, 60% in Georgia, and 57-59% in the Carolinas. Fully 100% of Virginia’s peanut crop was in the good or excellent categories, along with 84% of the acreage in Alabama, 78-79% in the Carolinas, 75% in Florida, and 63% in Georgia.

“Crops look good, but the fields are extremely wet from all the rain we’ve been getting,” said one Georgia contact. “Our biggest concern right now is getting fertilizer out; they have barely applied right now because of the rain. We are having a really hot spell, though, so fields should be drying up quick.”

Transportation

US Gulf:

Intermittent travel outages were expected between 7:00 a.m. and 7:00 p.m. at the Port Allen Route’s BNSF railroad bridge, located at Mile 1, through July 6. The interruptions were slated to repeat between July 17 and Aug. 14.

Harvey Lock, closed to navigation since June 15 due to reverse head conditions, will remain shut until further notice, sources said. Despite a planned June 23 return to normal operations at Colorado Lock, daytime travel outages continued during the week. Wait times were noted up to 33 hours.

Bayou Sorrel Lock guidewall repairs kicked off on June 26, limiting travel between 7:00 a.m. and 4:00 p.m. daily. The project was anticipated to run through March 2024. Corps data showed waits in a 4-11 hour range. Chamber repairs tentatively scheduled to begin on June 30 at Leland Bowman Lock were predicted to impact daytime travel through approximately July 14.

Mississippi River:

Low water levels continued to necessitate towing restrictions on the Lower Mississippi River, sources said. Northbound tows loading from NOLA saw maximum drafts reduced by up to 20%, while draft limits were cut by as much as 15% on southbound movements. In addition, barge counts were slashed by 15- 25% for southbound tows, prompting 24-48 hour delivery delays.

On the upper river, sources noted a 5-10% draft reduction on travel above St. Louis, while drafts were reduced by up to 25% for southbound tows loading at St. Louis. The St. Louis river gauge was posted at (-)0.02 feet and falling slowly on June 28. Forecasts called for a drop to (-)1.90 feet on July 12.

On the lower river, Memphis levels were noted at a low-stage (-)5.77 feet on June 28. Following a brief rise to (-)4.00 feet predicted on July 2-3, the gauge was forecast to recede to (-)8.10 feet on July 12.

Due to shoaling and groundings reported in the area, southbound passage through the lower river’s Mile 779 was restricted to daylight hours for tows of 20 barges or more. Dredging previously underway at Mile 537 shifted to Mile 608 on June 27. Rolling 24-hour shutdowns were expected for the duration of the project.

Work at Old River Lock, scheduled to run July 10 through Aug. 31, will block navigation on July 31-Aug. 3, Aug. 14-17, and Aug. 21-24.

Channel fortification efforts at Miles 931-933 were scheduled to continue through mid-July, limiting southbound navigation between 7:00 a.m. and 6:00 p.m. daily. Delays were reported at 12-18 hours for the week. The project was described as 40% completed on June 5.

Illinois River:

Brandon Road Lock, Dresden Island Lock, and Marseilles Lock are closed to navigation through the end of September due to planned maintenance and repairs, effectively shutting the river to commercial transport. Starved Rock Lock will go offline on July 11-14 for miter gate repairs.

Draft reductions persisted due to unseasonably low water levels. Wickets were raised at Peoria Lock and LaGrange Lock because of the conditions, prompting tows to lock through both locations. Waits were counted up to 10 hours at LaGrange.

Ohio River:

Ten-foot draft limits were reported on NOLA-loaded barges destined for the Ohio River.

The John T. Meyers Lock primary chamber is shut for repairs through Aug. 20. The site’s secondary chamber will go offline between Aug. 21 and Sept. 10 for miter gate maintenance, followed by an additional main chamber closure running Sept. 11 to Nov. 17.

The secondary chamber at New Cumberland Lock is closed to traffic through Aug. 18. The auxiliary chamber at Melville Lock is shut for repairs until Aug. 4, and travel through the Meldahl Lock auxiliary chamber was unavailable through June 30.

Use of an assist boat was required on southbound movements through Smithland Lock due to strong outflows, sources said. The site’s land chamber is due to close Sept. 22 through Oct. 21 for miter gate machinery repairs, while the river chamber will shut for machinery replacement Oct. 22 through Nov. 20.

The Greenup Lock main chamber is scheduled to close July 5 through Aug. 14, prompting detours through the auxiliary chamber. Winfield Lock repairs, scheduled July 10 through Sept. 15, are unlikely to require significant travel delays, sources said.

Delays were posted up to 20 hours at the Tennessee River’s Kentucky Lock, down from 26 hours reported previously. Boats transiting Wilson Lock waited up to 15 hours to pass. Draft reductions of 5% continued on the Monongahela River due to low water levels.

Corn Crop Jumps to 94.1 Million Acres, USDA Reports; Soybean Acreage Falls to 83.5 Million

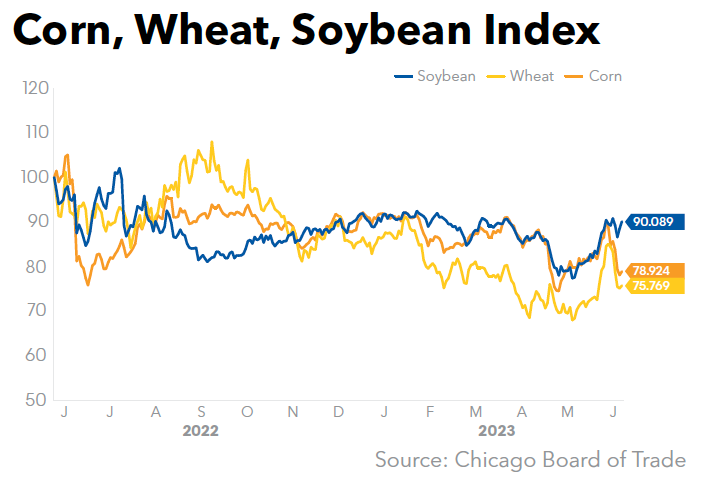

US corn growers planted an estimated 94.1 million acres this spring, USDA said in its June 30 Acreage report, up 6%, or 5.52 million acres, from last year and a jump from the March Prospective Plantings estimate of 92 million acres. USDA said this represents the third-highest planted acreage in the US since 1944.

The corn acreage estimate was well above a Bloomberg survey of as many as 32 analysts prior to the report’s release, which averaged 91.9 million acres. USDA said corn acreage is expected to be up or unchanged in 43 of the 48 estimating states compared with last year, with the projected area harvested for grain at 86.3 million acres, up 9% from last year.

The corn acreage increase came at the expense of soybeans. Soybean planted area for 2023 is estimated at 83.5 million acres, down 5% from last year and well below the March Prospective Plantings estimate of 87.5 million acres. Bloomberg’s survey of analysts had yielded a soybean acreage estimate of 87.7 million acres.

USDA said planted soybean area is down in fully 20 of the major producing states, but the 83.5 million acres estimate still places this year’s crop as the fifth-highest planted area on record.

All wheat planted area for 2023 is estimated at 49.6 million acres, up 9% from 2022 and down just slightly from the March estimate of 49.9 million acres. The Bloomberg wheat acreage survey was nearly spot-on, with an average estimate of 49.7 million acres.

All cotton planted area for 2023 is estimated at 11.1 million acres, down 19% from last year and just slightly below the March estimate of 11.3 million acres. The Bloomberg survey came in at an average of 11.2 million planted cotton acres.

US growers planted 6.81 million acres of sorghum in 2023, up 8% from last year and above the Bloomberg survey estimate of 6.2 million acres. Area planted to rice in 2023 was estimated at 2.69 million acres, up from last year’s 2.22 million acres and also besting the March Prospective Plantings estimate of 2.58 million acres.

USDA also released its updated Grain Stocks report on June 30, which pegged total corn stocks at 4.11 billion bushels, down 6% from this time last year; soybean stocks at 796 million bushels, down 18% from last year; and all wheat stocks at 580 million bushels, down 17% from last year at this time.

Vanguard Starts Construction on Compound Fertilizer Plant in Ontario

Vanguard Crop Nutrition Inc. (VCN), a Canadian producer of specialty fertilizer, confirmed on June 14 that it has begun construction on a compound fertilizer manufacturing facility in Maitland, Ont. The manufacturing site is located near the St. Lawrence Seaway, Highway 401, and mainline rail, and is targeted to open in 2024 with a 25 mt/h production capacity.

“There is no better time than now to build and safeguard Canada’s manufacturing and supply of next-generation crop nutrition solutions.” said VCN CEO Ryan Brophy. “Supply chain disruptions and recent offshore production quality are serious issues for farmers on this side of the Atlantic, and VCN Canada will help correct that. A win-win-win for the producer, the people, and the planet.”

The facility will produce VCN’s flagship compound fertilizer Eleven Superstart for multi-crop application, a product that provides 11 plant nutrients in one low-salt, high density granule designed for seed-placed/in furrow application. The product was previously manufactured in Eastern Europe and imported into Canada and the Americas.

The new plant will also manufacture the company’s Soy7 MAX and Pulse8, which are slated to be launched in 2024 and 2025. VCN said the project will provide local and indirect jobs throughout the construction phase, and in manufacturing, logistics, and distribution once the facility is operational.

VCN is a subsidiary of V6 Agronomy Inc., a Canadian wholesale fertilizer distributing company founded by Brophy in 2012 with distribution warehouses in North Augusta, Ont., and Wilcox, Sask. V6 also operates railyards in both eastern Ontario and southeastern Saskatchewan, and expanded its distribution into northern New York in 2014 (GM Jan. 20, 2014).

VCN said its focus is on “regenerative agriculture” and on-farm climate change mitigation, and its manufacturing process involves mixing mineral and organic components with conventional ingredients to remineralize soils and remove carbon dioxide via enhanced rock weathering.

“It’s an exciting day and time for farmers across Canada and the Americas,” said Brophy. “This is the first step to providing a secure supply of fertilizers developed to improve food security and make tangible in-soil contributions to fighting climate change.”

Intrepid Completes Phase One of HB Mine Project; Expects Phase Two Construction by End of Year

Intrepid Potash Inc. on June 21 announced the successful completion of Phase One of its HB Injection Pipeline Project at the company’s HB Solar Solution potash mine near Carlsbad, N.M., which involved the installation of a 21-mile pipeline to increase brine injection rates.

The goal of the pipeline is to improve brine grade and maximize brine availability, Intrepid said, both of which are essential for the efficient operation of the HB Solar Solution mine. Capital spending for Phase One totaled approximately $16 million, the company said.

As a result of Phase One completion, Intrepid said it now has proven injection rates at up to 2,000 gallons per minute (GPM), almost triple the average injection rate of approximately 700 GPM over the past five years.

“Our primary focus for 2023 is the successful execution on our growth projects designed to improve our brine grade and availability,” said Bob Jornayvaz, Intrepid CEO and Executive Chairman. “Completing Phase One of the HB Injection Pipeline Project on schedule and within budget is a great first step in increasing our annual potash production, which should significantly improve our unit economics.”

The company also provided an update on Phase Two of the project, which involves the installation of an in-line pigging system to clean the pipeline and prevent scaling to help ensure more consistent flow rates. Intrepid said it continues to work through the permitting process but expects Phase Two construction to begin by the end of the year, with commissioning expected in the first quarter of 2024.

“Due to the nature of the brine injection and evaporation cycle, we expect to see production improvements at HB starting in the fall of 2024,” Jornayvaz said.

Until the completion of Phase Two, Intrepid anticipates operating at average injection rates of approximately 1,100 GPM, which the company said are roughly 55% higher than rates before the start of the project. Following the completion of Phase Two, however, Intrepid expects injection rates to jump to 1,500-2,000 GPM.

First Phosphate Commissions Phosphate Concentrate Pilot Plant in Quebec

Junior miner First Phosphate Corp., Saguenay, Quebec, on June 19 announced that it has completed the commissioning of its pilot plant to produce phosphate concentrate. The concentrate will be used in the formulation of battery-grade purified phosphoric acid for use in the manufacture of lithium iron phosphate (LFP) cathode active material for the LFP battery industry in North America.

The pilot plant, which the company said uses fully solventless, environmentally friendly extraction methods, is located at the Quebec City facilities of SGS Canada Inc., a multinational company that provides inspection, verification, testing, and certification services.

“The commissioning of the pilot plant is a major milestone for First Phosphate in the processing of battery-grade purified phosphoric acid that will be used in the LFP homologation process with our partners,” said Peter Kent, First Phosphate President.

Following positive bench test results that demonstrated a recovery of 91.4% of phosphate-bearing apatite to a concentrate containing 40.2% P2O5, First Phosphate decided to build the pilot plant to process a large, 15-ton bulk sample that optimizes the company’s metallurgical process for the production of high-grade phosphate concentrate approaching 41% P2O5.

Based on 15 separate crushed rock specimens, the bulk sample tested by SGS assayed 7.6% P2O5 and 6.9% titanium oxide. “SGS is committed to First Phosphate as a trusted partner,” said Dominique Lascelles, Director, Technical Services, at SGS. “The test work to-date has proven positive, and we are happy to have completed this full pilot plant program with First Phosphate.”

The pilot plant has produced over 900 kilograms of apatite concentrate, which were sent to the facilities of Prayon SA in Belgium, Europe’s largest producer of battery-grade purified phosphoric acid (PPA). Prayon and First Phosphate signed a Memorandum of Understanding (MOU) in February to collaborate on PPA production (GM March 3, p. 1).

First Phosphate said the battery-grade PPA produced by Prayon will then be sent to company partners for homologation into their LFP cathode active material production processes. The company said the pilot plant also produces marketable recoveries of ilmenite and magnetite.

First Phosphate holds 1,500 square kilometers of total land claims in the Saguenay Region, some 110 kilometers north of the City of Saguenay, which it is actively developing to produce battery grade phosphate at ESG standards and with a low-carbon footprint (GM Oct. 14, 2022).

Uralkali Plans to Restore Potash Output in 2H; Uralchem Expects N Sales to Support Full Production

Russian potash producer Uralkali PJSC is expecting to see a recovery in its potash output in the second half of this year, Uralchem Board Chairman Dmitry Tatyanin said in an interview with Russian news agency Tass at the St. Petersburg International Economic Forum on June 14-17.

“The decline in Uralkali’s potash production happened in the first quarter. We expect further steady growth, with volumes returning to capacity levels in the second half of this year,” Tatyanin said, according to the report.

Uralkali’s current potash production capacity is unclear, but according to its website, the company produced 12.3 million mt of KCl in 2021. Russia’s first-quarter potash production in 2023 fell 31% year-over-year, to 1.7 million mt of active ingredient, according to an Interfax report in April, citing the country’s Federal State Statistics Service, Rosstat (GM April 28, p. 31).

Russian company EuroChem Group AG also produces potash, cranking out 2.39 million mt of potassium chloride in 2021 at its Usolskiy Potash operation, south of Berezniki (GM Sept. 8, 2022) and 427,000 mt of potassium chloride at its VolgaKaliy operation in Russia’s southern Volgograd region in 2022, according to company data (GM April 7, p. 26). EuroChem has not published full operational results since 2021.

Meanwhile, Uralchem expects its own nitrogen fertilizer sales this year will enable the company to maintain a 100% production capacity load, according to Tatyanin. He noted, however, that the situation with ammonia will change in 2024 following the launch of the company’s terminal in the Russian Black Sea/Azov Sea port of Taman.

Uralchem last month reaffirmed its plans to commission the new terminal in late 2023 (GM May 26, p. 32). A first stage rated for freight turnover of up to 2 million mt/y of ammonia will be put into operation in late 2023, according to the company. Under a second stage of development, currently scheduled for completion by the end of 2025, the terminal’s transshipment capacity is targeted to grow to 3.5 million mt/y of ammonia and 1.5 million mt/y of urea.

Tatyanin told Tass that the construction of the new terminal could eliminate the problem of the Togliatti-Yuzhny ammonia pipeline being blocked. “The new Black Sea terminal, with a transshipment capacity of 3.5 million mt/y of ammonia, will adequately meet the needs of producers,” he said.

A further expansion of the terminal’s capacity for fertilizer transshipment is possible, according to Tatyanin, who told TASS that Uralchem is “considering several ideas for the development of the Taman terminal.”

The Togliatti-Yuzhny ammonia pipeline, which Russia used to transport ammonia for export to three Black Sea ports, has been shut since Russia’s invasion of Ukraine in February 2022. Russia is reported to have sent more than 2 million mt/y of ammonia through the pipeline for export before the shutdown.

Earlier this month, a portion of the pipeline in the Kupiansk district of Ukraine’s Kharkiv region was damaged by explosions (GM June 9, p. 1). Kyiv said Russian missiles were responsible, while Moscow blamed Ukrainian saboteurs.

OCP Plans Green Ammonia Plant in Southern Morocco

OCP Group SA plans to invest $7 billion to build an ammonia plant in Tarfaya, in southern Morocco, using green hydrogen produced from renewable fuel, Reuters reported on June 20. The plant is slated to produce 200,000 mt/y of ammonia by 2026, increasing to 1 million mt/y by 2027 and 3 million mt/y by 2032, the company told Reuters.

The plant, which would use hydrogen produced from solar and wind powered electrolysis as a raw material to make ammonia, is part of an ambitious strategy that OCP announced in December to invest approximately $13 billion in 2023-2027 to ramp up its transition to carbon neutrality by 2040 and reduce the company’s dependency on ammonia imports (GM Dec. 9, 2022).

Morocco imported a total of 1.88 million mt of ammonia in 2022, according to Trade Data Monitor, up from 1.65 million mt in 2021. Russia was Morocco’s main ammonia supplier before the war in Ukraine, but imports from Russia fell to 254,531 mt in 2022, down from 826,255 mt in 2021.

With the loss of Russian ammonia, Morocco has been forced to cast a wider net. Ammonia imports for January-April this year totaled 444,650 mt, down 37% from the prior year’s 706,139 mt, with more than half supplied by Trinidad. Other exporters of ammonia to Morocco for the first four months of this year included Saudi Arabia, the US, Oman, and Indonesia.

In addition to the green ammonia plant, OCP also plans to invest in desalination powered by renewable energy, both to supply its industrial facilities and to supply adjacent farmland. Its Tarfaya project involves a renewable-energy powered desalination plant with capacity of 60 million cubic meters/y to supply the industrial facilities, OCP confirmed in December.

Morocco’s largest announced green hydrogen and green ammonia project to date is the HEVO Ammonia Morocco project, unveiled in July 2021 (GM July 16, 2021). Based on solar power, the plant is targeted to produce 183,000 mt/y of green ammonia when operations commence, which is expected in 2026.

The International Fertilizer Association – Management Brief

The International Fertilizer Association (IFA) announced that Tony Will, President and CEO of CF Industries Holdings Inc., has been elected as the new Chair of the association, replacing Svein Tore Holsether, President and CEO of Yara International ASA, who took the post in June 2021 (GM June 18, 2021). Jeanne Johns, outgoing Managing Director and CEO of Incitec Pivot Ltd. (IPL), is the new Vice Chair of IFA, replacing UralChem CEO Dmitry Konyaev.

Will has served as CF’s President and CEO since January 2014. Johns was appointed IPL’s CEO and Managing Director in 2017, but the company announced earlier this month that she was stepping down (GM June 9, p. 26).

“I am honored to serve as Chair of IFA and help advance this vital organization’s mission to promote the efficient and responsible production, distribution, and use of plant nutrients,” Will said. “Our industry is at the forefront of some of the world’s most important challenges, from food security to climate change. I look forward to working with our members and the IFA team to continue our leadership role in addressing these global priorities, collaborating not just within our own industry, but with government and other stakeholders as well.”

Both Will and Johns serve on IFA’s Executive Board, along with Immediate Past Chair Holsether, IFA CEO and Director General Alzbeta Klein, and Raviv Zoller, President and CEO of ICL Group. Ahmed El Hoshy, CEO of OCI Global and Fertiglobe, and Abdulrahman Shamsaddin, CEO of SABIC Agri-Nutrients, are joining the Executive Board as well.

IFA also welcomed five new members to its Board of Directors, including Robert Wilt, CEO of Saudi Arabian Mining Co. (Ma’aden); Maen Nsour, President and CEO of Arab Potash Co. (APC); Julian Palliam, President and CEO of Foskor; Yasser Alabassi, President of Bahrain’s Gulf Petrochemical Industries Co. (GPIC); and Wang Bei, General Manager of CNAMPGC Holding Ltd Co. Members reelected to the Board of Directors include David Delaney, CEO of Itafos Inc., and Suresh Krishnan of Adventz.