Iowa Farmers Union, More Legislators Weigh In on Koch/OCI Deal

The Iowa Farmers Union (IFU) on Feb. 12 weighed in on the $3.6 billion deal in which Koch Industries Inc. would buy OCI Global’s Iowa Fertilizer Co. (IFCo) plant at Wever (GM Dec. 22, 2023). They are asking the US Federal Trade Commission, the Department of Justice, and Iowa Attorney General Brenna Bird (R) to stop the deal.

“It is a slap in the face for taxpayers who invested about $550 million (as well as $1.2 billion of Iowa Finance Authority bonds) to build the plant, now known as the Iowa Fertilizer Co.,” the IFU Board of Directors said in a statement.

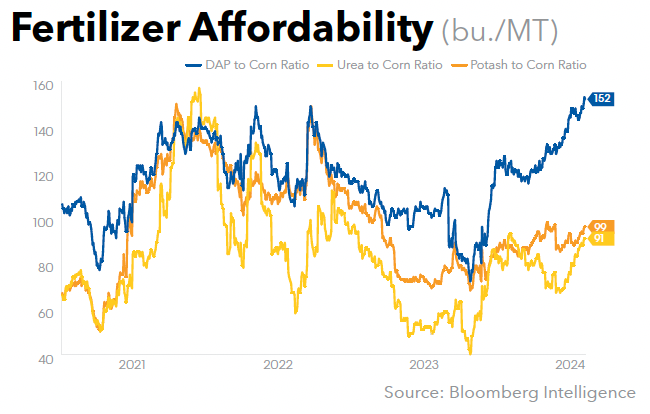

“The stated justification for the tax subsidies was to increase competition in the nitrogen fertilizer supply – a critical input for corn, the Midwest’s major crop,” the IFU said. “In fact, the Brandstad/Reynolds administration cited Koch Industries’ market dominance as the reason why the investment was necessary. Now we are on the cusp of those tax dollars being used to increase Koch’s anti-competitive stranglehold.”

All 36 Democratic members of Iowa’s House of Representatives also sent a letter to the agencies and AG to examine how the purchase could further entrench Koch’s market power, posing the risk of not only higher fertilizer prices but also job losses, according to Bloomberg.

President Biden’s 2021 executive order to bolster competition specifically identifies concentrated market power in agricultural input industries, including fertilizer, as a threat to farmers’ livelihoods, suggesting the letter from state lawmakers could capture regulators’ attention.

Their plea could be buoyed by the federal agencies’ new focus on labor markets when assessing deals. The FTC and DOJ under the Biden administration have focused on labor market impacts, a departure from past decades of a narrower focus on consumer welfare. New merger guidelines finalized by the agencies in December include, for the first time, the effect of corporate mergers on workers. The FTC’s proposed updates to its merger review process also require standard disclosures from deal-making companies on how their workers will be affected.

Koch has yet to disclose whether the roughly 250 fertilizer plant workers could risk losing their jobs as a result of the acquisition, or if it might close one of its older plants in favor of the Wever facility, which is one of the newest nitrogen plants in the US.

Koch Fertilizer spokesperson Greg Lemon said the acquisition is “consistent with the significant investments we have made in our business to increase production, improve reliability, and expand our customers’ access to the products and services they need.”

Some 18 agriculture and environmental groups (GM Jan. 26, p. 1), as well as Iowa State Auditor Rob Sand (GM Feb. 2, p. 1), have also pressed for an investigation of the deal. Iowa State Senator Jeff Reichman (R), by contrast, has expressed enthusiastic support for the deal (GM Feb. 9, p. 1).