Yara 2Q Earnings Fall Far Short of Estimates; 3Q Recovery Expected

Yara International ASA reported an 83% drop in adjusted EBITDA for the second quarter, to $252 million from the year-ago $1.48 billion, falling far short of analysts’ average estimate of $537.5 million (Bloomberg Consensus).

The plummet in adjusted EBITDA mainly reflected lower margins with lower selling prices, which offset a decline in energy costs and an improved volume and product mix. Revenue was down 39% year-over-year, to $3.94 billion from $6.45 billion, also missing analysts’ average estimate of $4.47 billion.

Total deliveries for the quarter were 1.5% lower than a year earlier, but with an increased share of premium product deliveries, the company reported. Overall fertilizer deliveries were up 1.6%, to 5.88 million mt from 5.79 million mt in last year’s second quarter.

Yara posted a net loss attributable to shareholders of the parent of $300 million for the second quarter versus a net profit of $664 million the previous year. Analysts had estimated net profit would come in at $205.3 million (Bloomberg Consensus). Yara shares slumped as much as 5.8% on the Oslo stock exchange following the earnings release, the biggest drop since June 13.

“Second-quarter results are impacted by the falling price trend we’ve seen so far in 2023, pushing the industry into a low-margin environment,” said Yara International President and CEO Svein Tore Holsether.

The company noted that the steep price declines generated position losses, including new inventory write-downs. Yara said recent price developments suggests stronger demand going forward, however. “The European nitrogen industry saw a recovery of volumes during the second quarter, and season-to-date deliveries were in line with a year-ago,” Holsether said.

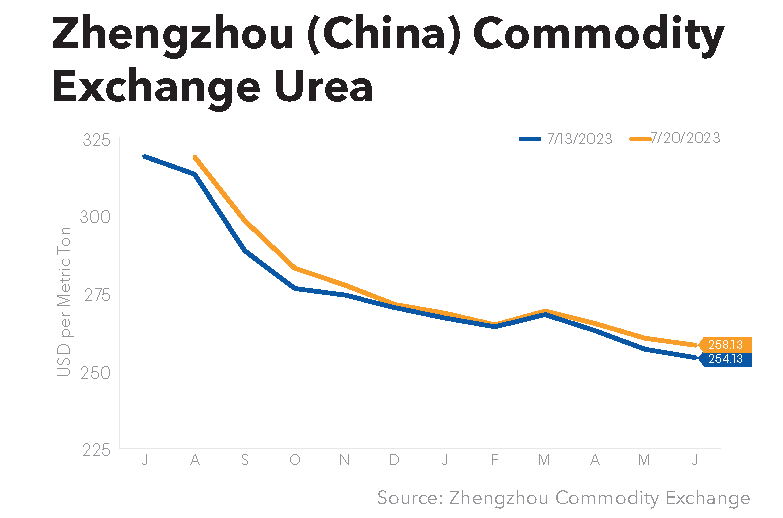

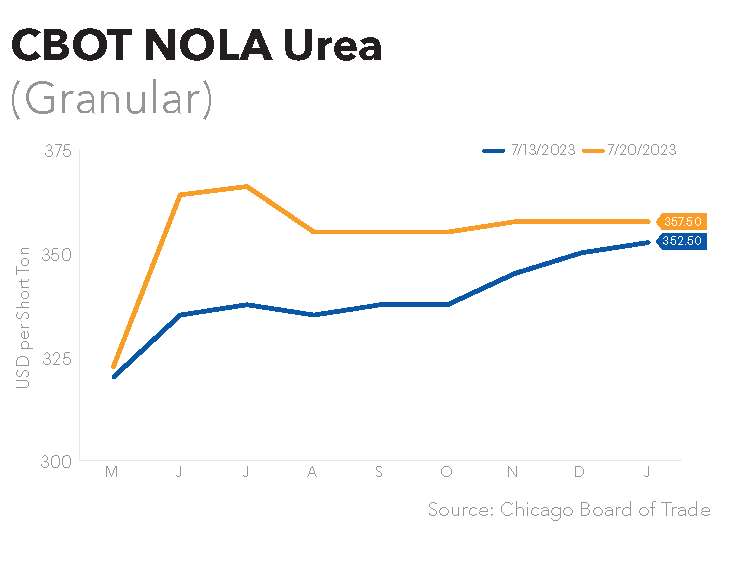

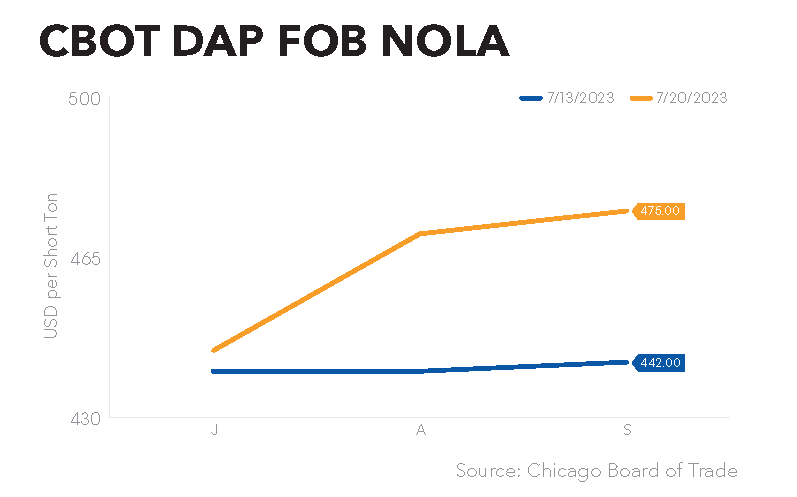

“Given supply overhangs from last season, this indicates an increase in application rates this season. For the new season, recent price developments indicate stronger demand and a tighter urea market going forward, despite substantial recent capacity additions,” he continued. “Together with healthy farmer incentives and low producer stocks in Europe, this creates a positive backdrop for nitrate markets. Based on the latest price developments also for phosphate and potash, margin recovery is likely in the third quarter.”

Second-quarter European deliveries were 32% higher year-over-year, to 2.07 million mt from 1.57 million mt. Americas deliveries, however, were 11% lower, to 2.69 million mt from 3.01 million mt, mainly reflecting lower Brazilian deliveries (-23%) and offsetting slightly higher deliveries in North America (+6%) and to Latin America excluding Brazil (+6%).

Yara’s production curtailments were largely discontinued due to stronger order books, leaving second-quarter curtailments of finished fertilizers at 0.4 million mt, 10% of the company’s European capacity, with more than half related to urea. Curtailed finished fertilizers capacity is now down to some 7% of the company’s European capacity, Yara said.

The company said 0.2 million mt of ammonia production (17% of its European capacity) was curtailed during the quarter, and it continued to use its global sourcing and production system to import ammonia.

As of mid-July 2023, Yara had curtailed an annualized capacity of 0.5 million mt of ammonia and 1.2 million mt of finished fertilizers. Yara produced 1.42 million mt of ammonia and just under 4.4 million mt of finished fertilizers in the second quarter, down 16% and 1.5%, respectively, from second quarter 2022.

European natural gas prices are now down about 90% from their August 2022 high, the company said. Based on current forward markets for natural gas as of July 12 and assuming stable gas purchase volumes, Yara sees its gas cost for the third quarter at an estimated $800 million lower than a year ago.

Yara posted a 74% decline in six-month adjusted EBITDA, to $740 million from last year’s $2.82 billion. Six-month revenue was down 34% year-over-year, to $8.10 billion from $12.37 billion. The company made a half-year net profit attributable to shareholders of the parent of $1.61 billion, versus $2.78 billion in the first half of last year.

Bloomberg cited Norne analyst Tomas Skeivys as saying this is the second quarter in a row that Yara posted a major miss to estimates. He noted that earnings have yet to stabilize after last year’s “super profits,” while “uncertainty is very high after major volatility and unpredictability” in recent quarters.

Yara Production and Deliveries (‘000 mt)

| 2Q-2023 | 2Q-2022 | 1H-2023 | 1H-2022 | ||

| Production* | |||||

| Ammonia | 1,418 | 1,688 | 2,799 | 3,411 | |

| Finished fertilizer and industrial products (excluding bulk blends)* | 4,398 | 4,466 | 8,441 | 9,328 | |

| Yara Deliveries | |||||

| Ammonia Trade | 412 | 404 | 828 | 847 | |

| Fertilizer | 5,880 | 5,789 | 10,527 | 11,912 | |

| Industrial Product | 1,642 | 1,862 | 3,141 | 3,663 | |

| Total Deliveries | 7,934 | 8,055 | 14,496 | 16,422 | |

| * Includes Yara’s share of production in equity-accounted investees, excluding Yara-produced blends |

Yara Deliveries (‘000mt)

| Crop Nutrition Deliveries | 2Q-2023 | 2Q-2022 | 1H-2023 | 1H-2022 |

| Urea | 1,284 | 1,317 | 2,332 | 2,695 |

| Nitrate | 1,171 | 871 | 2,137 | 2,232 |

| NPK | 2,050 | 2,050 | 3,805 | 4,134 |

| CN | 446 | 417 | 768 | 836 |

| UAN | 337 | 314 | 522 | 616 |

| DAP/MAP/SSP | 186 | 192 | 252 | 294 |

| MOP/SOP | 159 | 300 | 228 | 512 |

| Other Products | 247 | 329 | 482 | 592 |

| Total Crop Nutrition Deliveries | 5,880 | 5,789 | 10,527 | 11,912 |

| Europe Deliveries | 2,074 | 1,566 | 3,744 | 3,815 |

| Americas Deliveries | 2,687 | 3,014 | 4,688 | 5,810 |

| North America | 884 | 833 | 1,608 | 1,738 |

| Brazil | 1,355 | 1,760 | 2,277 | 3,248 |

| Latin America excluding Brazil | 447 | 421 | 803 | 824 |

| Africa & Asia Deliveries* | 1,119 | 1,209 | 2,095 | 2,287 |

| Asia | 836 | 966 | 1,554 | 1,835 |

| Africa | 283 | 243 | 541 | 452 |

| Industrial Solutions Deliveries | 1,642 | 1,862 | 3,141 | 3,663 |

| *Includes Oceana |