Fertilizer Futures

US Gulf/Tampa:

The Tampa ammonia price for June was concluded at $400/mt CFR, down $50/mt from May’s $450/mt CFR and the lowest monthly contract price since September 2023’s $390/mt CFR.

The drop at Tampa pushed the Caribbean ammonia market down to $345/mt FOB and the NOLA barge market to an indicative $364/st FOB.

Eastern Cornbelt:

Ammonia prices continued to slip in the region as spring demand shifts to sidedress applications. Most terminals were reported in the $560-$575/st FOB range in the Eastern Cornbelt, down from last week’s $575-$590/st FOB.

Western Cornbelt:

Ammonia prices dropped to $560-$580/st FOB in the Western Cornbelt, depending on location, down from $575-$590/st FOB last week.

Northern Plains:

Ammonia prices fell sharply in the Northern Plains as spring demand winds down. Sources reported the latest prompt offers at $520-$570/st FOB terminals and $600/st DEL, well below the prior $635-$650/st FOB and $650-$675/st DEL ranges.

Great Lakes:

Michigan sources reported prompt ammonia offers at $570-$575/st FOB terminals in northern Indiana and northwestern Ohio.

Northwest Europe:

Bullish factors for ammonia in Northwest Europe include natural gas prices that have risen to $10/MMBtu and several downstream nitrates producers who have issued higher prices. On the more bearish side, Tampa settled $50/mt lower at $400/mt CFR for June.

Contract deliveries continue to dominate the Northwest European ammonia market, which for now remains unchanged at $460-$470/mt CFR.

India:

FACT has awarded its 12,000 mt ammonia tender to Sun International, the only company to participate, at $353/mt CFR. Sources speculated that the tonnage will be sourced from Iran.

Middle East:

Sources described Middle East ammonia prices as steady, but ready to show some strength. A positive price factor for the market stems from the Ma’aden turnaround, scheduled into mid-June. The absence of Saudi ammonia from the market has reportedly inspired sellers to push harder for price increases.

Southeast Asia:

Ammonia pricing in Southeast Asia continues to be supported by thin availability. A deal concluding last week ex-Indonesia to Mitsui reportedly yielded a netback of around $400/mt FOB, bringing the regional range higher to $330-$400/mt FOB. A tender award in India at $353/mt CFR fell within this week’s range.

Thailand:

January-April ammonia imports totaled 103,000 mt, according to Trade Data Monitor, off 21% from the year-ago 130,000 mt. Malaysia sent 43,000 mt and Australia added 31,000 mt. Thailand received 15,000 mt in April, down 57% from 34,000 mt in April 2023.

US Gulf:

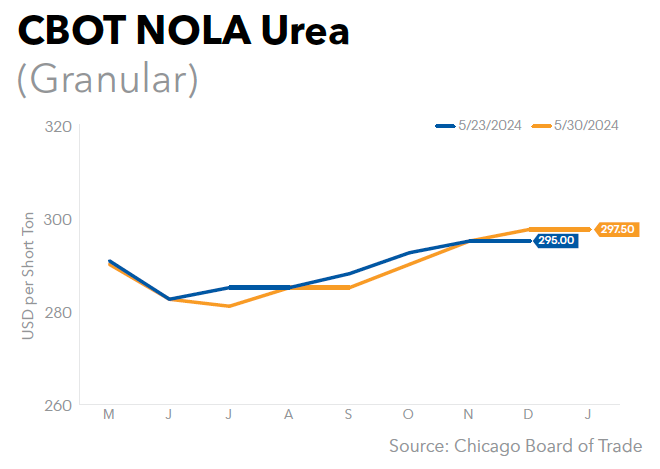

The NOLA urea market was quoted at $284-$291/st FOB for loaded and full-May barges, down from last week’s $285-$295/st FOB as demand slows and the price premium for nearby tons begins to fade. While no June business was actually confirmed during the week, sources reported the market flat at $285-$290/st FOB for that shipping window.

Barge sales of upriver tons were reported at a high of $298/st FOB NOLA based on netbacks.

Eastern Cornbelt:

Urea dropped to $360-$375/st FOB in the Eastern Cornbelt, down from last week’s $370-$390/st FOB, with the low confirmed out of spot Illinois River terminals as the week progressed. The Cincinnati, Ohio, market was pegged at $365-$375/st FOB, below the last confirmed $375-$380/st FOB range.

Western Cornbelt:

Urea in the Western Cornbelt fell to $350-$375/st FOB during the week, down slightly from last week, with the high confirmed in Iowa on a spot basis. The St. Louis, Mo., urea market remained at $350-$360/st FOB, while the latest offers in the Southern Plains region included $375-$380/st FOB Catoosa/Inola, Okla.

Northern Plains:

The urea market remained under pressure in the Northern Plains, with the latest prompt prices reported at $355-$375/st FOB St. Paul, Minn., and $410-$460/st DEL, down from $370-$390/st FOB and $440-$460/st DEL last week. Sources quoted the lower end of the delivered range for unit train shipments in eastern North Dakota.

Great Lakes:

Urea was quoted at $395-$425/st FOB in the Great Lakes region, with the higher numbers reported out of Michigan terminals. Michigan sources also quoted delivered urea offers at the $408/st level in central areas of the state.

Northeast:

Urea pricing in the Northeast slipped to $380/st FOB Fairless Hills, Pa., and $380-$390/st FOB Baltimore, Md., and East Liverpool, Ohio, down from the prior $390-$430/st FOB range in the region.

Though the official opening of the shipping channel at the Port of Baltimore was reportedly pushed back to early June, sources said vessels were able to navigate a temporary channel after the Dali was towed back to port after being trapped under wreckage of the Francis Scott Key Bridge for 55 days.

Eastern Canada:

Urea was quoted in a broad range at C$595-$700/mt FOB in Eastern Canada, down C$25/mt at the low end of the range.

India:

Traders continue to expect a new urea tender to be called around mid-June, after the end of voting in the national election and when the formation of the new government becomes clearer.

Few expect to see India buy a large amount of urea in the tender. The country’s domestic reserves are reported at near-record levels – around 11 million mt expected by June 1 – while domestic urea production likewise remains strong. This combination leaves little incentive for large tender purchases. The only major unknown is the weather. So far, sources said the government is expecting a slightly better-than-average monsoon season.

With polls showing Narendra Modi in the lead to return as prime minister, the current provisional budget, which reduced the funds available for urea subsidies, will most likely be made permanent.

It has long been a goal of Modi to reduce the subsidies paid for fertilizers. The government is now promoting the use of domestically produced urea and liquid Nano Urea to reduce payments for imported product.

Pakistan:

Members of Pakistan’s parliament last week called for an end to natural gas subsidies for urea producers. The government this week agreed to the request, ending subsidized natural gas for the producers.

The move came after a government report showed that the savings from reduced natural gas prices were not passed on to farmers. Domestic producers told local media outlets that high prices for other inputs in the production process left price reductions impossible.

In an additional action, the government authorized the import of 200,000 mt of urea, to be handled by Trading Corp. of Pakistan (TCP). TCP will most likely purchase the tons via a government-to-government deal instead of a public tender.

If TCP were to call a tender, one trader said, few major trading houses would participate. Traders have long objected to the payment procedures TCP attaches to its tenders. Without the major houses involved, said one source, it would be difficult for TCP to secure the full tonnage at a reasonable price. The government-to-government deals TCP has secured in the past have quickly and quietly provided the needed urea at prices deemed acceptable to Pakistan’s treasury.

Black Sea:

Black Sea prilled urea followed the marginal increases seen in other major markets. Source now put the price at $255-$265/mt FOB.

Mediterranean:

Spanish importers saw $350/mt CFR offers following the recent Egyptian rally, but it is unclear whether any transactions occurred at this level. Prices in nearby Romania moved higher as well, with confirmed sales at $335/mt CFR.

Indications of $320/mt CFR were still reported by some Italian and French importers early in the week, however. As a result, the granular urea market in the Mediterranean was quoted at $320-$350/mt CFR for the week.

Southeast Asia:

Urea sales of more than 100,000 mt were reported by Pupuk Kaltim at $312/mt FOB, the same price attained in its latest tender. With no other confirmed transactions in other regional export markets, the Southeast Asia granular urea price firmed to a solid $312/mt FOB, up from last week’s $290-$312/mt range.

Indonesia:

After Pupuk closed its 45,000 mt granular tender to the Philippines’ Universal Harvester at $312.26/mt FOB, the company entered into talks with other traders for additional sales. Sources ultimately reported sales totaling 250,000 mt to Universal and three other traders, all for June shipment.

Liven, Koch, and Samsung were all reportedly able to buy cargoes of 30,000-45,000 mt at Universal’s price. The tons sold to Universal are expected to go to Philippine buyers, with the other tonnage reportedly destined for Australia and Latin America.

Sources reported the latest offer from Pupuk in the low-$320s/mt FOB at week’s end.

Thailand:

Urea imports stood at 947,000 mt in January-April, Trade Data Monitor reported, a significant increase from the 602,000 mt received through the first four months of 2023. Saudi Arabia led suppliers with 392,000 mt, Qatar shipped 120,000 mt, and Malaysia added 118,000 mt. April imports were noted at 225,000 mt, above the 210,000 mt received in April 2023.

Middle East:

Sources reported a sale of granular urea from PIC for shipment to Australia at $315/mt FOB. Producers last week pushed for $310/mt FOB following a prilled sale at $295/mt FOB and price increases in Egypt and Indonesia.

In addition to the PIC spot sale, sources said a number of contract cargoes are being loaded for delivery to Australia. The contract business has been profitable enough that producers have found little reason to chase after spot deals, said one trader.

The modest price increase showed a continued firming of the market, though several traders have raised concerns that the increases are not sustainable. Traders shared the view that the market was stable but not firm, noting that Australian demand is expected to slow in the short term. While interest from India and Brazil may increase in the coming months, the global supply of urea is expected to exceed demand, leaving producers with little support for further price increases.

Helwan, in Egypt, sold 3,000 mt of granular urea at $325/mt FOB at the end of last week. The deal came to light following a government order directing producers to reduce output by 20% as part of a plan to divert natural gas away from the urea industry.

The previous two weeks showed a significant shift in both prices and tonnage sold. By the end of last week, however, most producers were reportedly satisfied with completing the accounting for the newly closed deals and were ready to reassess their situations given the mandate to reduce output.

As this week opened, some producers had reportedly gotten word that their natural gas allotments would be restored, though others continue to wait for a similar communication. Even with the cutback, sources said the producers who made sales during the mid-month selling frenzy have enough product on hand to cover the deals.

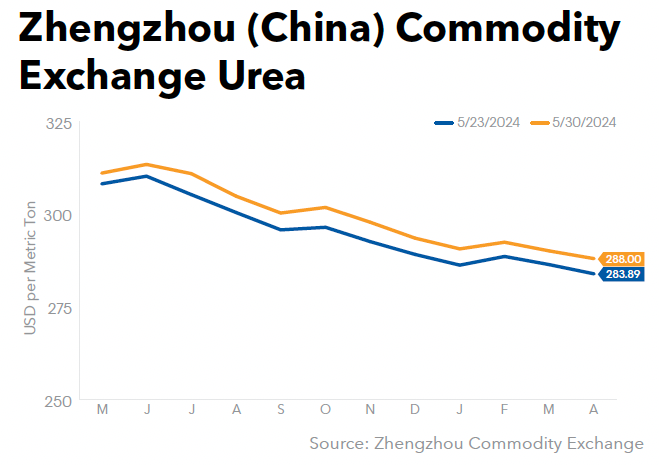

China:

Urea prices remain too high for the government’s liking, players said. The estimated export price, based on the domestic ex-factory price, remained at $335-$338/mt for prills and $342-$345/mt FOB for granular.

Exports have been mostly limited to container-sized shipments to regional buyers, sources said. No major exports are expected until July.

Brazil:

Brazil granular urea prices firmed to $325-$330/mt CFR, up from the week-ago $320-$325/mt CFR, cementing a 4.8% increase from late April. While some sellers were noted offering as high as $340-$350/mt CFR during the week, buyers did not commit at those levels.

Rondonópolis prices moved up to $465-$485 FOB, a $5-$25/mt increase from the previous week. Forward pricing remains uncertain, with demand expected to peak in the late third quarter or early fourth quarter. That timeframe will also be important for India, adding additional demand to the 4Q global market.

US Gulf:

The UAN barge market remained at an indicative $235-$245/st ($7.34-$7.66/unit) FOB NOLA based on netbacks from upriver terminal pricing, though no actual barge transactions were reported during the week.

Eastern Cornbelt:

The UAN-32 market was quoted at $260-$275/st ($8.13-$8.59/unit) FOB in the Eastern Cornbelt, down from $270-$290/st ($8.44-$9.06/unit) FOB, with the low confirmed at Cincinnati during the week. The latest UAN-28 offers at Cincinnati were reported at the $228-$236.25/st ($8.14-$8.44/unit) FOB level, down from $240.63/st ($8.59/unit) FOB.

Western Cornbelt:

UAN-32 was unchanged at $270-$290/st ($8.44-$9.06/unit) FOB for prompt tons in the Western Cornbelt, depending on location, with the low confirmed at St. Louis.

Northern Plains:

The UAN-28 market was quoted at $250-$265/st ($8.93-$9.46/unit) FOB terminals in the Northern Plains, with reference prices for delivered tons from Canada holding at $325/st ($11.61/unit) level for the last confirmed offers.

Great Lakes:

The UAN-28 market was pegged in a broad range at $248-$287/st ($8.86-$10.25/unit) FOB in the Great Lakes region, depending on location, with the higher end of the range reported out of Michigan terminals.

Northeast:

The temporary channel has allowed Baltimore UAN inventories to be partially restocked as the first sidedress applications begin on early-planted corn in the Northeast.

UAN-32 pricing in the region slipped to $275-$295/st ($8.59-$9.22/unit) FOB for the latest offers, down from the previous $310-$320/st ($9.69-$10.00/unit) FOB range. Both the high and low ends of the range were reported at Baltimore in late May, while offers at Fairless Hills were quoted at the $295/st FOB level during the week.

The latest 27-0-0-3S offers were pegged at the $270/st level FOB Baltimore.

Eastern Canada:

UAN-28 pricing in Eastern Canada slipped to C$416-$460/mt (C$14.86-$16.43/unit) FOB in late May, just C$4/mt lower at the bottom of the range. The UAN-32 market in Ontario was down C$5/mt, to C$475/mt (C$14.84/unit) FOB.

France:

Rouen UAN prices ticked higher, following the bullish momentum in the urea market. The latest indications were reported at €215-€230/mt FCA, though business as high as €235/mt FCA is believed possible by some sellers. The previous week’s €210-215/mt FCA offers were no longer deemed workable.

Western Cornbelt:

Ammonium nitrate remained at $365-$410/st FOB in Missouri, with the low reported in the south and the high in northern parts of the state.

France:

Yara on May 27 announced a new ammonium nitrate price of €355/mt CPT for July deliveries, up €15/mt from the previous list price announced last week. The weekly price range for France was quoted at €340-€355/mt CPT, with the low reflecting sales of limited volumes at Yara’s previous price.

United Kingdom:

With no news of a new ammonium nitrate price from CF, the UK market remained flat at last week’s £315/mt CPT. CF is expected to issue new pricing soon, however, buoyed by stable-to-rising ammonia prices and a bullish urea market.

US Gulf:

The ammonium sulfate barge market slipped to $390-$395/st FOB based on the latest trades, down $5/st from last week’s $395-$400/st FOB range.

Eastern Cornbelt:

Granular ammonium sulfate remained at $415-$435/st FOB in the Eastern Cornbelt, with the low confirmed at Illinois River locations and the high in Ohio. The Cincinnati market was quoted at $430-$435/st FOB in late May.

Western Cornbelt:

The granular ammonium sulfate market firmed slightly to $415-$430/st FOB in the Western Cornbelt, with the low reported at St. Louis and reflecting a $10/st increase from last week amid reports of tight supply.

Northern Plains:

Sources quoted the latest granular ammonium sulfate offers in the Northern Plains at $410-$440/st FOB St. Paul and up to $450/st FOB Missouri River terminals in South Dakota, with delivered offers reported in a wide range at $430-$480/st in the region.

Great Lakes:

Ammonium sulfate was quoted at $425-$435/st FOB terminals in the Great Lakes region, with delivered pricing at the $463/st level in central Michigan. Sources described inventories as tight, with multiple locations sold out in late May.

Northeast:

The granular ammonium sulfate market was pegged at $415-$430/st FOB and $415-$425/st DEL in the Northeast in late May.

Eastern Canada:

The ammonium sulfate market was steady at C$570-$675/mt FOB in Eastern Canada, depending on location and supplier.

Northwest Europe:

Standard ammonium sulfate prices in Northwest Europe found support in a strengthening urea market, firming to €140-€145/mt FOB, or $150-$157/mt FOB at midweek exchange rates.Granular prices were reported in the wider range at €180-€200/mt FOB, or $195-$217/mt FOB.

Indonesia:

Pupuk Holdings has closed a tender for 35,000 mt of caprolactam grade amsul to be delivered in three June shipments. The lowest price came just shy of $150/mt CFR, though Pupuk did not reveal the offering company’s name. Other offers were reported in the upper-$150s/mt CFR.

The tender called for 20,000 mt to be shipped to Gresik, 5,000 mt to Palembang, and 10,000 mt to Jakarta. Freight was pegged in the low-$20s/mt for the larger shipments and low-$30s/mt for the smaller lots.

Thailand:

Ammonium sulfate imports totaled 223,000 mt in January-April, Trade Data Monitor reported,up dramatically from the 67,000 mt received through the first four months of 2023, with nearly all of the tonnage coming from China. April imports were pegged at 78,000 mt, against the 23,000 mt received in April 2023.

China:

Increased demand and limited supplies lifted the China amsul price to $125-$130/mt FOB. Offers made into the Pupuk Holdings/Indonesia tender helped to set the new price level, sources said.

Brazil:

Brazil ammonium sulfate prices traded up to $175-$180/mt CFR, above last week’s $165-$175/mt CFR and a 7.6% month-over-month increase in May. Buyers have been active in booking product for forward shipment, while new offers were noted firming to $180-$185/mt CFR.

Rondonópolis prices moved up in line with the broader nitrogen market, to $300-$315/mt FOB from $275-$295/mt FOB. Despite players reporting firmer demand, the market has yet to reach its seasonal peak.

Central Florida:

Central Florida phosphate prices held firm, with truck-loaded DAP posted at $580/st FOB while MAP trucks continued at $600/st FOB. North Florida MAP was steady at $630/st FOB, sources said.

US Gulf:

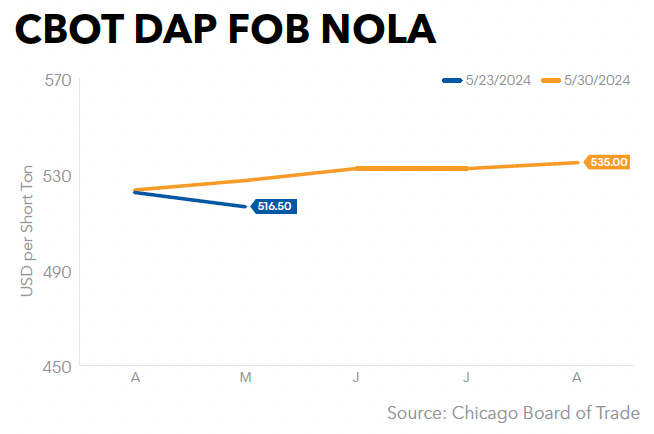

Players reported another active week at NOLA for DAP and MAP barges loading in both the second and third quarters, though third-quarter barge trades were excluded from the week’s prompt range.

Second-quarter DAP barges firmed $10/st, to $520-$535/st FOB from last week’s $510-$525/st FOB range. MAP increased 3.2% for the week and 17.1% in May to settle at $550-$580/st FOB, up from the prior $530-$565/st FOB.

US Exports:

Sources reported a $550/mt FOB DAP cargo sold into the West Coast of Latin America during the week, down from $570/mt FOB at last report. With no MAP transactions reported, that product continued at $570/mt FOB.

Eastern Cornbelt:

DAP continued at $620-$660/st FOB for prompt tons in the Eastern Cornbelt, with the low reported out of spot Illinois River locations and the high inland. The Cincinnati DAP market was pegged in the $635-$650/st FOB range during the week, down from $650-$660/st FOB.

MAP was quoted in a broad range at $640-$685/st FOB in the region, depending on location, with the low once again confirmed at spot Illinois River terminals and the high inland. The Cincinnati MAP market was pegged at $660-$680/st FOB in late May.

Western Cornbelt:

DAP was steady at $640-$660/st FOB in the Western Cornbelt, with MAP pegged in the $660-$680/st FOB range in the region. Pricing at St. Louis remained at $640-$650/st FOB for DAP and $665-$675/st FOB for MAP in late May.

Northern Plains:

DAP was pegged at $640-$660/st FOB in the Northern Plains with MAP slipping to $650-$670/st FOB in the region.

Great Lakes:

MAP was quoted at $645-$690/st FOB in the Great Lakes region, depending on location and time of shipment, with the low reported for limited fill offers. Delivered DAP was reported at the $658/st level in central Michigan in late May.

Northeast:

DAP slipped to $680-$685/st FOB East Liverpool, with MAP pegged at the $700/st FOB level at that location. Rail-DEL MAP offers in Pennsylvania were quoted at the $720/st level in late May.

Eastern Canada:

MAP pricing in Eastern Canada slipped slightly to C$975-$995/mt FOB, down C$10/mt at the low end of the range, with DAP remaining at C$945/mt FOB Montreal.

Benelux:

DAP in Benelux remained flat at €585-€595/mt FCA, but prices inched marginally lower, to $635-$646/mt FCA, reflecting midweek exchange rates for an appreciating euro. Demand remains minimal, which is normal for the time of year, but supply has stayed in check, resulting in stable indicative pricing.

Morocco:

Moroccan DAP prices were stable this week, with OCP’s sales into Latin America and Europe resulting in netbacks falling in the existing $495-$590/mt FOB range. Sellers overall appear more confident that DAP prices may have reached a floor and expect FOB values to soon see some gains, encouraged by the recent buying momentum in Brazil.

Baltic:

MAP prices in the Baltic were stable this week at $520-$530/mt FOB. Some market participants expect FOB values to rise in the near term, however, fueled by lower freight indications, and assuming Brazil CFR values remain supported.

China:

Buyers continue to bid in the $490s/mt FOB for Chinese DAP, though sellers refuse to go below the $500/mt FOB mark. Buyers believed their arguments carried more weight because of earlier business, but the latest deal into India showed a netback of$500/mt FOB with wiggle room on either side. Producers responded that the last Indian business consisted of Russian and Moroccan tons – not Chinese – followed by a repeat of offers in the low-$500s/mt FOB.

Shipments of DAP and MAP are expected to remain strong for the next few months. As previously reported, April DAP exports of 310,000 mt were more than triple the total exported during the first quarter.

India:

Buyer efforts to secure lower-priced product has failed. Sources reported the latest DAP deal into India at $518/mt CFR, a slight increase on the last spot purchase. This price nets back $500/mt FOB to China, a level that Chinese producers have indicated they do not want to sink below.

Brazil:

The Brazil MAP range lifted to $575-$580/mt CFR from last week’s $560-$575/mt CFR, with the low end reportedly trading early in the week. Domestic tons were reported trading at a $590-$595/mt CFR equivalent.

With only a single quarter remaining for summer crop fertilizer purchasing, players reported standout MAP demand during the week. Prices were stimulated by strong buyer interest and regional supply restrictions, pushing negotiations to $700-$735/mt FOB Rondonópolis. Additional price increases are expected over the coming weeks.

US Gulf:

NOLA TSP barges moved up $14/st at the top of the range, to $425-$449/st FOB from the prior $425-$435/st FOB, with tons priced at the range’s low side reported trading early in the week.

Eastern Cornbelt:

TSP was unchanged at $500-$510/st FOB in the Eastern Cornbelt, with the lower end of the range reported at Cincinnati.

Western Cornbelt:

TSP remained at $510-$520/st FOB in the Western Cornbelt, with the low reported at St. Louis.

Great Lakes:

Delivered TSP was quoted at the $548/st level for May-June tons in central Michigan.

Brazil:

Landed TSP prices firmed to $425-$435/mt CFR from last week’s $415-$420/mt CFR, closing out May with a 2.4% price increase compared to April. The next round of TSP imports is expected in August, sources said.

Following a week of high demand, some Rondonópolis players reportedly pulled their TSP prices, resulting in an uncertain market. While pricing is generally expected to continue trending higher through the near term, the combined lack of availability and suspended price lists put the market at $560/mt FOB for the week.

Brazil:

Citing a focus on higher-concentration phosphates, players continued to note Brazil SSP 19-21 prices at the $200-$220/mt CFR level, while Rondonópolis prices firmed to $340-$355/mt FOB, a $5-$20/mt increase from last week’s $320-$350/mt FOB.