Nutrien Drops Geismar Clean Ammonia Project; Reviewing Strategic Options

Nutrien Ltd. no longer plans to pursue the clean ammonia expansion of its Geismar, La., facility, Bloomberg reported, citing a June 12 Nutrien filing with the US Securities and Exchange Commission (SEC).

At its Investor Day on June 12, Nutrien President and CEO Ken Seitz said the company “paused work last year [on the Geismar expansion] in response to higher capital cost estimates and uncertainty over the pace of emerging demand for clean ammonia. Today, with a clear view to prioritizing our capital, we have made the decision to no longer pursue this project.”

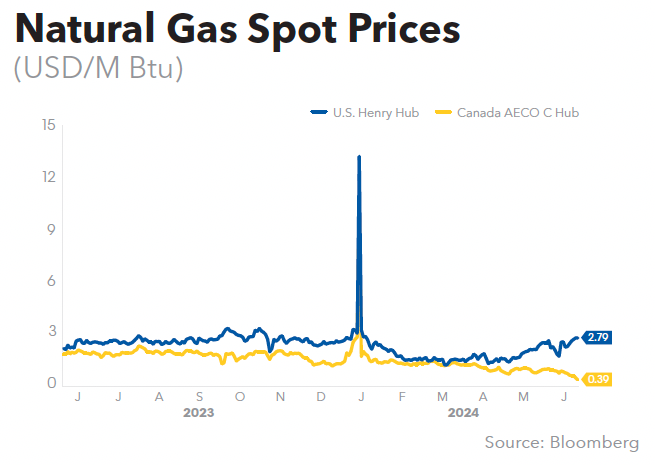

The expansion was first announced in 2022 (GM May 20, 2022) and at the time the facility was expected to be the world’s largest clean ammonia production plant with expected volumes of 1.2 million mt/y. Nutrien said it would leverage low-cost natural gas, tidewater access to world markets, and high-quality carbon capture and sequestration to serve the growing demand in agriculture, industrial, and emerging energy markets.

Production at the facility was originally set to begin in 2027, but in August 2023 Nutrien suspended work on the project (GM Aug. 4, 2023) and last October the Louisiana Board of Commerce approved a delay in the commencement of operations from March 31, 2027, to March 31, 2030 (GM Oct. 27, 2023). At that time Nutrien said it had invested more than $100 million in the project.

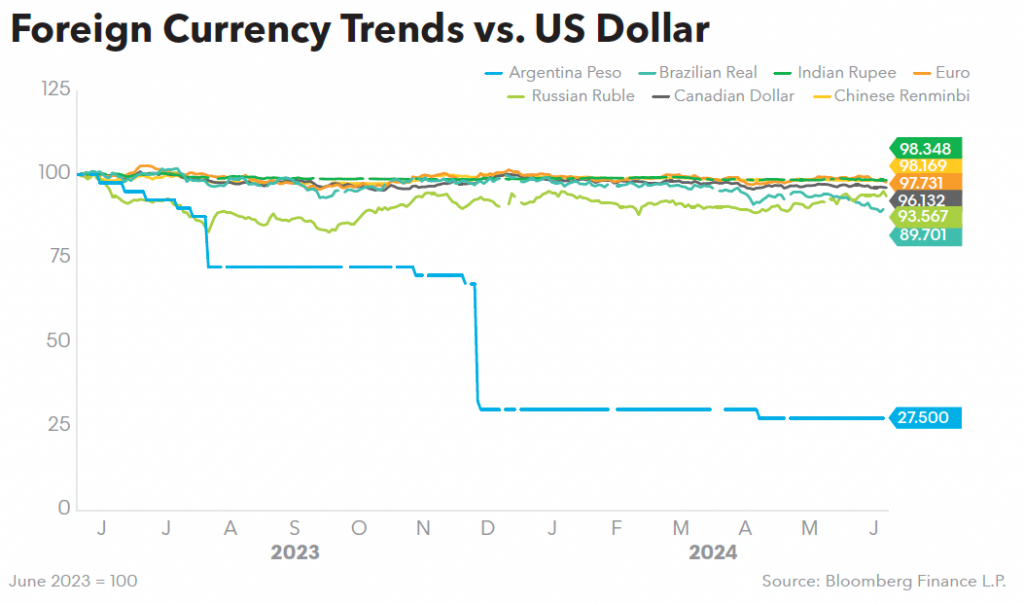

Nutrien also indicated at its June 12 Investor Day that it is reviewing strategic options for its 50% ownership in Profertil in Argentina. Seitz said the company will be “laser-focused” on areas where it has the greatest competitive advantages, scale, and strategic fit.

“This includes enhancing our low-cost upstream fertilizer production assets in North America, growing our proprietary product capabilities, strengthening our global distribution network, and investing in our downstream core retail geographies,” Seitz said.

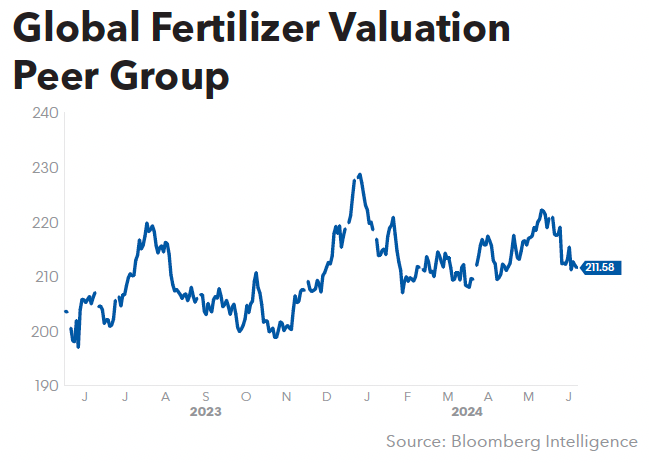

Bloomberg Intelligence Fertilizer Analyst Alexis Maxwell said Nutrien’s “strategic focus and capital now shifts to improving nitrogen reliability, energy efficiency, and upgraded product volumes. The company is targeting a 92-93% ammonia production rate in 2026, up from 88% achieved in 2023 and which could translate to up to 12 million tons of nitrogen in 2026, a 15% increase from 2023 nitrogen sales.”