Eastern Cornbelt:

The remains of Hurricane Beryl moved through the Eastern Cornbelt on July 9-10, pouring several inches of rain on the region and spawning at least six tornadoes in Indiana and northern Kentucky. High heat and humidity was expected to return to the region later in the week, with heat index values climbing to the triple digits.

Parts of eastern Illinois registered more than four inches of rain from Beryl, while Indiana was hit with an EF-3 tornado packing 140 mph winds near Mount Vernon, and EF-2 with 120 mph winds near Poseyville, and two EF-1 tornadoes with 100 mph winds near Springfield and Patoka.

Ohio and Michigan also received heavy rain from the storm, with multiple locations in southern Michigan reporting more than four inches on July 9-10, and a few isolated areas posting 6-7 inches of rain.

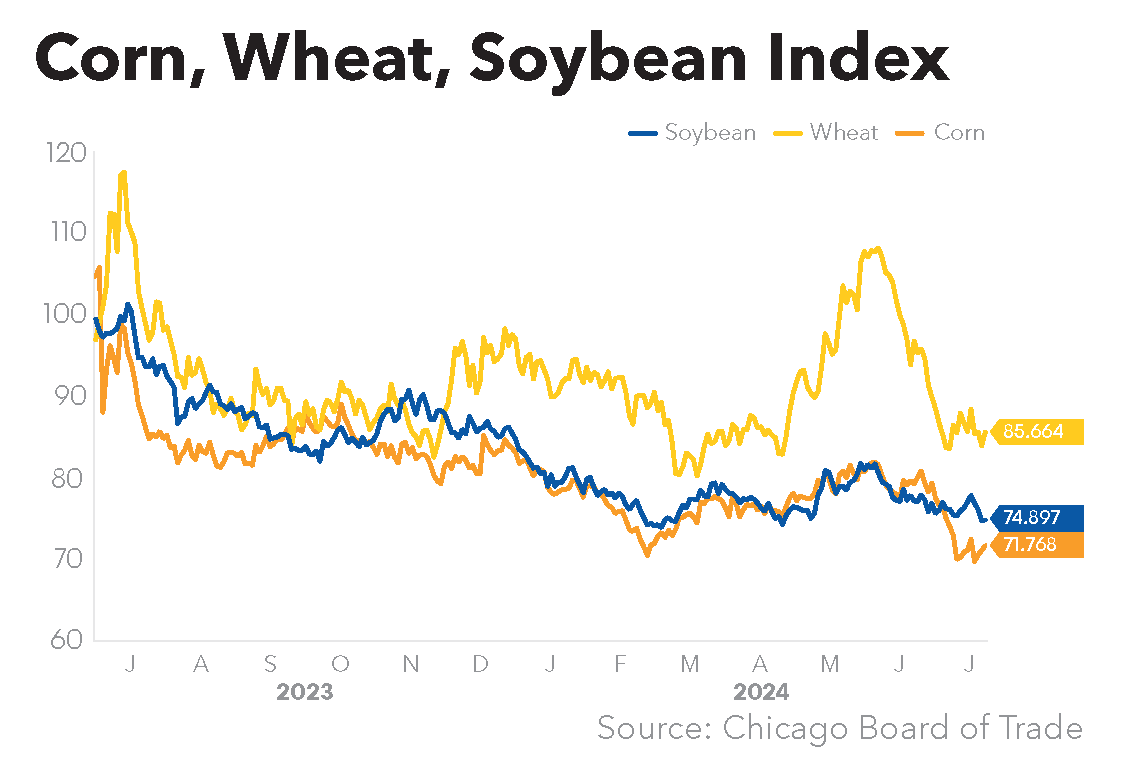

Good or excellent ratings were assigned to 73-74% of the corn and soybeans in Ohio on July 7, compared with 66-67% in Illinois and Indiana. Michigan’s corn crop was 73% good or excellent, with 60% of the state’s soybean crop falling into those two categories.

Western Cornbelt:

While the Eastern Cornbelt, Great Lakes, and Northeast received heavy rain from the remnants of Hurricane Beryl, Iowa was finally able to enjoy mostly dry weather during the week after heavy and frequent showers in recent weeks. Hot, humid weather was on tap for the coming weekend, however, with heat indices expected to reach the lower triple digits.

Nebraska and western Missouri were also bracing for high heat by the weekend, with forecasts calling for highs in the mid- to upper-90s and heat indices climbing to 100-110 degrees.

USDA rated 76-80% of the corn and 75-76% of the soybeans as good or excellent in the region on July 7. Good or excellent ratings were also assigned to 59% of Missouri’s cotton and 77% of the state’s rice crop, along with 84% of Nebraska’s sorghum crop.

Northern Plains:

A line of thunderstorms moved through parts of central and southern Minnesota at midweek, with reports of localized power outages from strong winds and hail.

Temperatures steadily increased throughout the week. Highs in the Dakotas were reported in the mid-80s at midweek but were expected to reach the upper-80s and low-90s by the weekend. Highs in the upper-90s were in the forecast for July 14.

Corn and soybeans in South Dakota were rated as 68-72% good or excellent on July 6, compared with 58-70% in North Dakota and 59-60% in Minnesota. The region’s small grains crops were in excellent condition, with 78-81% of North Dakota’s spring wheat, barley, and oats rated as good or excellent, along with 75-82% of the acreage in South Dakota and 76-88% in Minnesota. Fully 81% of South Dakota’s sorghum was also rated as good or excellent.

Northeast:

The remnants of Hurricane Beryl brought heavy rain to the Northeast and New England, triggering flash flooding across the region and tornado activity in New York.

While most of the heavy rain had subsided by July 11, flash flood warnings remained in effect across the region. Many areas in northern New York, Vermont, and New Hampshire picked up 3-5 inches of rain, with some areas seeing more than six inches.

“As many of you know, last night’s rainfall across several counties resulted in power outages, several closed roads and bridges, many evacuations due to rushing water, damage to homes and property, and regrettably, the loss of one life at this point,” Vermont Gov. Phil Scott said during a July 11 news conference.

The region endured a heat wave prior to Beryl’s arrival, with heat indices nearing triple digits in many locations on July 8-9. The heat and moisture have benefited corn crops in the region, with fully 81% of Pennsylvania’s crop rated as good or excellent on July 7.

Eastern Canada:

Heavy rain hit much of Eastern Canada as the remnants of Hurricane Beryl moved through the region on July 10-11. Special weather statements and rainfall warnings were in effect in southern Ontario, Quebec, and the Maritimes during the week, with the hardest hit areas expecting up to 75-100 mm of rain and other locations looking at 30-50 mm.

Montreal was bracing for 50-75 mm of rain at midweek. In the Maritimes, forecasts warned of 40-70 mm of rain in New Brunswick and 40-60 mm in Prince Edward Island, though up to 100 mm was possible in some areas by July 11.