Data Signals

In response to accounting problems reported earlier this year that prompted an investigation by federal authorities and the suspension of the company’s CFO (GM Jan. 26, p. 26), Archer Daniels Midland Co. on March 12 revised three years of results for the operating segments at the center of its accounting woes via a so-called “Little R” revision, Bloomberg Law reported.

ADM tucked the corrections into its 10-K and told analysts and investors that while Securities and Exchange Commission (SEC) and Department of Justice (DOJ) investigations continue, the errors were a small part of the company’s financial results. It simultaneously said the revision did not trigger a review under new executive compensation clawback rules.

“We determined that the adjustments are not material to our consolidated financial statements, taken as a whole for any period,” CEO Juan Luciano told analysts on the company’s earnings call on March 12. The quiet correction that does not require the fanfare of releasing a special 8-K announcing a restatement or re-issuing old financial reports.

When the accounting errors were revealed, the news stunned the trading and processing world. ADM shares plunged 24% on Jan. 22, the most on record, wiping $8.8 billion from the company’s market value. ADM also placed CFO Vikram Luthar on leave after announcing that the SEC was probing inter-segment sales between the nutrition segment and the company’s other business arms. ADM launched an internal investigation and appointed an interim finance chief.

The SEC requires companies that uncover errors in their past financial statements to correct them. Significant errors are considered red flags in financial reporting, forcing companies to issue statements that they need to fix their mistakes and then file updated financials with the SEC. Smaller errors can be corrected by revisions, which get disclosed in the next period’s financial statements.

That’s what ADM did, with the most significant revisions to the operating profits for its nutrition segment, the unit of the business that includes livestock feed and pet food. The nutrition business is the smallest of the company’s operating segments, but its performance had a big impact on executive bonuses in 2020 and 2021, Bloomberg reported in January.

The company on March 12 shrank its previously reported operating profit in the nutrition segment by $31 million, or 7%, for the year ending 2023. It also reduced operating profits for 2022 by $68 million, or 9%, and revised the 2021 operating profit by $59 million, an 8.5% reduction. The accounting fixes won’t affect executive bonuses, the company said. ADM declined to comment for this article.

Wall Street’s top regulator pays close attention to cases where companies are perceived to sweep accounting errors under the rug without calling them out in a “Big R” restatement. SEC Chief Accountant Paul Munter in March 2022 warned companies against using stealth revisions to fix accounting mistakes if those errors could be considered relevant to investors and analysts. He also said companies have to consider not just the numerical materiality of mistakes.

New SEC rules forcing executives to pay back bonuses if earnings turn out to be erroneous put further pressure on accounting mistakes. Under the rules that went into effect in December, companies have to consider both “Big R” and “Little R” corrections when they develop executive pay clawback policies. They also have to check a box on the front of their annual financial reports indicating whether an error correction triggered such an analysis.

Given the regulator spotlight on accounting mistakes, ADM likely didn’t take the decision to do a “Little R” revision lightly, said Phil Lamoreaux, accounting professor at the W.P. Carey School of Business at Arizona State University.

“I would bet a lot of very expensive people spent a lot of time thinking about this,” Lamoreaux said, referring to attorneys and consultants. “They all knew there was going to be a lot of scrutiny when this 10-K came out.”

Regardless of how ADM corrected its numbers, its problems are not over, said Francine McKenna, accounting lecturer at the University of Miami and author of The Dig, an accounting newsletter. The SEC and DOJ are still investigating, and the company showed signs of stress within the nutrition business unit, McKenna said, pointing to a $137 million goodwill impairment the company recorded this past quarter related to its animal nutrition line.

“At this point it’s technical semantics,” McKenna said of the debate over the type of error correction the company did. “They’ve drawn enough attention to themselves with this issue, even if they didn’t make the disclosure that they had a Big R restatement.”

Federal authorities will closely look at every company move, she said. “They kind of cooked their own goose by putting an executive on leave and really attacking this with a massive investigation,” McKenna said. “Someone’s going to look at it more strenuously.”

The Fertilizer Institute (TFI) on March 14 praised the US Senate for introducing bipartisan legislation to include phosphate and potash on the final list of critical minerals of the Department of the Interior.

The legislation was introduced by Sens. Sherrod Brown (D-Ohio), Thom Tills (R-N.C.), Tammy Baldwin (D-Wisc.), Roger Marshall (R-Kan.), Pete Ricketts (R-Neb.), and Rick Scott (R-Fla.), and TFI said it will recognize the importance of ensuring a strong and sustainable domestic fertilizer supply for American farmers.

“We thank Senators Brown, Tillis, Baldwin, Marshall, Ricketts, and Scott for coming together and introducing this important legislation,” said TFI President and CEO Corey Rosenbusch. “The majority of the world’s phosphate and potash resources are concentrated in only a few countries, leaving them open to supply chain vulnerabilities and geopolitical instability. The events of the past few years have shown us that food security is national security and now is the time to change how we talk about these vital resources.”

TFI noted that the US imports roughly 95% of its potash needs, the bulk of which comes from Canada. Only 14 countries in the world produce potash, with Belarus and Russia comprising nearly 40% of global production. Regarding phosphate, China accounts for more than 40% of global production.

“It is vital that we, as a country, take proactive steps to secure our own agricultural future by recognizing the role these minerals play in putting food on our tables,” Rosenbusch said. “Without these two minerals, modern agricultural systems would crumble and the ability to feed our growing population would be nearly impossible.”

TFI noted that while the US has both phosphate and potash production, expanding mines and opening new ones is a costly and time-consuming process measured in years and in the tens of millions of dollars for permitting alone. Being listed as critical minerals would not exclude these projects from environmental reviews but would streamline the process by assigning responsibility to a single permitting agency.

“By adding phosphate and potash to the Critical Minerals list, we can take a significant stride towards securing our own future and sending the clear message that safeguarding our nation’s food supply is not only an economic imperative, but a strategic priority that ensures our well-being,” Rosenbusch concluded. “We look forward to working with Congress to support this vital legislation.”

NEW Cooperative, Red Oak, Iowa, on March 11 notified the Iowa Department of Natural Resources (DNR) of a release onsite of approximately 1,500 st of UAN 32. The product was discharged into a drainage ditch, then into the East Nishnabotna River. Dead fish were observed but the extent of the fish kill is still to be determined.

DNR Senior Environmental Specialist Wendy Wittrock, who investigated the incident, told The Des Moines Register that the incident involved “a lot of fertilizer” and is likely the largest fertilizer spill she has investigated. Based on current Midwestern retail pricing, the UAN would be valued between $540,000-$615,000.

As of March 14, DNR said clean-up efforts were still underway. It said the product flowed several miles downstream of Red Oak on the East Nishnabotna River, reaching Missouri. The Missouri Department of Natural Resources was notified.

The DNR encouraged private well owners in Montgomery, Page, and Fremont counties with wells in near proximity to the East Nishnabotna River to contact their county health department to test their wells for nitrate. It said this service is free using Iowa’s Grants-to-Counties (GTC) program. The DNR will be providing county health officials with lists of registered private wells that may be vulnerable.

Due to low water levels in the East Nishnabotna, the concentration of the liquid nitrogen fertilizer is higher than during normal stream flows, causing concern for all animals due to high nitrate and urea levels.

Iowa State University College of Veterinary Medicine Toxicologist Scott Radke recommended that all animals be kept away from the East Nishnabotna River until the plume of contaminant moves out of the area.

The Iowa DNR is working with local, state and federal officials, and will continue to investigate impacts of the spill. DNR reported that the release occurred due to a valve left open on an aboveground storage tank overnight. It said areas of pooled fertilizer were pumped into a vac truck and will be land applied later.

“Upon discovery of the spill, management immediately initiated containment protocols as per our established safety procedures,” NEW Cooperative said in a prepared statement on March 13, cited by The Des Moines Register. “We promptly notified the appropriate local authorities and regulatory agencies and have been working diligently in close cooperation with them ever since.”

Just a few days earlier on March 8, DNR said an Adair County Conservation Officer reported a “red sheen” on an unnamed tributary of the Middle Nodaway River. DNR responded and discovered that diesel had overflowed a vent tube of an above ground storage tank at a farm operation owned by Kading Land Co. Inc.

DNR said the discharged diesel reached a stormwater intake located inside the secondary containment area and continued flowing via field tile, eventually reaching the tributary and then the Middle Nodaway River.

The amount of diesel spilled is unknown. No dead fish have been observed. Staff will continue to work with the responsible party to clean up the spill. The investigation is ongoing.

Agricultural powerhouse Brazil is harvesting one bumper crop after another. However, growers are going bankrupt at an alarming rate, according to a recent Bloomberg report, dealing a blow to investors in the fast-growing $7 billion market for agribusiness funding.

Tumbling corn and soybean prices are sparking defaults, undermining returns for so-called Fiagros, the Brazilian investment funds backed by agricultural receivables such as interest, dividends, and land-lease payments. Funds including Galapagos Recebiveis do Agronegocio and SFI Investimentos do Agronegocio have plunged below the value of their underlying assets after farmers skipped payments on some credit facilities.

It’s a surprising turn of events for a country that has seen its agribusiness expand quickly over the past decade. Brazil first overtook the US as the world’s largest soybean shipper in 2013 and climbed to the top spot for corn just last year. The number of growers filing for bankruptcy protection surged six-fold in 2023, according to credit data provider Serasa Experian.

“There’s a wave of bankruptcies in the Brazilian agriculture sector, and that’s very worrying,” said Paulo Sousa, who heads the Brazilian operations of Cargill Inc. “That brings uncertainty for financiers. A lot of new money has entered the sector in recent years, and that’s a risk.”

Fiagros were first introduced in 2021 and gained popularity with retail investors seeking high returns and exposure to the fastest-growing sector in Latin’s America’s biggest economy. These investment funds had more than 34 billion reais ($7 billion) under management in January, up 43% from a year earlier, according to capital markets association Anbima.

Brazil’s agriculture boom was in part funded by these new instruments. Prior to Fiagros, the sector had been largely shut out of capital markets, relying on funding from banks and trading firms. Fresh cash helped growers expand soybean plantings at a record pace, adding 4.6 million acres a year on average since 2019, according to Conab, Brazil’s national supply company.

Now a rash of defaults is fueling concern about the health of those funds and jeopardizing a push to broaden access to capital through debt securitization. If more and more farmers file for bankruptcy, it could also pose a risk for the Brazilian economy, which has grown increasingly dependent on agriculture.

Big banks including Itau BBA SA are tracking clients with debt coming due in the short term to renegotiate maturities and avoid defaults. “2024 will be a more challenging year,” Pedro Fernandes, Director of Agribusiness at Itau, said in an interview. “Some farmers will have to put off debt payments.”

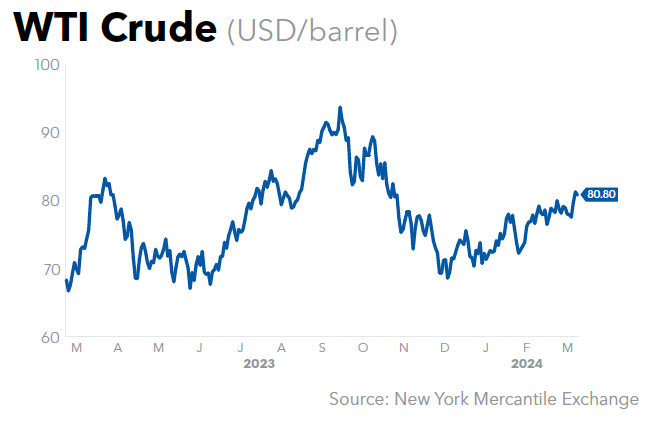

Crop prices have been in decline since mid-2022 as bumper global supplies offset trade disruptions caused by Russia’s invasion of Ukraine. A Bloomberg gauge of key agricultural commodities tumbled almost 16% last year, the biggest drop in a decade. In Brazil, prices fell even further, with corn and soybeans trading at large discounts to futures in Chicago.

Farming companies filing for bankruptcy protection have included Elisa Agro Sustentavel Ltda., a soybean and corn producer in the state of Goias. The company is part of a group that sold 293 million reais in local bonds known as CRAs to investors including Galapagos. Grupo Castilhos, which grows crops on roughly 222,000 acres in Bahia and Parana states, has also skipped payments on CRAs.

Elisa Agro said it is working with creditors and advisers to find a “feasible” restructuring plan. Grupo Castilhos did noy reply to a request for comment.

The profitability squeeze has also hurt other sectors. Sales of tractors and other farming machinery plunged 20% last year, the biggest drop in nearly a decade, and a blow for the likes of Deere & Co. and CNH Industrial NV. Pesticide maker FMC Corp. and seed producer Corteva Inc. were also hard hit.

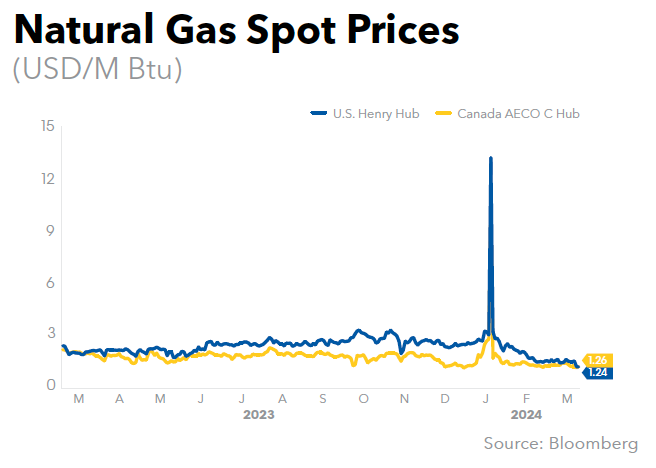

Nitrogen fertilizer producer Unigel, citing high natural gas costs and low fertilizer prices, has been trying to stave off bankruptcy and announced the closure of its two plants last week (GM March 8, p. 34).

AgroGalaxy Participacoes SA, a crop-input distributor, lost almost 80% of its value over the past year following a decline in sales and higher delinquency rates. The Aqua Capital-backed company reported in February that it was seeking a covenant waiver after its leverage rose above the level agreed with debt holders.

The Fiagro industry “grew too quickly and there has been a governance issue with excessive exposure to rural producers,” said Leandro Albuquerque, an analyst at S&P Global Ratings. Most issuers of receivables backing those investments have no rating and provide no public information to investors.

Agropecuaria Tres Irmaos Bergamasco Ltda., which filed for bankruptcy protection in December, agreed to pay a staggering 12.3% a year plus inflation to investors buying its 36 million reais in CRAs maturing in 2027. That compares with an average coupon of 7.26% for a basket of 256 dollar-denominated bonds from Brazilian companies with at least $300 million in outstanding debt. The company did not respond to a request for comment.

“Fiagros went for issuers with high debt loads that are less able to withstand a downturn,” said Vitor Duarte, Chief Investment Officer at asset manager Suno Asset. Any drop in earnings would make it hard for them to pay back debt, he said.

Galapagos, whose Fiagro is already contending with bankruptcy filings and defaults, said lenders are becoming more cautious.

“It’s highly likely that lending will become constrained, maturities will be shorter, and capital will be more expensive,” said Carlos Fonseca, a partner at the Sao Paulo-based fund. “But the agriculture industry is solid. We have a lot of great producers and entrepreneurs. I believe this issue will be solved soon.”

For Cargill’s Sousa, the risk is that much needed credit will disappear. “Capital is skittish, and any threat could lead it to seek calmer waters,” he said. “Working capital in agribusiness is like oxygen.”

Bayer AG is weighing whether to use a controversial legal maneuver known as the Texas Two-Step bankruptcy to try to resolve tens of thousands of US lawsuits claiming its Roundup weedkiller causes cancer, according to a Bloomberg report, citing people familiar with the company’s thinking.

Faced with a recent string of costly jury verdicts over the herbicide, Bayer executives are consulting with law firms and advisers about how to prompt a bankruptcy judge to halt further trials scheduled for this year. The object is to wrangle a settlement of more than 50,000 cases, said the people, who asked not to be identified discussing a confidential matter.

The bankruptcy maneuver gets its name from the use of a Texas state law that lets companies split their assets and liabilities into separate units, then place the unit loaded with liabilities into bankruptcy to drive a global settlement. Courts have rejected the tactic by 3M Co. over suits targeting faulty hearing protection devices for US soldiers and by Johnson & Johnson in litigation tied to its talc-based baby powder.

Bayer is looking for breathing room after it was hammered over the last four months with Roundup jury verdicts totaling about $4 billion. While the company has won more recent trials than it has lost, its latest courtroom defeat was its biggest yet, with a Pennsylvania jury awarding $2.25 billion to a man who blamed his cancer on long-term exposure to Roundup. Bayer maintains the product is safe.

“Given the recent rulings on Texas Two-Step bankruptcies, I’m pretty sure Bayer knows this is a long-shot bid for a settlement,” said Bruce Markell, a former federal bankruptcy judge who now teaches law at Northwestern University. “But they may feel like they don’t have any other choice.”

Bayer declined to comment on any plans for a bankruptcy filing over the Roundup litigation. But Bill Anderson, the company’s new CEO, has said he is prepared to “explore every reasonable option to protect the company and protect our mission from the litigation industry.”

The company’s stock has lost about 70% of its value since Bayer’s 2018 acquisition of Monsanto, from which it inherited Roundup, for $63 billion. Bayer officials acknowledged earlier this month that profits are falling partly because of the ongoing litigation.

The German conglomerate is taking steps that may be in preparation for a unit’s bankruptcy filing. Last month it proposed to add veteran activist investor Jeff Ubben to its Supervisory Board. Ubben publicly called for Bayer to consider a Texas-Two Step filing to deal with the Roundup litigation more than a year ago.

Bayer is also proposing to bring on former McKesson Corp. General Counsel Lori Schecter as a Director. Before joining McKesson, a drug distributor that paid $6 billion to settle litigation over its alleged mishandling of opioid painkillers in 2012, Schecter was a partner at the Morrison & Foerster law firm, where she handled complex litigation and corporate investigations.

Part of Bayer’s problem is that the company is facing tens of thousands of lawsuits in state courts across the country. When it tried to consolidate the litigation through a class settlement program in 2021, a federal judge rejected its efforts.

Since then Bayer has sought to settle Roundup suits when it makes sense for the company and to go to trial when necessary. For a while, that strategy appeared to work, as Bayer won nine cases in a row. But in the fall Bayer lost several trials, with big jury verdicts. Those losses have damaged its leverage in negotiating settlements and spurred plaintiff lawyers to bring new claims against the company.

The idea of a filing would be to collect the scattered Roundup cases before a bankruptcy judge in hopes of negotiating a settlement. The company has spent about $10 billion of the $16 billion it set aside to resolve more than 110,000 Roundup cases so far. The remainder is intended for resolutions of newly filed cases, existing suits that bowed out of previous settlement efforts, and future claims.

One way for Bayer to foster a settlement would be to move a unit to Texas so it can take advantage of the state’s laws. While Bayer is a foreign company, Monsanto was based in Missouri and the company retains major operations there. It is unclear whether Bayer would use Monsanto or another entity name for any Texas Two-Step, the people familiar with the discussions said.

The Texas Two-Step has drawn criticism from some legal experts for allowing solvent companies to use bankruptcy court to force settlements on claimants. While the legitimacy of a Two-Step aimed at the Roundup litigation was hashed out in court, a bankruptcy judge would likely halt all litigation against the company, said Melissa Jacoby, a University of North Carolina law professor and bankruptcy expert.

“Given the track record of recent Texas Two-Step bankruptcies, the pursuit of this strategy looks like a strong sign that the company is more interested in delay than honoring the legal rights of cancer patients or a comprehensive settlement at a fair price,” she said.

Ralph Brubaker, a University of Illinois professor who teaches bankruptcy law, said bankruptcy could give Bayer time to come up with a settlement proposal. “Even if Texas Two-Steps are ultimately repudiated” by the courts, “the strategy allows defendants to shut down all tort litigation indefinitely,” Brubaker said.

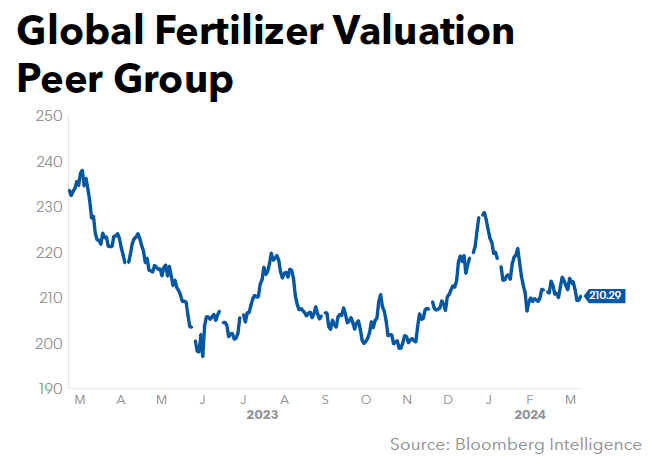

K+S

Group on March 14 posted a 71% decline in EBITDA, to €712.4 million

(approximately $779.1 million at current exchange rates) for the 12 months to

Dec. 31, 2023, down from €2.42 billion the previous year but beating analysts’ average

estimate of €691.6 million (Bloomberg Consensus).

EBITDA came in a little above the midpoint of K+S’s forecasted guidance for

FY2023 of €600-€800 million (GM Nov.

17, 2023), which it lowered in late July due in part to lower potassium

chloride prices in the second quarter, particularly in the Brazilian market (GM July 28, 2023). The original EBITDA

forecast for FY2023 was €1.15-€1.35 billion (GM May 12, 2023).

FY2023 revenue fell 32%, to €3.87 billion from the prior year’s €5.67 billion, while adjusted net income for the year slumped by 89%, to €161.9 million from €1.49 billion, missing analysts’ estimate of €178.1 million.

Agriculture customer segment revenues fell 39%, to €2.72 billion from €4.47 billion in 2022, with K+S citing mainly price factors. It noted that price pressure intensified after the conclusion of China’s contract price at the lower-than-expected $307/mt CFR level and spread into other sales regions. It said the subsequent price recovery later in the year could not offset that development.

On a positive note, K+S said the segment’s sales volumes increased 3%, to 7.31 million mt from 7.11 million mt in 2022. Sales volumes in Europe grew by 6%, to 2.97 million mt from 2.81 million mt, while Overseas volumes were up 0.9%, to 4.34 million mt from 4.30 million mt. Overseas sales volumes dipped 7% in the fourth quarter of 2023, to 1.14 million mt.

Potassium chloride sales volumes were up 4% in 2023, to 4.62 million mt from 4.44 million mt in the previous year. Fertilizer specialties sales volumes grew 1%, to 2.69 million mt, and were up by 21% year-over-year in the fourth quarter.

K+S Chairman and CEO Burkhard Lohr told analysts at a company earnings call on March 14 that K+S has seen its market share grow in Europe and that demand is higher than a year ago and prices are quite stable. He said K+S currently isn’t doing much in Brazil, and will potentially ship less than 100,000 mt to that country in the first quarter.

Lohr said the company expects to produce roughly 2.3 million mt at Bethune, Sask., in 2024 after recording output of 2.1 million mt last year. The plan is to add 100,000-150,000 mt output there every year, he said.

| 4Q-2023 | 4Q-2022 | % change | FY2023 | FY2022 | % change | |

| Total Sales Volumes (million mt) | 2.04 | 1.89 | +8 | 7.31 | 7.11 | +3 |

| Europe | 0.90 | 0.66 | +36 | 2.97 | 2.81 | +6 |

| Overseas | 1.14 | 1.23 | (7) | 4.34 | 4.30 | +1 |

| Potassium Chloride | 1.22 | 1.20 | +2 | 4.62 | 4.44 | +4 |

| Fertilizer Specialties | 0.82 | 0.68 | +21 | 2.69 | 2.67 | +1 |

| Average Price €/mt | 333.9 | 592.2 | – | 372.1 | 628.1 | – |

| Europe €/mt | 367.0 | 617.7 | – | 404.8 | 594.1 | – |

| Overseas $/mt | 330.8 | 585.6 | – | 377.7 | 682.4 | – |

| Potassium Chloride €/mt | 315.2 | 602.1 | – | 359.4 | 671.0 | – |

| Fertilizer Specialties €/mt | 361.7 | 576.6 | – | 393.9 | 557.0 | – |

Revenues declined 5% in the Industry+ customer segment, to €1.15 billion from €1.21 billion the previous year. K+S said lower prices for industrial products containing potash were offset by rising prices for salt products.

Industry+ sales volumes were down 3% year-over-year, to 6.62 million mt from 6.83 million mt. De-icing sales volumes showed a modest increase of 1%, to 2.10 million mt from 2.08 million mt.

Despite the upheaval in the market over the past two years and challenges on the cost side, Lohr said K+S is optimistic that the balance between supply and demand in the potash market can return in 2024.

“The observable return of supply from Russia and Belarus outside Europe and North America should be accompanied by a further normalization on the demand side worldwide,” the company said. “An oversupply on the potash market is, therefore, not to be expected for the year as a whole.”

K+S expects global potash demand to rise by 4 million mt in 2024, with nearly the same amount of additional supply coming mostly from Belarus and Russia, Lohr told analysts.

K+S expects EBITDA of €500-€650 million for FY2024. The upper end of the range assumes a price recovery overseas during the spring season and sales volumes in the Agriculture customer segment of 7.6 million mt, up from 7.31 million mt in 2023.

The company warned, however, that EBITDA could be at the lower end of the range with fertilizer sales volumes at 7.3 million mt if potash prices in Brazil remain at February 2024 levels, which is estimated at $290/mt CFR, with possible spillover effects into other sales markets.

“We have a strong footprint in Europe and we have specialties, and that is what makes us optimistic for 2024,” Lohr said.

K+S said it expects energy and freight costs to decrease by some €100 million in 2024 compared with 2023, based on the midpoint of sales volume guidance of 7.3-7.6 million mt. The company noted it had achieved a hedging of less than €40 per megawatt hour in gas, and said the unhedged part will be below that. In terms of labor costs, K+S said it has reached a settlement of a 2% increase for 2024.

K+S expects adjusted free cash flow in 2024 to break even, taking into account the continued high level of capital expenditure of around €550 million, particularly in the strategic projects at Werra in Germany and Bethune in Canada. FY2023 adjusted free cash flow was €311 million versus €932 million in FY2022.

K+S is proposing a dividend of €0.70 per share for 2023, below analysts’ estimate of €0.76 (Bloomberg Consensus). The company paid a dividend of €1.00 per share for 2022.

Several analysts saw K+S’s results as “encouraging” and noted the positive tone for the start of 2024. The company’s shares rose as much as 7.2%, the most in four months, immediately following the release of its results.

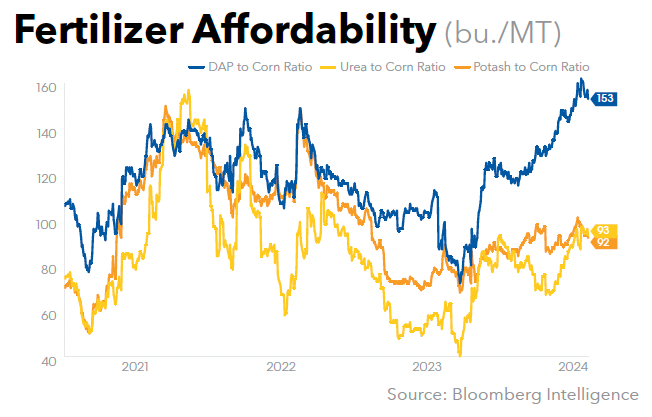

Citi analysts led by Ranulf Orr, as cited by Bloomberg, said “the ground seems set for earnings to continue to inflect upwards into 1Q” due to “supportive” farm economics. But Baader analyst Konstantin Wiechert highlighted the implied dividend miss to market expectations, and noted the FY2023 free cash flow was weaker than expected.

Morgan Stanley analysts Lisa De Neve and Jonathan Chung said that although K+S’s FY2024 outlook is “soft,” the free cash flow guidance brings some relief.

Land O’Lakes Inc. reported a 4% uptick in net earnings for the year ending Dec. 31, 2023, while net sales were off 12.6%. Net earnings were $257.9 million on net sales of $16.8 billion, up from 2022’s $248.2 million and $19.2 billion, respectively.

Russian potash producer Uralkali PJSC reported an 89% slump in net profit based on International Financial Reporting Standards (IFRS), to RUB11.7 billion (approximately $128 million at current exchange rates) for the 12 months ended Dec. 31, 2023, down from RUB105.3 billion the previous year, according to Interfax, citing a company financial report.

Sales revenue increased almost 10%, however, to RUB367.5 billion.

Uralkali cited a 1.5-fold increase in the cost of sales due partly to increased logistics costs and export duties. The company paid RUB6.74 billion in export duties last year, according to the report.

Uralkali’s total debt increased by 60% compared with year-end 2022, to RUB577.2 billion as of Dec. 31, 2023. It reported that its company accounts held RUB59.6 billion, of which RUB20.2 billion were blocked or restricted for use due to sanctions.

Uralkali said it paid RUB105 billion on preferred shares in 2023. It paid no dividends in 2022. Uralchem owned 78.03% of the authorized capital of Uralkali as of the end of 2021, according to the Interfax report.