Fertilizer Futures

PhosAgro, Moscow, reported on Dec. 18 that its Board of Directors had determined a new composition of the group’s Management Board.

The new board is made up as follows: PhosAgro CEO Andrey Guryev as Chairman; First Deputy CEO Mikhail Rybnikov; Deputy CEO Siroj Loikov; Deputy CEO for Corporate and Legal Affairs Alexey Sirotenko; Deputy CEO for Finance and International Projects Alexander Sharabaiko; Сhief of Staff for the CEO of PhosAgro Alexander Seleznev; and Deputy CEO for Business Development Roman Osipov. Many have retained their previous positions.

Nutrien Ltd., Saskatoon, confirmed on Dec. 18 that it will keep its Vanscoy potash mine down through the end of January, citing market conditions. Some 265 employees will be affected.

Vanscoy was originally to come back up at the end of December. The idled Allan and Lanigan mines are expected to return to production on Dec. 29 as previously planned.

“With Allan and Lanigan returning to operations we will have the network capacity to meet near-term potash demand,” Nutrien spokesman Will Tigley told Bloomberg.

Nutrien announced in September (GM Sept. 13, p. 1) that it would be taking the Vanscoy, Allan, and Lanigan mines down for an eight-week period, a move that would reduce production by up to 700,000 mt and potash annual EBITDA by as much as US$100-$150 million. In addition, prodded by the CN rail strike, the company opted to take the Rocanville mine down for two weeks in December (GM Nov. 29. p. 1).

Itafos, Toronto, has entered into a binding letter of intent (LOI) with majority shareholder CL Fertilizers Holding LLC (CLF) to raise US$36 million in capital through a non-brokered private placement financing of US$15 million and an amendment to increase the availability of a previously issued unsecured subordinated promissory note by US$21 million. The capital’s proceeds are expected to be used to fund general working capital and capital expenditure needs by Itafos and its subsidiaries.

In November, CLF committed to invest up to $36 million, if required, for Itafos to meet its liabilities as and when they become due to ensure business continuity and ongoing operations through Dec. 31, 2020 (GM Dec. 6, p. 1).

Under the LOI, CLF will subscribe for up to 38,076,923 shares in Itafos capital at an offering price of 52 cents a share in Canadian dollars on a non-brokered private placement basis, for aggregate gross proceeds of US$15 million (equivalent to about $19.8 million in Canadian dollars).

In addition, Itafos and CLF will amend the convertible unsecured and subordinated promissory note in favor of CLF that was issued by Itafos on Sept. 11 (GM Sept. 13, p. 27) to make the promissory note non-convertible and increase the availability by US$21million.

At closing, Itafos intends to borrow US$5 million of the available US$21 million, with the balance of US$16 million remaining available to be drawn by Itafos at its sole discretion through Dec. 31, 2020. An availability fee of 4 percent per year shall apply on undrawn amounts during the availability period, with such fee to be capitalized and added to principal on a quarterly basis.

In other news, Itafos has announced that mineral reserve estimates at its Rasmussen Valley and Lanes Creek phosphate mines in eastern Idaho – which supply its Conda fertilizer complex near Soda Springs – are expected to extend Conda’s mine life through mid-2026, or an additional 18 months to two years.

The mineral reserve estimates for the two mines in Caribou County total 14.4 million short tons (MST) at about 26.6 percent P205. The 14.4 MST include 12.2 MST at Rasmussen Valley, 0.8 MST at Lanes Creek, and 1. 4 MST stockpiled.

Itafos said in November the recent exploratory work supports the permitting process at the Husky1/North Dry Ridge project (GM Dec. 6, p. 1; Jan. 26, 2015) as the route to extend Itafos Conda’s mine life.

Bion Environmental Technologies Inc., New York City, said on Dec. 13 it is preparing an application to the Organic Materials Review Institute (OMRI) for certification of its ammonium bicarbonate production process. The company said the ammonium bicarbonate crystals produced by a pilot plant have been analyzed by an independent lab and will serve as the foundation of the OMRI application.

“The added economic driver of an organic, water-soluble, and quick-release nitrogen fertilizer cannot be overemphasized,” said Craig Scott, Bion Director of Communications. “U.S. organic sales hit a record $52.5 billion in 2018, making it the fastest growing segment of American agriculture.”

Bion said its 3G technology, which was patented in 2018, captures ammonia in the livestock waste stream and converts it into stable concentrated ammonium bicarbonate (GM Aug. 16, p. 24). It will contain 12-17 percent nitrogen in a crystalline form that is easily transported, water soluble, and provides readily-available nitrogen. It will contain none of the other salt, iron, and mineral constituents of the livestock waste stream, and will be in an industry-standard form that can be precision-applied to crops using existing equipment.

Bion announced in August that the Terms and Definitions Committee of the Association of American Plant Food Control Officials (AAPFCO) has recommended to officially approve ammonium bicarbonate as a listed fertilizer under their guidelines at their next meeting in February 2020 (GM Aug. 16, p. 24).

The Mosaic Co. on Dec. 19 announced that it plans to decrease phosphate production at its Central Florida facilities by 150,000 mt per month and continue to operate at lower rates at its Saskatchewan potash mines. This follows the 500,000 mt phosphate reduction it took in second-half 2019, mainly in Louisiana. As reported last week, Mosaic is in the process of bringing its Louisiana production back up (GM Dec. 13, p. 1).

“A third consecutive disappointing application season in North America has led to continuing high inventories and price weakness. Mosaic will not produce at high rates when we are unable to realize reasonable prices,” said President and CEO Joc O’Rourke.

“We believe our extended production curtailments will contribute to balancing the global supply-and-demand picture as we move into 2020,” O’Rourke continued. “With fertilizer-depleted soils and rising agricultural commodity prices, we continue to expect robust demand and strong business conditions in the year ahead.”

Mosaic’s cut of some 150,000 mt per month of phosphate production will come initially from the company’s Bartow, Fla., plant, the company confirmed with Green Markets on Dec. 20. The company explained that Bartow was due a maintenance turnaround, and this will be done in January. After this is completed, the situation will be determined on a month-by-month basis, depending on market conditions.

An initial report in the Lakeland Ledger termed the situation at Bartow as a shutdown. Instead, Mosaic says the plant will be down for maintenance, with no furloughs for some 360 employees.

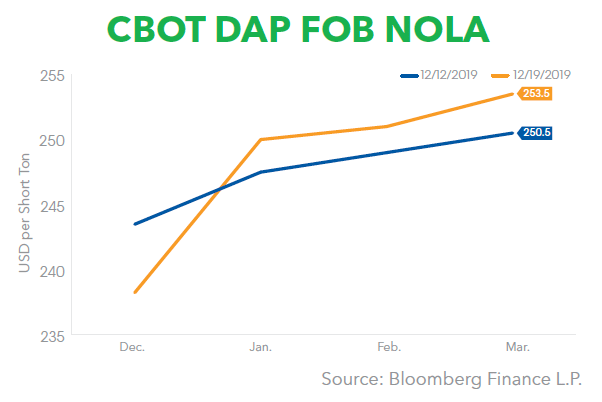

New Orleans DAP barge prices are near a 13-year low.

Mosaic said production in both phosphates and potash will return to full rates when required to meet customer needs. Mosaic and other major producers have idled nearly 3 million mt of potash production in the second half of 2019 (see Markets – Potash). Mosaic has curtailed some 600,000 mt of production at its Esterhazy and Colonsay mines since August (GM Aug. 9, p. 1; Oct. 11, p. 1).

The company expects its potash and phosphates shipment volumes for the fourth quarter to be modestly below its most recent guidance ranges – 1.7-1.9 million mt and 2.1-2.3 million mt, respectively. In addition, phosphate gross margins per mt are expected to fall significantly below the previous guidance range of negative $10 to zero, as a result of the low volumes and realized prices.

Green Markets Research Director Alexis Maxwell also noted the three straight unfavorable fertilizer seasons. “I haven’t seen before where we’ve had a poor fall in 2018, a poor spring in 2019, and then again a poor fall in 2019,” she said. “The industry is expecting a lot of pent-up demand for fertilizer applications.”

Maxwell said prices may remain soft as “supply growth is exceeding demand growth in the coming year,” while input costs probably will stay low. However, favorable spring weather in the U.S. Midwest may turn the tide, she added.

The Ma’aden Wa’ad Al Shamal Phosphate Co. (MWSPC) has signed a three-year service agreement with DuPont Clean Technologies, Wilmington, Del., for its sulfuric acid plant in Sirhan, in the Turaif region of the Kingdom of Saudi Arabia.

The program includes activity testing of catalyst samples, evaluation of catalyst performance, plant optimization, troubleshooting, and management of catalyst replacement. DuPont will also track performance and assess the overall health of the plant using pre-agreed metrics, and will employ its proprietary portable MECS® PeGASyS™ gas chromatography system to assist MWSPC with troubleshooting and plant performance optimization.

The MWSPC operation is a joint venture between Ma’aden, SABIC, and The Mosaic Co.

Junior sulfate of potash (SOP) producer Salt Lake Potash Ltd. (SO4), Perth, Western Australia, announced on Dec. 18 that it has inked a binding term sheet with Helm AG, Germany, for the sale of SOP from its Lake Way project in the Northern Goldfields Region of Western Australia.

The volume commitment under the agreement is for 50,000 mt/y for 10 years from start of production. SO4 explained that the actual volume would be 20 percent of Lake Way production during ramp-up and 50,000 mt/y thereafter, with effective take or pay arrangement on product resale.

The offtake by Helm will be sold into key geographical markets within Southeast Asia and the Middle East, with the actual countries specified under the agreement, SO4 said.

The two companies have agreed on a net-back price mechanism.

SO4 said it has now secured 220,000 mt/y of committed sales, representing 90 percent of total planned production for five- and ten-year terms from start of shipping in 2021, with take-or-pay arrangements on product resale. The SOP developer in November reported that it had signed three binding term sheets for the sale and distribution of 170,000 mt/y of SOP from its Lake Way project with Unifert for 60,000 mt/y in the Middle East and Africa; Indagro for 50,000 mt/y for North America and Europe; and Fertisur for 60,000 mt/y in South America (GM Nov. 22, p. 28).

The company revealed in October that the Bankable Feasibility Study (BFS) for the Lake Way project had moved expected SOP production to 245,000 mt/y, up from the earlier 200,000 mt/y from a previous Scoping Study (GM Oct. 11, p. 29).

SO4 this week also announced that it has completed the previously announced placement to new Australian institutional investors and existing institutional shareholders to raise A$23.0 million (approximately US$15.8 million at current exchange rates) for the ongoing development of the Lake Way project (GM Dec. 13, p. 26).

OCP Group, Casablanca, said late on Dec. 17 it is temporarily curtailing its phosphate production plans by 500,000 mt, effective mid-December through the end of February 2020.

OCP said this decision to reduce its planned production is driven by recent weather conditions and forecasted consignments at Moroccan ports that are expected to continue until the end of February 2020.

Market sources noted that the port of Jorf Lasfar is facing problems with swells this month and in January, which will restrict vessel loading. They see the Moroccan group’s move to curtail production as one of inventory control to avoid stock build at the port, rather than a move to control supply (see Markets). OCP, like the Russian producers, hitherto has been turning out both DAP and MAP in big quantities to secure larger market share (GM Dec. 13, p. 3).

A spokesperson for OCP clarified that the production curtailment will be for all phosphate fertilizers, and reflecting the nature of the group’s product portfolio, will comprise more DAP/MAP than NPK or TSP.

Given current demand levels, the Moroccan phosphate group said it does not believe that this temporary reduced production will affect supply to its customer base. It added that it continues to expect demand to increase in 2020, and it will be ready to adjust its phosphate production levels to meet its customers’ needs.

Acron Group, Moscow, said this week that Russia’s state-owned development corporation VEB.RF’s Supervisory Board has approved a syndicated loan for the group’s Talitsky potash project under development in the Perm region of the country.

Under the financing plan now approved, VEB.RF and four Russian banks will provide a total of $1.45 billion of syndicated loan financing to Acron for up to 13 years. VEB.RF will provide $280 million, and the four banks, comprising Gazprombank, VTB Bank, Sberbank, and Otkritie Financial Corp. Bank, will provide a total of $1.17 billion. VEB.RF has also agreed a reserve tranche of $360 million.

The Russian fertilizer group in June reported that it had reached a preliminary agreement for a syndicated loan from Russian banks to fund the construction of the project (GM June 7, p. 27). The funds will be used to finance the completion of the vertical shafts and the development of the mine, as well as the construction of the processing plant and related infrastructure. Acron reported in late August that vertical shaft-sinking was 70 percent complete (GM Aug. 30, p. 25).

Talitsky, which is being developed by Verkhnekamsk Potash Co. (VPC), a majority-owned (60.1 percent) subsidiary of Acron, will have design capacity to produce some 7.5 million mt/y of potash ore and 2 million mt/y of potassium chloride. Acron confirmed its previously announced target of a 2023 commissioning of the new mine and processing plant, adding that it continues to expect full design capacity to be reached in 2026 (GM Aug. 30, p. 25).

Acron put the total capital budget for the Talitsky potash project at $2.6 billion, including previously incurred expenses and VAT. This figure is presumed to include the cost of the license to develop the Talitsky section of the Verkhnekamkoye potassium and magnesium salts deposit, acquired in 2008. In August, the Russian fertilizer group had put the total required capital expenditure for the project at $1.5 billion, but said that figure excluded the cost of the license (GM Aug. 30, p. 25).

Acron revealed in late August that it was considering a subsequent expansion of production at Talitsky to 2.6 million mt/y following full ramp-up of the initial capacity (GM Aug. 30, p. 25). It put the cost of this expansion at $0.3 billion.

At that time, the Russian fertilizer group said it expects to consume some 700,000 mt/y of the potash produced in-house from 2025. It currently buys in all of its potash requirements, largely for its complex fertilizers production.