CF Expects Imminent Production of Green Ammonia; Sees Blue Ammonia Focus in Near Term

CF Industries Holdings Inc. expects production at its 20,000 st/y green ammonia project at Donaldsonville, La., to start within the next few weeks or in in early January, the company announced on Dec. 4 at the BMO 2023 Growth & ESG Conference.

CF first announced plans for the Donaldsonville green ammonia project in October 2020 (GM Oct. 30, 2020). “We are excited to be able to bring that project finally to fruition,” said CF CEO Tony Will on Dec. 4. “It has been about three years in the making, and we are really excited about it.”

Thereafter, the company is moving toward the production of blue ammonia. Will said the next project is the dehydration compression project for CO2 at Donaldsonville. The company has signed an offtake agreement with ExxonMobil, who will be moving 2 million tons a year of CO2 into permanent geological sequestration.

“We should be mechanically complete with the dehydration compression in about a year, maybe into the beginning of 2025,” Will said. “We expect to be shipping CO2 and sequestering at the beginning probably about the middle of 2025 at this point.”

Will added that CF is excited about the CO2 project due to the 45Q tax credit. “We’ll start earning at a rate of $85 on a gross basis per ton of CO2 captured,” he said. “We’ve about, I think about $30-$35 worth of cost all in terms of being able to process and sequester the CO2. So we’ll be netting about $50 a ton on 2 million tons a year beginning kind of midway through 2025. So that is a very exciting project, and that is just on the CO2.”

As for the green ammonia, Will said the company has been engaged in ongoing discussions with a number of potentially interested parties. Will said CF’s expectation is that the sales price needs to be commensurate with what the full end cost structure looks like.

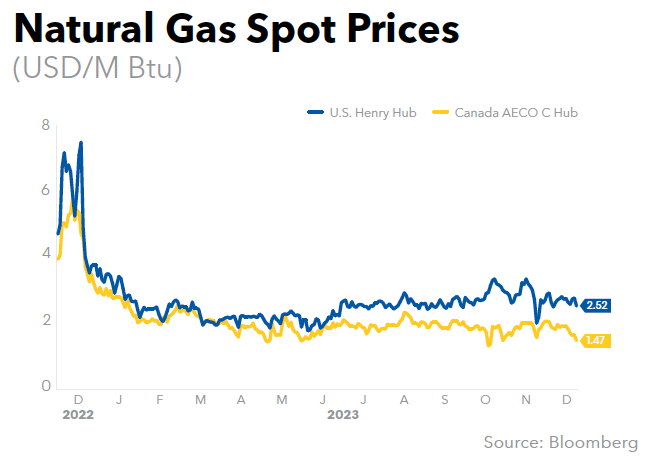

“So while we are engaged in these conversations, it may take a while to find the right applications where the counterparty is willing to pay that kind of number, but we are confident we can get there,” he said. Asked by analysts as to the ammonia price for a world-scale plant for green ammonia, Will noted that the current Henry Hub natural gas price is sub-$3.00 mmBtu.

“So the energy content in a ton of conventional ammonia is $100/st,” he continued. “The energy content in a ton of green ammonia is closer to $450-$500/st. That’s before you get to the capital recovery on all of the investment, and it’s also before you have the energy cost associated with running an air separation unit that is a completely distinct part of a green ammonia project. So, realistically, the cost that you need to be able to recover, to cover energy costs and capital, is going to be pushing four figures on a green ammonia ton.”

“And right now, we’re just not seeing a lot of demand at the end market side to really step up and say yes, give me more of that,” Will said, referring to green ammonia. “There is a provision in the tax code where there’s a hydrogen production credit that can certainly add some potential value and basically buy down the cost of a ton of green ammonia.”

Will cautioned, however, that the rules on the hydrogen production credit have not been finalized, adding that there are “rumors floating around” about a Biden Administration proposal. “It’s suggesting that the rules for new renewable energy additionality is going to be pretty stringent, which means it’s even more difficult to get some of those projects approved,” he said.

As a result, Will said the time for a massive investment in green ammonia production is not yet here. “In fact, I think it’s probably decades away,” he added. “We’re really focused on what we can do with carbon capture, sequestration, and blue projects because we think it’s a much lower cost alternative, still delivering a very, very low carbon intensity product, and certainly miles ahead of where we are today in terms of environmental impact.”

Will noted a high level of interest in blue ammonia, however. “Basically, everyone that we’ve talked to has said, yes, we want some of that,” he said. “So we’re beginning some of those conversations now.”

Will gave several examples of areas where blue ammonia demand is accelerating. “Interestingly enough, some of them happen to be in agricultural applications,” he said. “So to get a very low carbon intensity ethanol product that qualifies for the California low carbon fuel standard, there’s a lot of value associated with that, and having a low carbon fertilizer going into growing that crop is an important point.”

Will said Brazil is also making “sizable investments” in developing an ability to produce sustainable aviation fuel, particularly for the European market, and is looking at low carbon intensity fertilizer to help bring this along.

“In addition, we’ve talked to a number of other applications, whether it be on a mining services basis or other places like that, where there’s a lot of interest, although quantification of premium is still in discussion right now,” he said. “But suffice it to say there’s an awful lot of interested counterparties and it really just is going to require settling out on the value.”

In addition, CF continues to see blue ammonia potential for export markets and recently inked Memorandums of Understandings (MOUs) with several offshore partners.

“Mitsui, JERA, Lotte, POSCO, and others suggest that the demand is real and it’s going to be coming in sizable amounts,” Will said. “The big question is, what is the carbon intensity threshold that you have to hit and what are the other requirements in terms of the Asian parties, equity investments, or participation in the projects themselves?”

“We certainly are going to have a nice baseload to begin helping serve a developing marketplace based on what we’re doing at Donaldsonville and can replicate in other places,” he continued. “But I think longer term, the world is going to need more blue ammonia. I think we’re in an ideal position to add that capacity if and when it needs it.”

Referring to the “100 different projects” announced in the blue and green ammonia space in recent years, Will described “a lot of frothiness” on the supply side.

“Our expectation at that time was it’s easy to announce a project. It’s a lot harder to actually build one and bring one online,” he said. “I think some of the loss of luster might be because people are looking at what’s happening across a number of these previously announced projects and see that they’re either being canceled or deferred.”

He contrasted that, however, with what is happening on the demand side. “We’ve had people just very recently over in Japan visiting with JERA,” he said. “They are putting real capital in the ground. They are moving forward with their large tests, the Hekinan power facility. Our expectation is that that’s going to continue to move along at basically the pace that we thought it was.”

While noting that the Japanese government has “been a little bit slow in terms of finalizing the subsidy schemes and the regulations around it,” Will said this should not affect CF’s ability in the near term to supply that demand out of Donaldsonville.

“What it might affect is either the type of technology or additional flue gas capture that’s required if we go down the path of a greenfield plant,” he said. “But those things are things that we can wait and see how it develops. It’s not going to affect our ability to actually meet that demand as it emerges. I think all of our expectations, including the end users in Asia, continue to believe this is the path forward.”

Will also addressed the methanol versus ammonia debate on marine transportation. “Although there is a carbon molecule as part of a methanol atom, and so it doesn’t really get you our molecule, it doesn’t really get you all the way to zero carbon,” he said. “Ammonia, on the other hand, does.”

“We firmly believe, based on our track record of safe handling and storage and movement of ammonia, that the systems can be built that are 100% reliable and can be deployed appropriately in marine vessels,” he added. “I think one of the development points is really about the ongoing bunkering and resupply piece from ammonia.”

While noting that ammonia is “already in and out of something like 175 ports globally,” Will said it needs to be built out into “every shipping port out there” for ammonia shipping to become the propulsion energy source of choice.

“And so, there is some time lag associated with that,” he said. “But we believe that this will continue to be an ongoing developing source of new demand, and it’s exciting in terms of how big this can ultimately be based on the size of the fleet that’s out there.”