Fertilizer Futures

Canada’s two biggest railways closed operations early Thursday after contract negotiations with union leaders failed, shutting down 80% of the country’s rail network and immediately blocking arteries of North American supply chains that carry about C$1 billion ($740 million) per day in trade.

More than 9,000 employees at Canadian National Railway Co. (CN) and Canadian Pacific Kansas City Ltd. (CPKC) were locked out after a deadline passed at midnight without an agreement on a new contract. Members of the Teamsters Canada Rail Conference (TCRC) had voted to strike over a number of issues, including scheduling and worker fatigue.

Late on Aug. 22, however, Canadian Labor Minister Steven MacKinnon directed the Canada Industrial Relations Board (CIRB) to impose final binding arbitration on the parties. MacKinnon also ordered the CIRB to direct the parties to extend their current labor contract, and said the railways should resume operations “forthwith.”

Both CN and CPKS released statements on Aug. 22 saying they had ended the lockout and were preparing to restart operations following MacKinnon’s announcement. CN said it ended its lockout at 6 p.m. Eastern time and has started a recovery plan.

“While CN is satisfied that this labor conflict has ended and that it can get back to its role of powering the economy, the company is disappointed that a negotiated deal could not be achieved at the bargaining table despite its best efforts,” the company said in a statement.

CPKC also said it is preparing to restart operations. “The government has acted to protect Canada’s national interest,” CEO Keith Creel said in a statement. “We regret that the government had to intervene because we fundamentally believe in and respect collective bargaining.”

The TCRC on Aug. 23 confirmed that union members had taken down picket lines at CN and would begin returning to work on Friday. The union cautioned, however, that the work stoppage at CPKC “remains ongoing” pending an order from the CIRB.

“Despite the Labor Minister’s referral, there is no clear indication that the CIRB will actually order an end to the labor dispute at CPKC,” the TCRC said, adding that it would meet again with the CIRB Friday morning. TCRC President Paul Boucher said the union would review the minister’s referral and the CIRB’s response, and would consult with legal counsel to determine the next steps.

“By resorting to binding arbitration, the government has allowed CN and CPKC to sidestep a union determined to protect rail safety. Despite claiming to value and honor the collective bargaining process, the federal government quickly used its authority to suspend it, mere hours after an employer-imposed work stoppage,” Boucher said. “The Teamsters Canada Rail Conference is deeply disappointed by this shameful decision.”

The work stoppage on Aug. 22 had an immediate impact on shipments of fertilizer, wheat, chemicals, and other goods. An Aug. 21 estimate from Moody’s Corp. warned that the work stoppage could cost Canada as much as C$341 million ($251 million) per day.

The strike was a big topic of conversation at Fertilizer Canada’s annual conference in Montreal on Aug. 19-21. The trade group on Aug. 20 issued a statement urging the Canadian government to “take immediate action,” warning that a work stoppage “will have devastating impacts on Canada’s economy, our reputation as a reliable trading partner, and global food security.”

The railways move an average of 69,000 mt of fertilizer product per day, and 90% of Canadian-produced fertilizer destined for the US market is delivered by rail. Disruptions impacting all rail services across the country will cost the fertilizer industry an estimated C$55-$63 million per day in lost sales revenue, not including logistical and operational costs, Fertilizer Canada said.

“In the last seven years, Canadian supply chain labor disruptions have cost the fertilizer industry nearly a billion dollars,” said Karen Proud, Fertilizer Canada President and CEO. “These stoppages are doing immense damage to our reputation as a reliable trading partner. Our customers, who rely on Canadian fertilizer products, are being forced to turn to our competitors in Russia, Belarus, and China. We can’t afford for our railways to shut down, and we can’t afford a passive approach to our supply chains any longer. We need long-term solutions.”

Fertilizer shipments were among the first the feel in the impact of the looming strike. Both CN and CPKC issued embargoes halting certain ammonia shipments a full 10 days ahead of the Aug. 22 work stoppage (GM Aug. 16, p. 1). Additional embargoes followed, including US railways halting shipments to Canada as services began to slow down.

In an Aug. 22 statement, CN said it has negotiated “in good faith” with the TCRC and made a final offer to the union ahead of the lockout, but the union did not respond. “Without an agreement or binding arbitration, CN had no choice but to finalize a safe and orderly shutdown and proceed with a lockout,” CN said. “The Teamsters have not shown any urgency or desire to reach a deal that is good for employees, the company, and the economy.”

CPKC also issued a statement on Aug. 22, saying it had “executed a safe and structured shutdown of its train operations” across Canada when it became clear that an agreement with the TCRC was not within reach. CPKC also renewed its push for binding arbitration to end the dispute, which the railroads had urged in June but the offer was rejected by the TCRC (GM June 7, p. 1)

TCRC President Paul Boucher responded by saying the fault lies with the railroads and not the union. “Despite reaping billions in profits over the years, CN is demanding concessions that would drag working conditions back to another era,” Boucher said.

“They don’t care about supply chains, farmers, or small businesses – their sole focus is on padding the pockets of their managers and shareholders, with little regard for the safety or well-being of employees,” he continued. “Make no mistake – corporate greed is what brought us here. The biggest sticking points are company demands, not union proposals. The Teamsters remain committed to negotiating in good faith and doing everything possible to achieve a fair and equitable agreement.”

Industry groups across North America were relieved that the Canadian government took steps to end the railroad work stoppage on Aug. 22, which economists had warned could cause billions of dollars in damage to the country’s economy if not resolved quickly.

“Fertilizer Canada thanks Minister Steven MacKinnon and the federal government for their swift action to resolve the rail labor disruptions and get our trains moving,” said Karen Proud, the trade group’s President and CEO, in an Aug. 22 statement. “We are pleased to see the government’s acknowledgement of the need for short- and long-term solutions and its commitment to investigating the issues leading to the dual rail strike.”

While analysts were split on how much the disruption would cost the economy, most warned that the indirect damage would grow over time, though that impact is difficult to measure.

“The economic harm will extend well beyond the C$1 billion ($732 million) of goods that are transported by rail each day,” Goldy Hyder, CEO of the Business Council of Canada, said in an email to Bloomberg. “It will lead to billions more in lost revenue from goods that won’t be sold, lost wages of workers who won’t be able to do their jobs, and the potential for lost contracts from international shippers and consumers.”

A two-week lockout would shave as much as C$3 billion from the country’s nominal gross domestic product, including a C$1.3 billion hit to labor income and a C$1.25 billion loss to corporate profits, said the Conference Board of Canada.

Moody’s puts a higher price tag on the stoppage, saying it could hit nominal GDP by as much as C$4.8 billion over 14 days. To make a noticeable dent in the economy of the US, Canada’s largest trading partner, the strike would have to go on even longer, Moody’s Economist Brendan LaCerda told Bloomberg.

Analysts said the economy could face deferred sales, growing stockpiles of inventories, and goods shortages, as well as waning business and consumer confidence the longer the disruption lasts.

Some companies have shifted to ports in the US in preparation, already impacting domestic railway earnings. CN lowered its annual guidance in July and its CEO Tracy Robinson told analysts there was a sharp reduction in international volumes.

“Customers have a choice on where they get their goods from,” said Greg Moffatt, Executive Vice President of the Chemistry Industry Association of Canada. “If the supply chain they’re exposed to on the Canadian side is not reliable, they’ll look to modify that supply chain.”

With more than 90% of Canadian grain moving by rail, grain futures rose slightly in early trading on Aug. 22 as traders assessed the impact. The shutdown will have “ripple effects” across the continent, “especially given uncertainty toward potential strikes at US ports and given soaring global shipping costs driven by avoidance of the Red Sea and Suez Canal,” Bank of Nova Scotia Economist Derek Holt said in a note to investors.

“The indirect effect on the economy would likely be much larger, particularly if the labor dispute lasted longer than a week,” Andrew Grantham, an economist with Canadian Imperial Bank of Commerce, wrote in a report to investors. He sees a 0.1% hit to real monthly output growth if the shutdown lasts one week.

The harm to indirectly affected industries is a big reason why many economists did not expect the strike to last long. “The fact that the costs of shutting down Canada’s railroads are so huge makes it less likely that disruptions will last too long, with government likely to step in and order a return to work relatively quickly,” Claire Fan, an economist with the Royal Bank of Canada, told Bloomberg.

According to Benjamin Reitzes, a rates and macro strategist at Bank of Montreal, a “very rough estimate” of the impact of the strike would be a 0.1% hit to monthly GDP growth for every week the action continues. “The longer it lasts, the worse it likely gets,” he said, adding that the impact depends on how prepared businesses are for the disruption.

While some industries that depend on rail can switch to trucks, this is no easy feat. A typical freight train holds the equivalent of 300 trucks and changing transport modes typically comes at a premium of as much as 20%, said Scott Shannon, Vice President of transport firm C.H. Robinson.

“Trucking rates could spike because a whole lot of freight would have to find another way to travel,” he said.

“There is no plan B,” added Wade Sobkowich, Executive Director of Western Grain Elevator Association. “There’s nothing that compares to rail in terms of moving the volumes of grain that need to move at economical rates.”

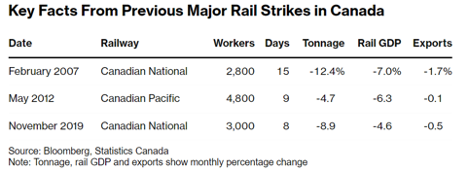

To be sure, some of the economic pain is likely to be reversed when the trains start running again. Bloomberg looked at recent rail strikes in Canada, and though none featured a simultaneous shutdown of Canada’s two rail giants, the impact on the country’s output has historically been limited.

A coalition of 35 US agriculture and industry trade groups on Aug. 19 sent a letter to Canadian Prime Minister Justin Trudeau and various government ministers urging the Canadian government to maintain rail operations to “prevent serious damage to the Canadian and US economies.”

The letter from the Agricultural Transportation Working Group was sent just days before more than 9,000 members of the Teamsters Canada Rail Conference (TCRC) were locked out at Canadian National Railway Co. (CN) and Canadian Pacific Kansas City Ltd. (CPKC), halting operations at Canada’s two largest railroads.

“A lockout or strike would lead to shutdowns or slowdowns of rail-dependent facilities resulting in harmful consequences for Canadian and American agricultural producers, the agricultural industry, and both domestic and global food security,” the letter said. The coalition includes The Fertilizer Institute (TFI) and the Agricultural Retailers Association (ARA).

“The ability to soften the blow of a strike varies by industry. Importing industries are arguably able to better prepare for a rail stoppage by diverting vessels to US ports,” the group said. “However, the impact of a strike would be particularly severe on bulk commodity exporters in both Canada and the US as trucking is not a viable option for many agricultural shippers due to their high-volume needs and the long distances for many of the movements.”

The group warned that agriculture ships more than 25,000 cars per week, and this figure will go to zero during a strike or lockout, with even higher volumes potentially lost during harvest.

“Agricultural facilities have no viable alternative transportation options to supply Canada’s international customers and the inability to cycle products through the supply chain could limit producers’ ability to deliver harvested crops,” the letter warned. “Costs from delayed shipments and lost sales will be amplified and carried by all system participants, as well as Canadian consumers in the way of higher grocery store prices. A work stoppage of any length of time means lost shipping opportunities that will never be recovered.”

The trade groups stressed that agriculture is “particularly exposed to rail stoppages” due to the heavy reliance on rail for industries such as fertilizer, grain, livestock, feed grains, biofuels, and flour mills.

“In the event of an interruption, they quickly run out of storage capacity and incur shortages of incoming raw materials,” the letter said. “In addition, shutting down and restarting these facilities are complex operations, meaning that even a short-term disruption could stop production for several weeks.”

“Operational railroads are essential on both sides of the border for the integrated North American supply chain,” the letter concluded. “While we believe a negotiated solution is always the preferred outcome, your government should be prepared to move quickly if negotiations fail.”

The letter was also circulated to the White House, the US Department of Transportation, USDA, and the Surface Transportation Board. TFI issued its own statement on Aug. 22, the day the work stoppage began, saying it continues to be engaged with US policymakers to amplify the impact of the work stoppage on the fertilizer and ag industries.

“Our outreach to Capitol Hill is catalyzing activity, as multiple Congressional offices have messaged to the White House, USDOT, USDA, the STB, and others about the impact of this work stoppage to the fertilizer supply chain, to farmers, to consumers, and to foreign and trade relations, emphasizing the importance of US engagement with Canadian officials,” TFI said.

ARA also sent an alert on Aug. 22 asking members to reach out to members of congress to urge them to contact the White House and key federal agencies “to take immediate action by working with the Canadian government on immediately ending this railroad strike/lockout.”

“Costs from delayed shipments and lost sales will be amplified and felt by all segments of America’s agricultural industry and consumers,” said Richard Gupton, ARA’s Senior VP, Public Policy and Counsel. “Rail stoppages will have a significant impact on fertilizer as Canada is the largest producer of potash and an important trading partner with the US.” US Transportation Secretary Pete Buttigieg said earlier this week that his department had been monitoring the situation closely and tracking the flow of vital goods to the US. The US Chamber of Commerce also called on the Canadian government to intervene.

As the fertilizer and other industries grapple with the impact of a work stoppage at Canada’s two largest railways, a union of 730 dock foremen in British Columbia – home to Canada’s busiest port in Vancouver – is also threatening to strike, pending a vote by the International Longshore and Warehouse Union (ILWU) Local 514.

The British Columbia Maritime Employers Association (BCMEA) reported on Aug. 16 that it and the ILWU have been involved in a hearing with the Canadian Industrial Relations Board (CIRB) to discuss the union’s pay and manning proposed, which the BCMEA alleges to be illegal. As a result, the BCMEA has filed an additional bad faith bargaining complaint against the union.

The CIRB hearing is set to resume on Sept. 11-17. While neither the ILWU nor the BCMEA have issued strike or lockout notices, the BCMEA on Aug. 16 said it is aware that an industry-wide strike vote is currently underway across various BCMEA member terminals.

“The BCMEA remains committed to achieving a fair settlement in good faith that is beneficial for the 730 hardworking forepersons and their families, while also protecting the stability of Canada’s West Coast ports, and regrets needing to seek resolution through further litigation,” the employers group said.

“The BCMEA proposed comprehensive offers that could have resulted in a competitive and balanced deal to ILWU Local 514 members, and if accepted, would have provided all forepersons with significant gains in wages and benefits, without any concession requests from employers,” the BCMEA added.

Businesses are still reeling from a 13-day dockworker strike by the ILWU a year ago (GM July 7, 2023), which the Greater Vancouver Board of Trade said disrupted C$10.7 billion ($8 billion) in trade. Canada’s transport ministry said last year’s disruption reduced Canada’s gross domestic product by as much as C$980 million.

“Our reputation as a reliable trading partner, already fragile after the strikes in our Western ports last summer, appears poised to take another costly hit,” Bridgitte Anderson, President of the Greater Vancouver Board of Trade, said in an emailed statement to Bloomberg.

Potash supplier Canpotex Ltd. is concerned about where Asian importers will turn if Canadian products are blocked, citing market share lost to Russia after last year’s strike, Bloomberg reported.

“We are stepping up to ship more Canadian potash in light of sanctions and restrictions on Russia and Belarus, but that hinges on Canada’s railroads and ports functioning,” said Natashia Stinka, Canpotex’s Director of Public Affairs. One week of the Canpotex’s train traffic is equivalent to about 10,000 trucks on the road, according to the company.

Industry bodies representing automakers and miners have previously warned about the impact of strikes to customer relationships and Canada’s brand for trade stability, according to an April report by Canada’s House of Commons trade committee.

After last year’s port shutdown, US marine terminals swooped in and signed long-term contracts with shipping companies to reroute cargo away from Canada’s west coast. “The impacts of that continued cargo diversion are still present today,” the BCMEA said in a briefing for Canadian lawmakers in December.

As fresh strikes loom, cargo is again being delayed and disrupted, said Jonathan White, Commercial Vice President at Canada Steamship Lines Inc., which ships millions of tons per year of dry bulk commodities, including iron ore, grain, cement and salt.

Some so-called discretionary cargo may be heading south to the Port of Long Beach and the Port of Los Angeles, which are handling a surge of containers approaching records set during the pandemic.

“We’re starting to see, especially on the west coast at least, some loss of market share here,” said Bonnie Gee, President of the Chamber of Shipping of British Columbia. “It erodes confidence, for sure, in the Canadian market.”

Ships currently en route to Vancouver are being told to slow down and delay their arrivals to prevent further congestion, and the port expects goods including grain, potash, coal, and other cargo to be disrupted, according to Alex Munro, a port spokesperson.

Canada’s labor disputes are also coinciding with stalled talks covering about 45,000 dockworkers in the US. The International Longshoremen Association called off wage negotiations earlier this summer and are preparing to strike if no deal is reached with the United States Maritime Alliance (USMX) before the Sept. 30 expiration of their existing contract.

Next Hydrogen, Mississauga, Ont., announced that it will be providing its latest alkaline electrolysis technology to the University of Minnesota (UMN) for research on the production of green ammonia. The system is expected to be operational by 2025.

The

project is supported by the U.S. Department of Energy’s Advanced Research

Project Agency and includes a broad team including Nutrien Ltd., GE, Nel

Hydrogen, Xcel Energy, and Shell in addition to other companies.

The University of Minnesota has been a leader in developing renewable energy.

The university’s Renewable Energy Center constructed a test plant to use wind

power to produce anhydrous ammonia in 2010, prior to the wind energy boom in

the US (GM June 21, 2010).

Scientists at the UK’s Farming Innovation Programme have been awarded £1 million to investigate the potential for a foliar photocatalyst-and-endophyte prototype to help cereal and oilseed crops generate their own nitrogen while reducing air pollution. The project, through Innovate UK, is led by Crop Intellect along with a six-partner project consortium.

“The photocatalyst being used is known as R-Leaf, which is specially processed titanium dioxide that uses daylight to capture and convert nitrogen oxides (NOx), known as air pollutants, directly into crop-usable nitrates,” said Dr. Apostolos Papadopoulos, founder of Crop Intellect.

“These small but continuous doses of nitrate add up to an average of 50kg N/ha during the growing season,” Papadopoulos said. “Extensive independent trials have demonstrated R-Leaf’s positive impact on crop productivity, with a 6% yield increase seen in cereals. Data also shows that R-Leaf can decrease the need for synthetic nitrogen fertilizers by up to 25%.”

In addition to converting NOx pollutants into nitrates, R-Leaf also breaks down nitrous oxide (N2O), a greenhouse gas (GHG) known to be 265 times more potent than CO2, into benign nitrogen and oxygen.

“Farmers could therefore utilize this technology to reduce their net GHG emissions, making this a unique opportunity for farmers to help move towards their net-zero emission targets,” Papadopoulos added. “The estimated effect of R-Leaf’s N2O capture is 5.4 mt of CO2 per hectare, per year. Eventually, farmers may also be able to monetize their climate-change mitigation from using the proposed technology.”

The green ammonia bidding scheme under India’s SIGHT program has begun to allow fertilizer plant visits, which will allow potential bidders to have information necessary for entering bids for producing ammonia on a “delivered” basis.

The visits will ensure that those bidding to produce the ammonia will have the necessary logistical information needed. The visits will be scheduled between Aug. 27 and Sept. 10. The current deadline for bids is Sept. 3, but that may be extended according to the Economic Times.

India introduced the bidding program for up to 550,000 mt/y of green ammonia earlier this year (GM June 21, p. 25) and then later increased the size of bids by 200,000 mt/y (GM June 28, p. 24). In the program, 10-year supply contracts will be awarded via a reverse auction to supply the volumes for the lowest price.

Winning

bids will also be awarded a three-year subsidy worth up to $0.11 per kg of

ammonia. The green ammonia is expected to be split across 11 different delivery

points at existing fertilizer plants along India’s east and west coasts.

The NEOM Green Hydrogen Company (NGHC) has initiated a major recruitment effort for its green hydrogen plant being built at Oxagon in Saudi Arabia. The $8.4 billion plant, which reached a Final Investment Decision (FID) last year, is moving closer to its operational phase (GM May 26, 2023).

NGHC recently held a virtual career fair that had more than 9,000 registrations. The company is seeking employees across Corporate, Safety, Operations & Maintenance, Finance, and other functions. The company has said it plans to employ more than 300 individuals directly when NEOM is fully operational by the end of 2026.

Wesam Alghamdi, CEO of NGHC, highlighted the project’s alignment with Saudi Vision 2030. “By bringing together top talent from Saudi Arabia and around the world, we are building a skilled team to deliver the world’s largest green hydrogen plant and kick off operations, setting the stage for a cleaner and more sustainable energy future,” he said.

The plant is expected to be the world’s largest green hydrogen plant, generating 600 mt/day, much of which will be exported in the form of green ammonia to offtaker Air Products. Saudi Arabia recently targeted budget cuts for part of its Vision 2030 plan, however, and NEOM is expected to be allocated 20% less than its targeted budget for this year (GM July 12, p. 1).