Fertilizer Futures

Canadian National Railway Co. (CN) and Canadian Pacific Kansas City Ltd. (CPKC) on Aug. 9 issued statements saying they will lock out more than 9,000 employees with the Teamsters Canada Rail Conference (TCRC) on Aug. 22 if a negotiated contract between the union and railroads is not reached by that date or if the TCRC refuses to agree to binding arbitration.

“Unless there is immediate and meaningful progress at the negotiating table or binding arbitration, CN will have no choice but to begin a phased and progressive shutdown of its network, starting with embargoes of hazardous goods, which would culminate in a lockout at 00:01 Eastern Time on Aug. 22,” CN said.

“Any product coming to, leaving, or moving within Canada on rail will not be transported during a work stoppage,” CN warned. “Only limited train movements within yards will be executed as there are not enough certified management train crews to ensure intercity train movements.”

The statements followed an Aug. 9 ruling by the Canada Industrial Relations Board (CIRB) that a strike or lockout would pose no serious danger to safety or public health. Both sides had been awaiting the ruling after the CIRB intervened in the dispute in May at former Labor Minister Seamus O’Regan’s request (GM May 24, p. 1) to avoid a threatened strike on May 22.

“There is no doubt that a work stoppage at CPKC/CN would result in inconvenience, economic hardship and, possibly, as some groups and organizations have suggested, harm to Canada’s global reputation as a reliable trading partner,” the CIRB said in its decision. “While such possible harm is by no means insignificant, these are not factors that are to be considered by the Board” under the Canadian Labour Code.

The TCRC also issued a statement on Aug. 9 saying it will give 72 hours advance notice in the event of any strike action. “The union’s focus remains on negotiating in good faith and reaching agreements at the bargaining table. Whether or not that is possible is entirely up to CN and CPKC,” the TCRC said.

“From the very beginning, rail workers have only ever sought a fair and equitable agreement,” said Paul Boucher, TCRC President. “Unfortunately, both rail companies are demanding concessions that could tear families apart or jeopardize rail safety. Rail workers have fought for a safer and more humane industry for decades, and we will not accept moving backwards.”

The two sides have been at an impasse since early this year over issues related to fatigue management and crew scheduling. TCRC members voted in April to authorize a strike action (GM May 3, p. 1) and again in late June (GM July 5, p. 1) after the first authorization expired.

“Since the beginning of the year, CN has made four offers to the TCRC,” CN said on Aug. 9. “The offers included points on wages, rest, and labor availability while remaining fully compliant with the government-mandated rules overseeing duty and rest periods. None of CN’s offers compromised safety in any way. The latest offer proposed third-party arbitration. The union rejected all offers and has made no counter proposals.”

“Supply chains require predictability to function properly,” CN continued. “Unfortunately, even the possibility of an unpredictable labor disruption and subsequent disorderly shutdown creates a safety risk and unacceptable uncertainty for industries that depend on rail. Prolonged uncertainty will impact consumers and workers across industries and across Canada.”

CPKC noted the timing of the lockout, saying it was acting “to protect Canada’s supply chains…from the more widespread disruption that would be created should a work stoppage occur during the fall peak shipping period. Delaying resolution to this dispute only makes things worse, causing more disruption and damage to Canada’s international reputation as a reliable trading partner,” the railroad said.

CPKC also warned the TCRC that the railroad’s latest contract offer will be “conditionally” withdrawn and replaced with a “status quo-style contract renewal” if the two sides remain deadlocked. Both CN and CPKC had pressed for binding arbitration in June (GM June 7, p. 1), but the TCRC rejected the offer.

The news of a pending lockout or strike was met with frustration by numerous industry trade groups, including the Chemistry Industry Association of Canada (CIAC), Canadian Manufacturers and Exporters (CME), the Canadian Chamber of Commerce, and Fertilizer Canada.

“Fertilizer Canada is calling on the federal government and Labor Minister Steven MacKinnon to take immediate action to assist all parties…in reaching agreements, including ordering a directive for binding arbitration that prohibits TCRC from undertaking strike action and CN and CPKC from lockout action,” Fertilizer Canada said in an Aug. 12 statement.

The trade association noted that both CN and CPKC have already issued embargoes halting certain ammonia fertilizer shipments a full 10 days ahead of any anticipated labor disruption, while service for all products will begin to slow 3-5 days ahead of a work stoppage and take another 3-5 days to reach regular service once it ends. Fertilizer Canada said 75% of all fertilizer produced and used in Canada is moved by rail.

“The threat of a work stoppage has already begun to impact the movement of fertilizer and our industry anticipates further embargoes and slowdowns in rail service,” Fertilizer Canada said. “A work stoppage that prevents the transportation of fertilizer will have potentially disastrous effects on crop yields and food security.”

Fertilizer Canada urged the federal government to amend the Canada Labour Code to strengthen the bargaining process, and also asked the federal government to recognize fertilizer as an essential good critical to domestic and global food security that should continue to move during work stoppages.

“We have had the threat of a work stoppage hanging over our heads since the beginning of the year,” said Karen Proud, President and CEO of Fertilizer Canada. “Canada’s reputation has been damaged by the numerous supply chain disruptions in recent history. This uncertainty gives our international competitors, like Russia and China, an advantage. We need swift action to protect Canada’s reputation as a reliable trading partner.”

The J.R. Simplot Co. announced that it has expanded its agricultural retail operations into Florida with the opening of Simplot Grower Solutions stores in Wauchula and Immokalee.

Simplot said the new locations in Florida’s Hardee and Hendry counties will provide a wide range of crop nutrition and crop protection products, as well as advanced precision agriculture services specific to the “unique growing conditions” in Florida.

“As an American based, family-owned agricultural company, Simplot has deep industry roots and has served the needs of farmers since we started doing business in 1929,” said Jared Gray, Simplot Grower Solutions Market Manager. “Our local team is excited to partner with Florida farmers to deliver field-proven solutions and services for challenges faced by growers in this market.”

The news follows an earlier announcement that Simplot is expanding its turf and horticultural services in southwest Florida with the opening of a new location in the greater Fort Myers area (GM July 26, p. 26).

“With the critical role Florida plays in supporting global agriculture, the new stores are dedicated to delivering field-proven products and services,” said Ryan Richards, a local Simplot Grower Solutions Crop Advisor in Immokalee. “We help to maximize yield on every acre with personalized advice, accurate agronomic expertise and innovative products and solutions ready for the unpredictable nature of farming.

Simplot Grower Solutions has retail stores in the US and Canada that employ more than 2,800 people and serve more than 40,000 customers.

Tidal Grow® AgriScience (TGA), a Washington-based producer of bioactive carbon-based fertilizers, has been awarded a $2.3 million Fertilizer Production Expansion Program (FPED) grant by the USDA.

TGA said it will use the grant to break ground on a new facility in Orange, Texas, and expand production capacity of its seafood hydrolysate liquid fertilizers Oceanic® and SeaPhos® at its Raymond, Wash., plant.

“Amidst continued global conflict and disrupted supply chains, American growers need novel regenerative solutions that improve soil and plant health to achieve higher yields,” said Norm Davy, Chief Commercial Officer at TGA. “Made by up-cycling waste from the seafood industry, our plant nutrition and crop protection products offer agronomists and growers creative solutions to solve some of agriculture’s greatest challenges.”

The FPED program is part of a government-wide effort to promote competition in agricultural markets and support fertilizer production that is independent, made-in-America, innovative, sustainable, and farmer-focused. USDA officials on July 26 toured TGA’s expansion project in Washington.

“The Biden-Harris Administration and USDA are committed to lowering costs for America’s farmers by supporting competition in the fertilizer market,” said Cindy Axne, USDA Senior Advisor for Rural Delivery, Engagement and Prosperity. “These investments, including the project I am visiting today, made possible through the Commodity Credit Corporation, will increase domestic fertilizer production and create good-paying jobs right here in Washington.”

Tidal Vision Products Inc., TGA’s parent company headquartered in Bellingham, Wash., said it plans to invest more than $10 million in capital growth to “scale manufacturing for the entire portfolio of advanced agricultural products and introduce novel technologies to the market” within 3-5 years.

“This grant enables us to triple supply for growers nationwide and supports domestic production with next-generation technologies,” said Tom Robeson, TGA Vice President of Manufacturing. “Our proprietary carbon-based fertilizers improve nutrient uptake and build soil health with marine-based omega lipids, amino-acid nitrogen, and critical soluble nutrients like phosphorus and calcium.”

Brazilian state-owned Petrobras on Aug. 15 announced that it will invest R$870 million to resume operations at the Araucária Nitrogenados S.A. (ANSA) fertilizer plant, a wholly-owned subsidiary of the company.

Located in the state of Paraná, the plant has been inactive since 2020 when Petrobras said it was mothballing the facility due to recurring losses and a failure to find a buyer (GM Jan. 17, 2020). The reopening of ANSA was approved in June 2024 and production is expected to begin in the second half of 2025 (GM May 3, p. 30).

The plant has a production capacity of 720,000 mt/y of urea, which represents 8% of the Brazilian market, and 475,000 mt/y of ammonia. The project aligns with the company’s previously approved 2024-2028 Strategic Plan, whereby investment in fertilizer production has been reinstated as part of Petrobras’ portfolio.

The plant is currently in the process of contracting services and acquiring materials, followed by the mobilization of service contracts and equipment maintenance before operations commence. According to the company’s statement, former plant employees have already resumed their work activities following an agreement proposed by the Labor Prosecutor’s Office and ratified by the Superior Labor Court in June.

Petrobras also owns a partially completed nitrogen fertilizer complex, Unidade de Fertilizantes Nitrogenados III (UFN-III), in Três Lagoas, Mato Grosso do Sul state. Additionally, it owns plants at Bahia (Fafen-BA) and Sergipe (Fafen-SE) that it leased to Unigel (GM Aug. 14, 2020), which are currently not in operation. Petrobras recently ended its contract with Unigel (GM July 5, p. 26).

Saudi Arabian Mining Co. (Ma’aden) on Aug. 11 posted second-quarter net profit of SAR2.01 billion ($540 million), up 160% from SAR770 million ($205 million) in last year’s second quarter. Ma’aden attributed the increase to higher selling prices, a decrease in the cost of raw materials, and depreciation expenses.

Sales volumes for the quarter decreased for all products, with the exception of basic aluminum, flat rolled products, and gold. Sales revenues increased by 3%, to SAR7.1 billion from SAR6.9 billion last year.

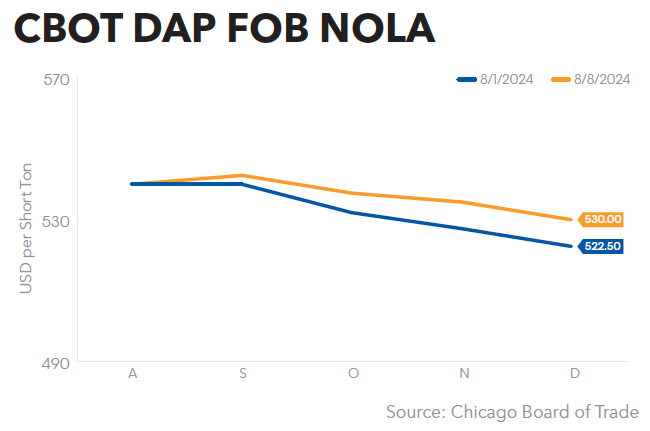

Phosphates generated SAR1.59 billion ($420 million) in EBITDA for the second quarter. DAP production volumes were steady, while sales were up 6% despite weaker realized prices of $526/mt versus $591/mt in the first quarter.

“We delivered a strong first half of 2024, demonstrating our ability to realize the benefits of operational efficiencies in a stable environment. Our large-scale Phosphate 3 project is progressing, with construction underway, and we are moving forward with a new aluminum recycling plant at Ras Al-Khair,” said Ma’aden CEO Bob Wilt

“Additionally, the successful completion of our investment in Vale Base Metals through Manara is set to increase our exposure to green metals,” Wilt noted. “Our strategic partnerships and technology-led innovation programs are fast-tracking mineral discoveries through the world’s largest greenfield exploration program of its kind.”

Ma’aden said it remains on track to deliver on its full year guidance across all business units, supported by further stabilization in commodity prices. Work on the Phosphate 3 megacomplex is underway, with commissioning of 1.5 million mt/y expected by the end of 2026.

Clariant, a specialty chemicals company based in Switzerland, announced that its deoxygenation catalyst from its EnviCat Green series has been chosen for a major green ammonia project in China. The specific facility where the catalyst will be used was not disclosed.

The catalyst removes trace oxygen and green hydrogen prior to the conversion to green ammonia, Clariant said, enabling efficient deoxygenation processes and requiring a much smaller reactor for oxygen removal than other catalysts, offering flexibility in transportation and installation.

According to Clariant, producers will benefit from significant capital and operational savings with the catalyst. The EnviCat series has been in commercial use for more than 20 years.

Clariant recently announced it is expanding its strategic cooperation with Houston-based KBR for ammonia production. That collaboration will combine Clariant’s AmoMax 10 Plus ammonia synthesis catalysts with KBR’s K-GreeN® ammonia technologies (GM Aug. 2, p. 25).

London-based Navigator Holdings Ltd. and Attis Clean Energy announced an investment in clean ammonia developer Ten08 Energy LLC, which is developing a hybrid blue and green ammonia production export facility on the US Gulf Coast.

The project Ten08 is developing has the goal to produce the most competitively priced ammonia molecule. The first phase of the project will produce 1.4 million mt/y of low-carbon ammonia molecules, with operations expected to commence in late 2029, according to Navigator Holdings. Navigator and Ten08 intend to provide transport services to Ten08’s clients in Europe and Asia with ammonia-fueled vessels.

Navigator has committed $2.5 million, complementing the development committed by lead investor Attis, which made an initial investment in May of this year. In return for its investment, Navigator has the option to make a larger investment of up to $100 million at the time of the project Final Investment Decision (FID).

Navigator Holdings in October 2023 announced an investment with Yara Growth Ventures AS in Azane Fuel Solutions AS, an ammonia bunkering startup that plans to commence construction of its first bunkering unit in Norway this year (GM Oct. 27, 2023).

Brandon Risner has been named Compass Minerals’ Vice President, Operations, Ogden and C&I, effective Aug. 16, 2024. Risner will be responsible for leading Ogden’s operations and strategy and will also maintain his leadership of the company’s North American Consumer and Industrial (C&I) processing and packaging plants.

Risner has served for almost four years as Vice President, Manufacturing, at Compass, where he helped increase workforce engagement, create efficiencies, and improve operational performance across the processing and packaging plants. Compass said he has nearly 25 years of mining operations and material processing experience, with a BS in mine engineering from the University of Missouri-Rolla and a Master of Business Administration from Washington University in St. Louis, Mo.